Welcome to an in-depth guide on trading in the stock market, specifically focusing on the NSE, BSE, and Nifty indices. Drawing from the expert insights of Rocketalgo Official, this article breaks down key trading concepts, strategies, and live market analysis to help traders—both beginners and experienced—navigate the dynamic stock market with confidence and clarity.

In this comprehensive overview, we’ll explore the proven Rocketalgo trading formula, understand how to identify ideal entry and exit points, learn the importance of patience in trading, and discover why timing your trades around market closing is crucial. Whether you trade in options, futures, or stocks, these insights will sharpen your approach and improve your trading outcomes.

Table of Contents

- 🔍 Understanding the Rocketalgo Trading Formula

- 📈 How to Spot the Right Entry and Exit Points

- ⏳ Why Timing Matters: Avoiding Trades After 3 PM

- 💡 Practical Tips for Using Rocketalgo Setup Effectively

- 📊 Market Highlights: Midcap, Bank Nifty, Gold, and Crude Oil Movements

- ⚠️ Beware of Trading Scams and False Promises

- ❓ Frequently Asked Questions (FAQ) 🤔

- 🚀 Conclusion: Elevate Your Trading with Rocketalgo’s Proven Strategies

🔍 Understanding the Rocketalgo Trading Formula

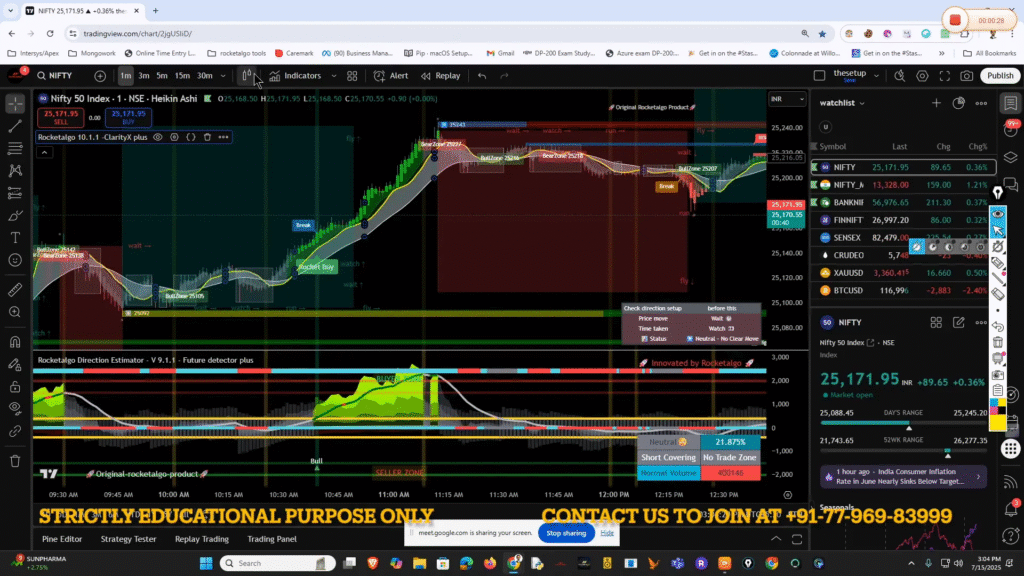

At the core of Rocketalgo’s approach lies a powerful trading formula that combines multiple market indicators to identify high-probability trades. This formula relies on five critical components:

- A for Angle: The angle refers to the market momentum or the slope of price movement before a breakout.

- B for Breakout: This signifies the moment when price breaks through a significant resistance or support level, signaling a potential trade opportunity.

- C for Candle: The candle patterns help confirm the breakout and the strength of the price movement.

- M for Money Flow: Money flow indicates the volume and buying/selling pressure, showing whether the market is favoring bulls or bears.

- P for Percentage: This measures the probability or confidence level of the trade setup, helping traders assess risk and reward.

This combination—A, B, C, M, and P—forms the backbone of Rocketalgo’s trading system. It’s designed to provide clear signals on when to enter and exit trades, ensuring you avoid impulsive decisions based on incomplete information.

For traders who want to dive deeper, Rocketalgo offers a free learning portal (galaxy.rocketalgo.in) with detailed courses and video series explaining these concepts in full. Engaging with these resources can build your confidence and improve your market timing.

📈 How to Spot the Right Entry and Exit Points

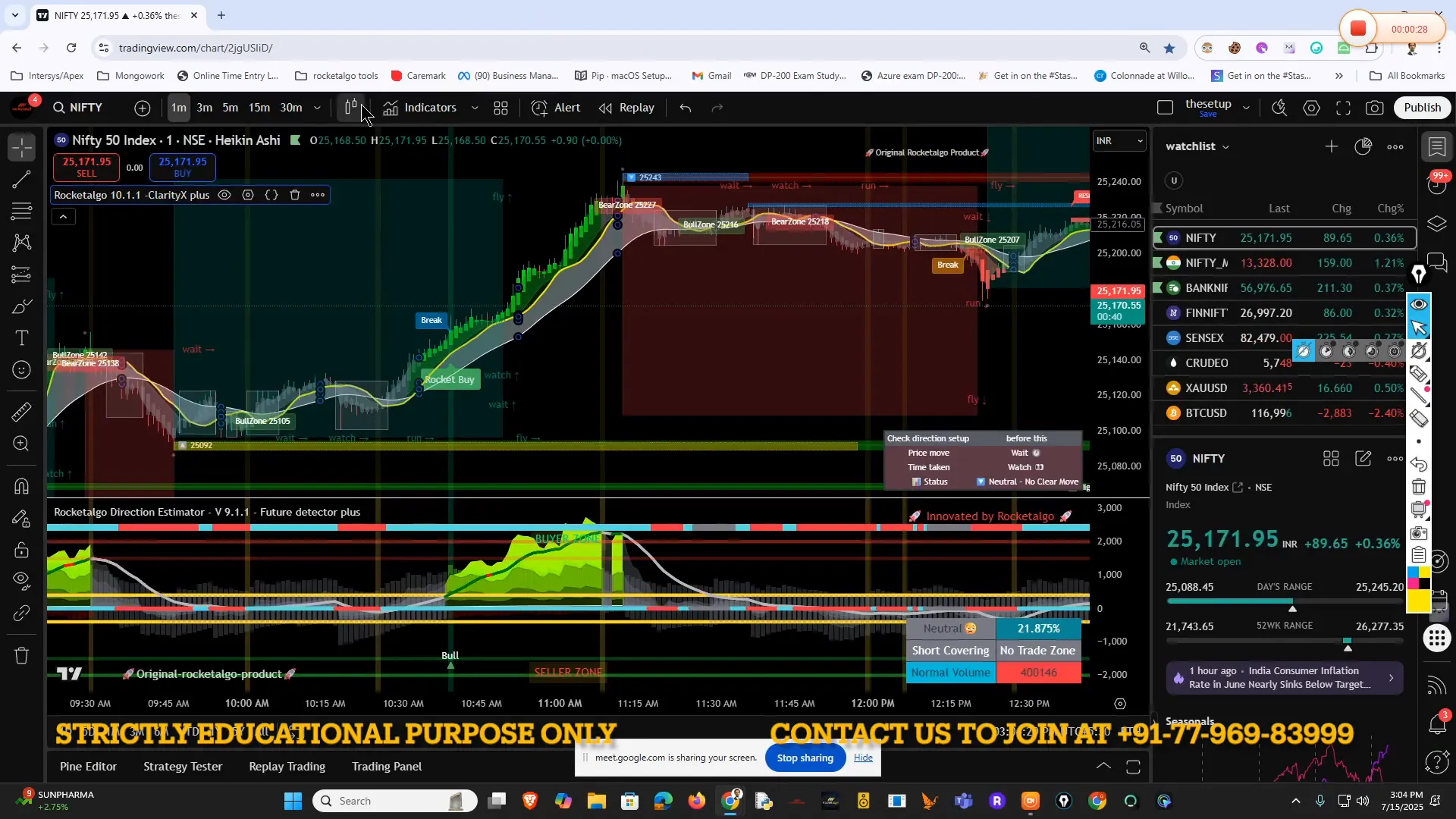

One of the key lessons from Rocketalgo’s market overview is the importance of patience and discipline in trading. The video highlights a live trade example where the formula successfully identified a strong momentum move, hitting the first target smoothly with a 10-point gain.

Here’s how the trade unfolded:

- Angle Formation: The market showed a clear upward angle, indicating strong momentum building before the breakout.

- Breakout Confirmation: Price broke through the resistance level, confirmed by candle patterns moving above the breakout zone.

- Money Flow Rising: Increasing money flow indicated strong buying interest, supporting the upward move.

- Percentage Confidence: The trade setup showed high confidence percentage, signaling a favorable risk-reward scenario.

After the initial move, the system issued a profit booking warning as price approached a key resistance zone. This is a crucial moment where many traders get tempted to hold out for extra gains.

However, Rocketalgo emphasizes the wisdom of booking profits calmly rather than chasing the last few points. The advice is clear: “If you have already gained 20-25 points with a smooth momentum, it is your duty to book profits rather than getting excited for the remaining 15-20 points, because trying to hold on too long often results in losing the gains.”

This trading discipline, summarized as “less is more”, separates serious traders from those who fall prey to greed and impulsive decisions.

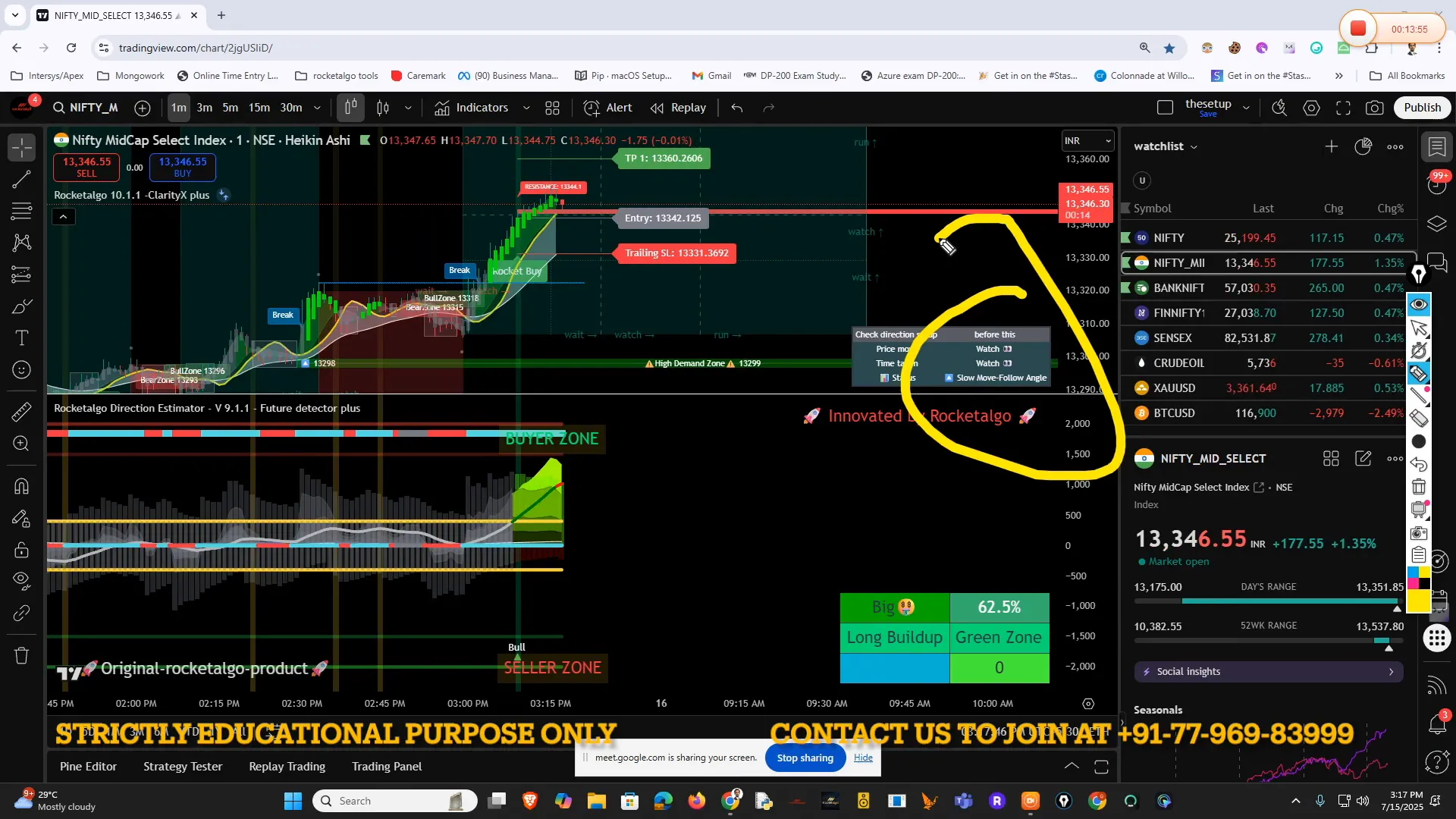

⏳ Why Timing Matters: Avoiding Trades After 3 PM

Another critical insight shared is the caution against taking new trades after 3 PM in the Indian stock market. The reasons are practical and rooted in market mechanics:

- Reduced Momentum: The final trading hour often sees reduced momentum and increased volatility, making it harder to predict price moves accurately.

- Broker Auto-Exit: Many brokers automatically close intraday positions around 3:15 PM to 3:30 PM, which can cause unexpected losses or missed profits.

- Increased Risk: With only a short time left before market close, the risk of sudden reversals or “flushes” is high, which can wipe out earlier gains.

Rocketalgo’s advice to traders is to either close positions before 3 PM or avoid initiating new trades after this time. Instead, focus on sharp scalping or small trades with tight risk management if you must trade late in the session.

This approach is especially important for options traders and those dealing with weekly or monthly expiries, where premiums can be volatile and unpredictable near market close.

💡 Practical Tips for Using Rocketalgo Setup Effectively

Based on the market analysis and trade rewinds, here are some practical tips to maximize your use of the Rocketalgo setup:

- Start with the Angle: Always check if the angle is forming properly before considering a trade. Without a clear angle, other indicators lose significance.

- Confirm Breakouts: Wait for a confirmed breakout with supporting candle patterns before entering a trade.

- Monitor Money Flow: Positive money flow is a good sign of sustained momentum. Use it to validate your trade direction.

- Use Percentage Confidence: High confidence percentages help filter out weak setups and avoid unnecessary risks.

- Be Patient with Targets: Do not rush to book profits at the first sign of movement; wait for your targets but don’t get greedy.

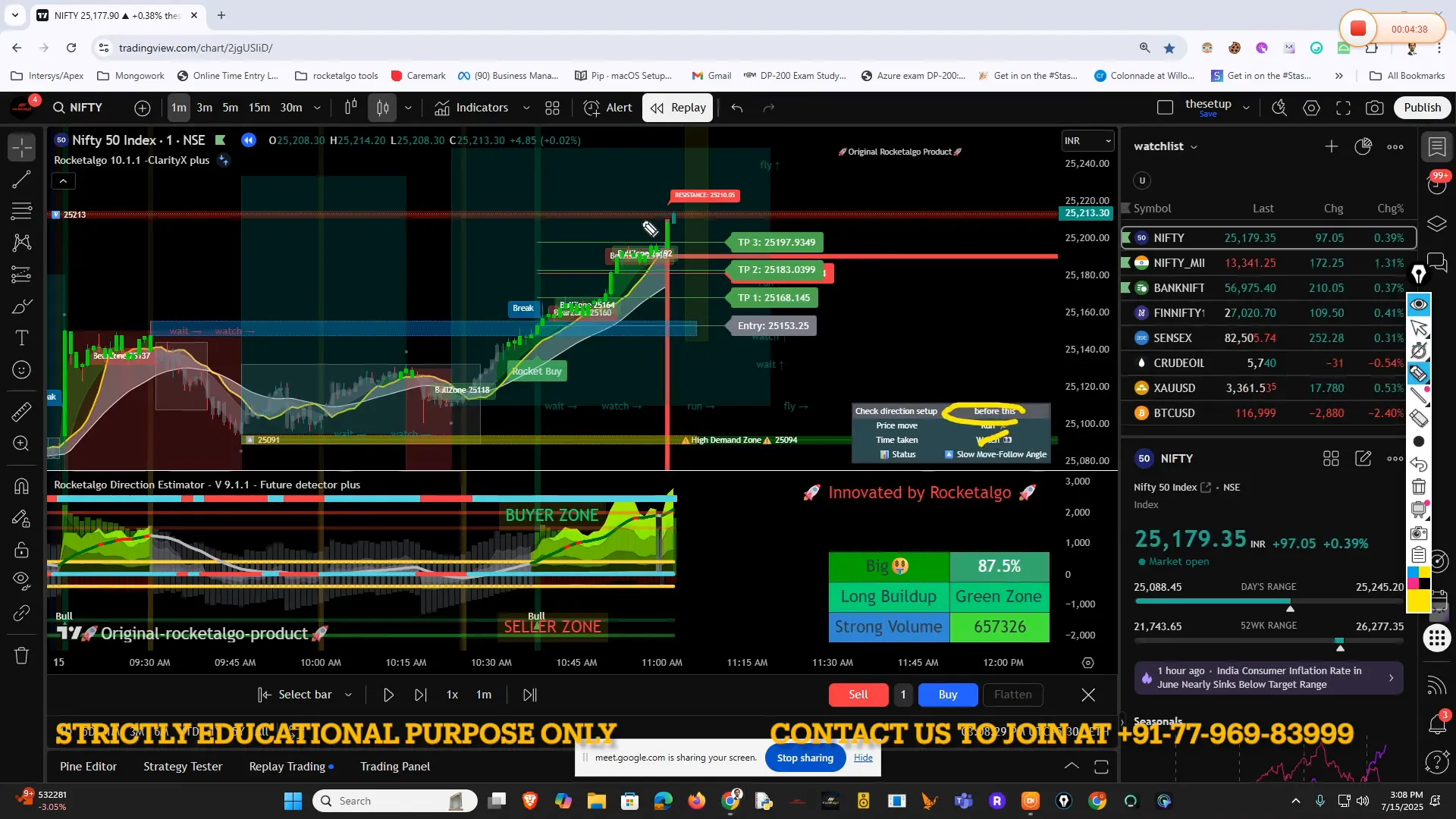

- Respect Market Timing: Avoid trading after 3 PM or near market close to reduce risk and avoid broker auto-exits.

- Use Multi-Time Frame Analysis: For volatile instruments like gold or crude oil, check multiple time frames (e.g., 3-minute and 5-minute charts) for better trade confirmation.

Implementing these steps will help traders reduce mistakes and improve their success rate in the NSE, BSE, and Nifty markets.

📊 Market Highlights: Midcap, Bank Nifty, Gold, and Crude Oil Movements

Rocketalgo’s session also covered recent momentum plays across different market segments and commodities:

- Midcap Stocks: Midcap indices showed beautiful momentum moves during the live session. However, caution was advised due to the proximity to market close and reduced percentage confidence.

- Bank Nifty: Bank Nifty trades exceeded expectations with strong upward moves. These were highlighted as excellent momentum plays for intraday traders.

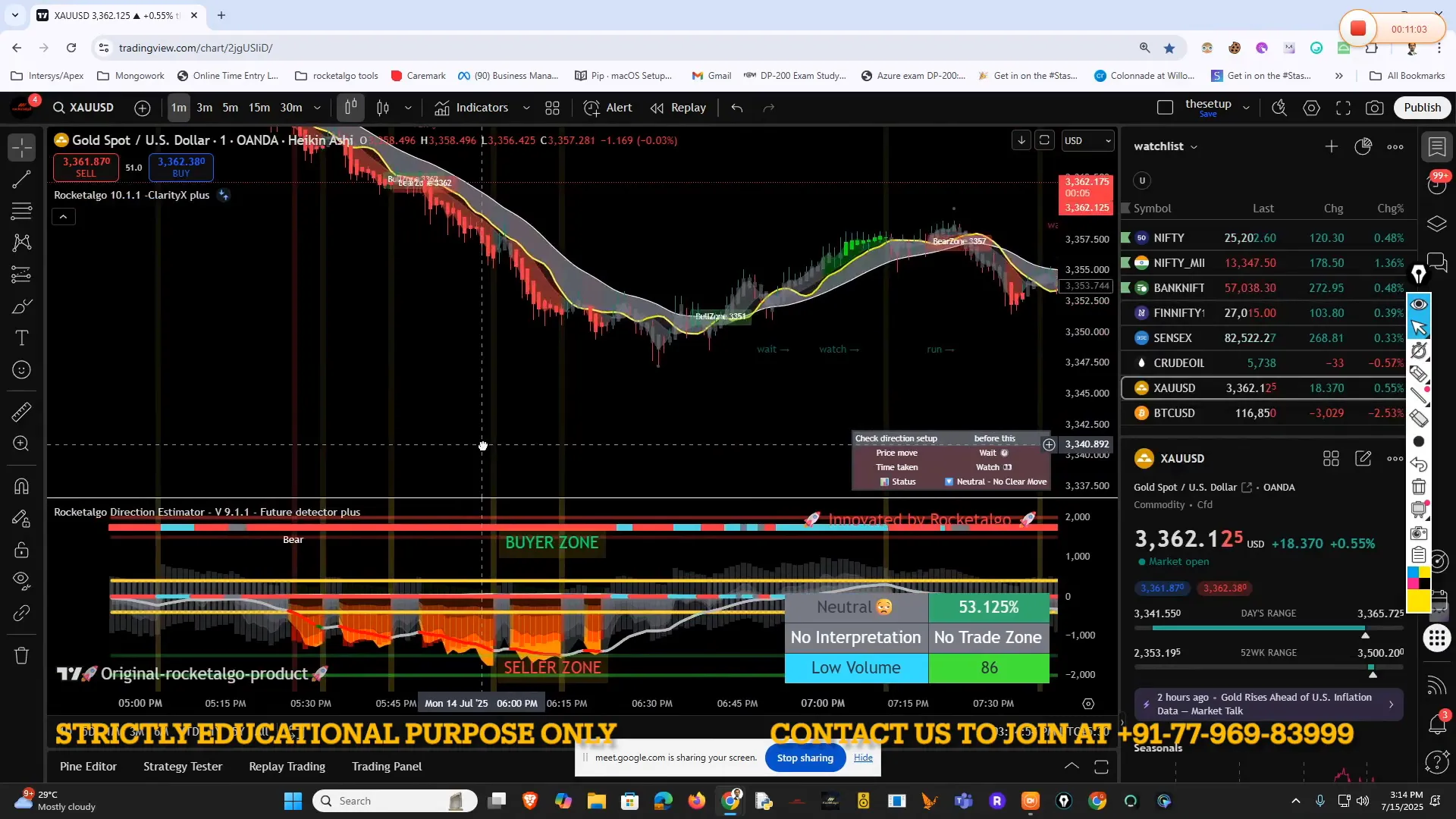

- Gold: Gold remains a favorite instrument for trading due to its dynamic price action. Despite sharp downtrends with jarring price swings, multi-time frame analysis helped capture clean trades with 12-point movements.

- Crude Oil: Crude oil trades displayed smooth and significant price swings, with some moves covering over 60 points, equating to thousands of rupees per lot.

These examples illustrate how the Rocketalgo setup can be applied across different assets and market conditions, emphasizing the importance of adaptability and technical analysis.

⚠️ Beware of Trading Scams and False Promises

One of the most valuable pieces of advice from Rocketalgo is a strong warning against scams and unreliable trading gurus. The speaker shares personal experience and cautions traders to avoid individuals or groups promising unrealistic returns or using manipulated data (“Photoshopped P&L statements”).

Key takeaways include:

- Trust Verified Sources: Rely on credible educational portals and verified trading setups like Rocketalgo’s learning platform.

- Avoid Get-Rich-Quick Schemes: Trading success requires experience, discipline, and continuous learning—not shortcuts or fake promises.

- Be Skeptical of Non-Technical Advice: Many fraudsters exploit non-technical traders by offering misleading tips or unreliable signals.

- Contact Official Support Only: Use official contact numbers and channels for queries, and never share personal information with unknown sources.

By staying vigilant and informed, traders can protect themselves from scams and focus on building genuine trading skills.

❓ Frequently Asked Questions (FAQ) 🤔

Q1: What is the Rocketalgo trading formula and how does it work?

A1: The Rocketalgo formula combines five indicators—Angle, Breakout, Candle, Money Flow, and Percentage—to identify high-probability trade setups. This systematic approach helps traders enter and exit trades based on clear market signals rather than guesswork.

Q2: Why should I avoid trading after 3 PM in the Indian stock market?

A2: After 3 PM, the market often experiences reduced momentum and increased volatility. Brokers also auto-exit intraday positions around this time, increasing the risk of unexpected losses. It’s safer to close trades before 3 PM or focus on small scalps with strict risk management.

Q3: How important is patience in trading according to Rocketalgo?

A3: Patience is crucial. Booking profits calmly after hitting reasonable targets prevents losses due to greed or impulsive decisions. Rocketalgo stresses “less is more” — it’s better to secure steady gains than chase uncertain extra points.

Q4: Can Rocketalgo’s setup be used for trading commodities like gold and crude oil?

A4: Yes, the setup is versatile and can be applied to commodities. Using multi-time frame analysis (e.g., 3-minute and 5-minute charts) helps capture clean momentum trades in volatile markets like gold and crude oil.

Q5: Where can I learn more about Rocketalgo’s trading strategies?

A5: Rocketalgo offers a free learning portal at galaxy.rocketalgo.in, along with video series and courses that explain the trading formula and strategies in detail. This is a great resource for traders looking to improve their skills.

🚀 Conclusion: Elevate Your Trading with Rocketalgo’s Proven Strategies

Trading in the stock market, especially in popular indices like NSE, BSE, and Nifty, demands a disciplined approach backed by reliable tools and strategies. Rocketalgo’s comprehensive setup—highlighting angle, breakout, candle patterns, money flow, and percentage confidence—provides a clear roadmap for traders to identify and execute profitable trades.

Key lessons to take away include the importance of patience, respecting market timing (especially avoiding trades after 3 PM), and using multi-time frame analysis for volatile assets. Moreover, staying away from scams and fake promises is essential for long-term success.

By combining Rocketalgo’s insights with consistent practice and risk management, traders can enhance their market understanding, reduce losses, and increase their chances of success in the dynamic world of stock trading.

Ready to take your trading to the next level? Explore the Rocketalgo Learning Portal today and start mastering the market with confidence!