Welcome to an insightful discussion on the latest updates from RocketAlgo, a leading name in AI-powered trading tools. In this article, we will dive deep into the newest version of RocketAlgo’s setup, designed to help traders navigate the complexities of the stock market, including NSE, BSE, and Nifty trading. Whether you are an intraday trader or someone looking to refine your trading strategy, this guide will walk you through the key features, practical insights, and trading logic behind the powerful updates that RocketAlgo has introduced. Let’s embark on this journey to enhance your trading skills and achieve better results in the dynamic market landscape.

🚀 Introduction to RocketAlgo’s Latest Trading Setup

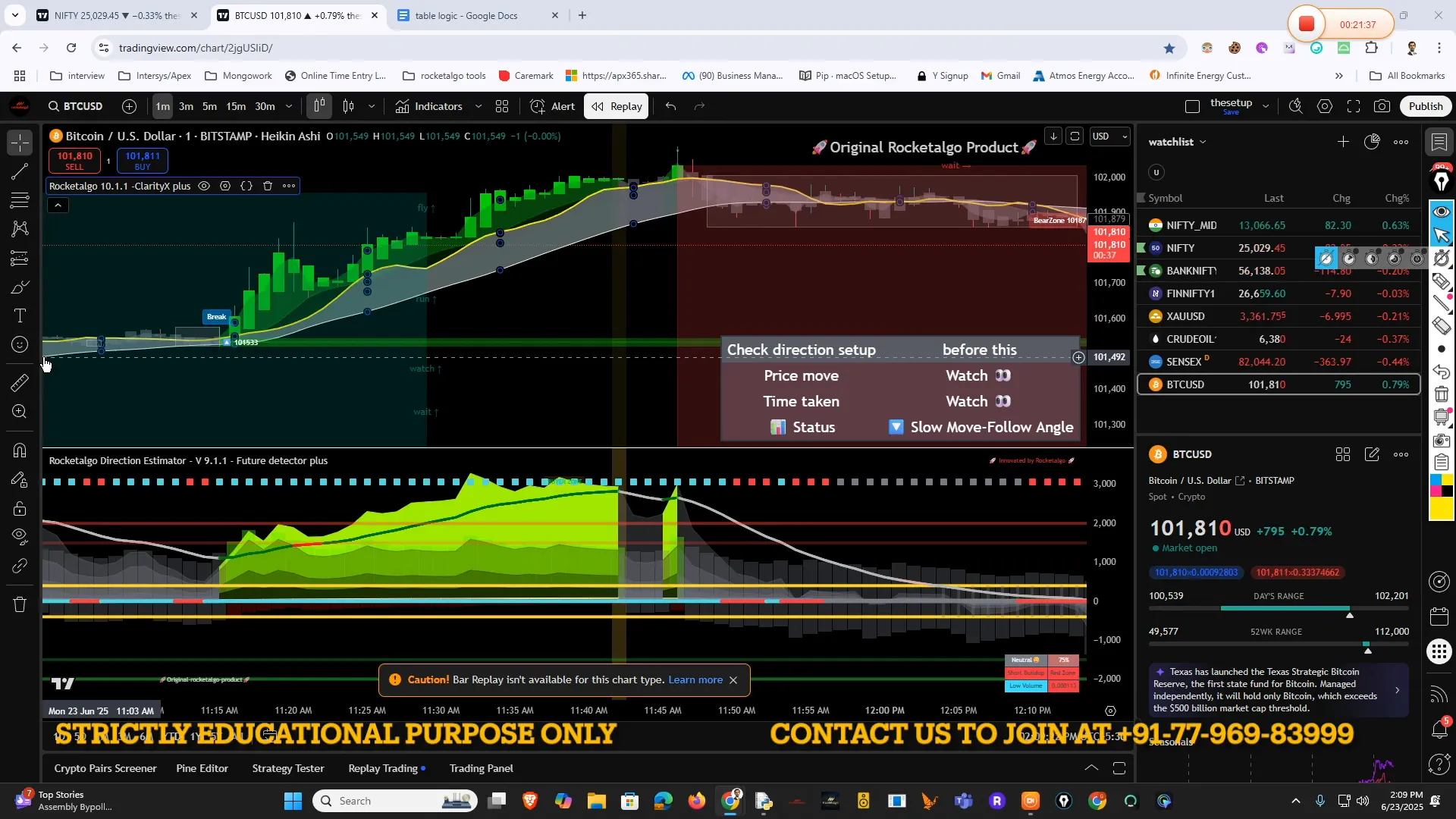

Trading in the stock market, especially on platforms like NSE and BSE, demands precision, timing, and a clear understanding of market momentum. RocketAlgo’s latest version, identified as 10.1.1, introduces a refined setup that assists traders in capturing market trends more effectively. This update brings a more detailed table logic, improved angle tracking, and momentum analysis, allowing traders to make informed decisions based on real-time data.

One of the key highlights of this update is the emphasis on “slow movement” and “momentum” indicators, which help traders recognize when the market is gearing up for a significant move or remaining neutral. As a trader, understanding these nuances can make the difference between a profitable trade and a missed opportunity.

📊 Understanding the New Table Logic and Momentum Indicators

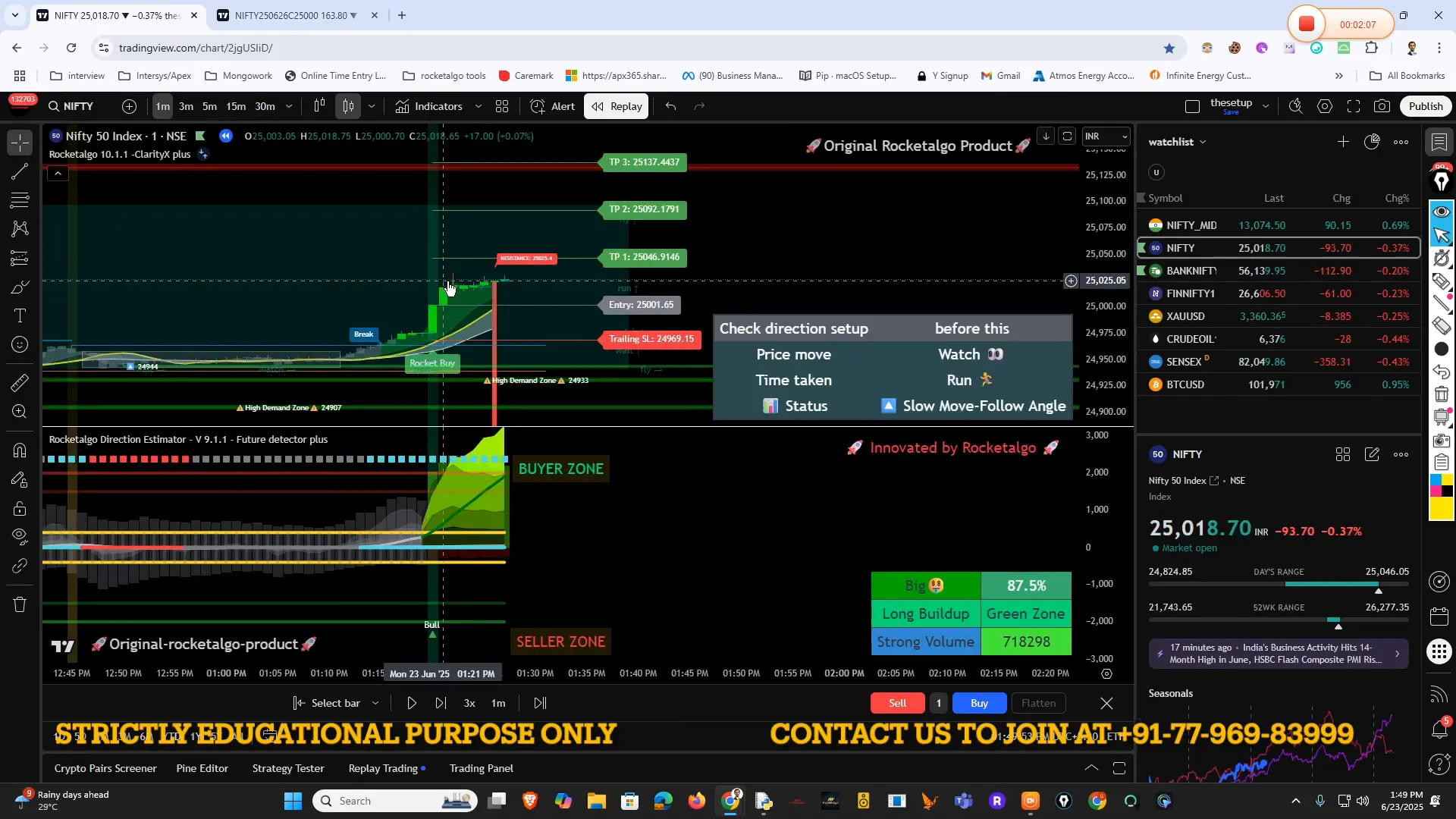

The core of RocketAlgo’s update revolves around the new table logic that displays in the dashboard as version 10.1.1. This table is not just a visual upgrade but a strategic tool that tracks the speed and direction of the market’s “train” — a metaphor used to describe price movement and momentum.

Here’s what the new table logic offers:

- Momentum Tracking: It highlights whether the market movement is slow or fast, enabling traders to adjust their strategies accordingly.

- Angle Measurement: The setup measures the “angle” of price movement, which indicates the strength and sustainability of a trend.

- Range Identification: By drawing lines around premium price ranges, traders can visualize where price action is consolidating or breaking out.

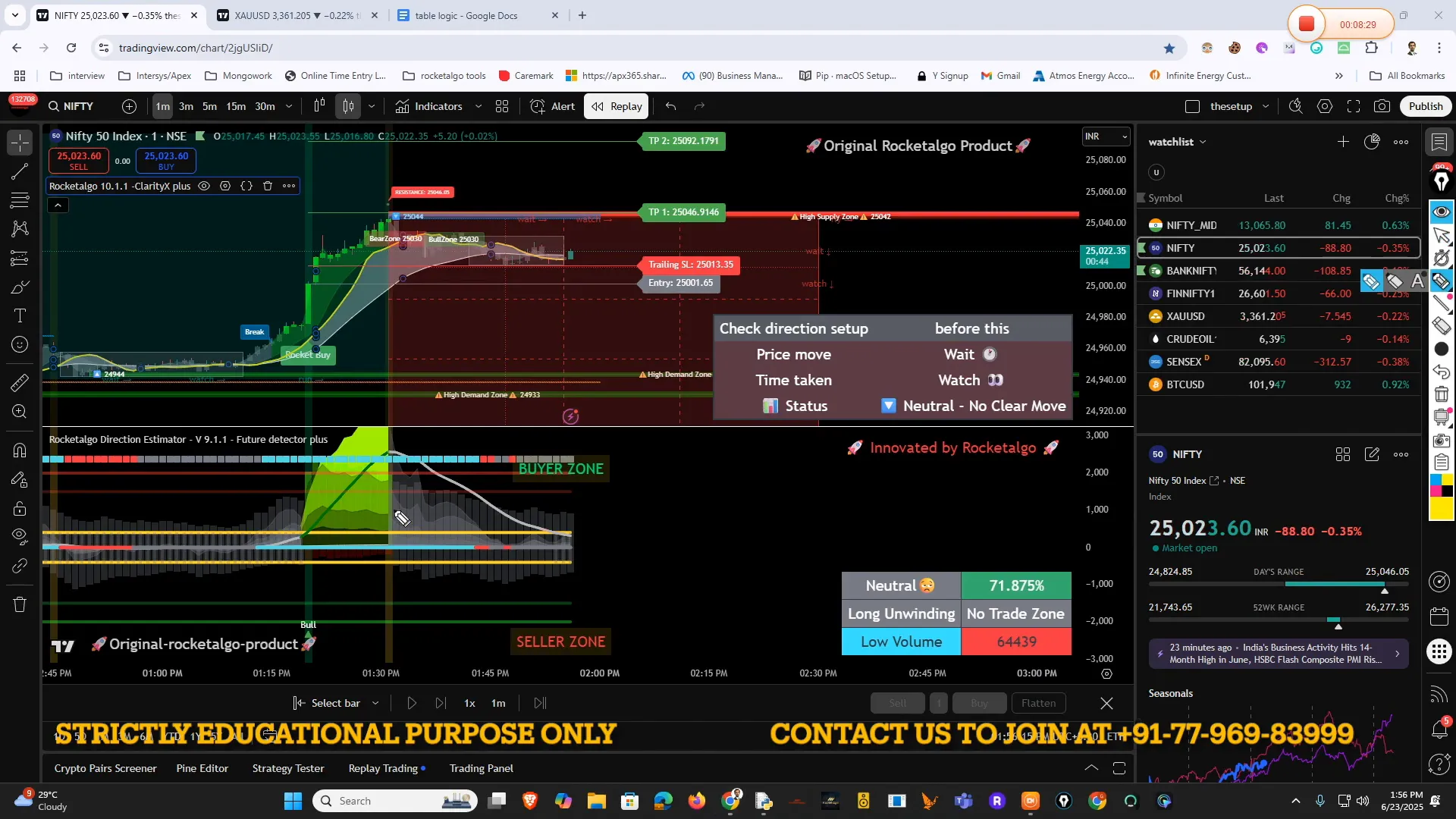

For example, when the market is in a “slow movement” phase, it means the price is moving gradually within a range, often signaling a neutral or consolidation phase. Conversely, a “run” or “fast movement” indicates stronger momentum and potential breakout opportunities.

📈 Practical Insights: How to Read and Use These Indicators

Trading is not just about identifying opportunities but also about avoiding traps. The latest RocketAlgo setup educates traders on the importance of patience and timing. Here are some practical insights shared during the session:

- Follow the Angle: Always track the angle of price movement. A larger angle usually means a stronger trend. If the angle is small, the movement is likely to be slow or neutral.

- Don’t Judge Early: Avoid making decisions too early in the session. The market can be deceptive, and momentum often develops slowly. The tool advises waiting until the trend is clear.

- Use Limit Orders: Avoid market orders which can lead to unfavorable entry prices. Instead, use limit orders to enter trades more strategically at desired price points.

- Recognize Range Dance: Markets often move sideways (“dance in a range”) before a breakout. The setup helps identify these phases so traders can prepare for the next move.

For instance, in the Nifty options chart from a recent session, the premium was moving slowly within a range between 163 and 170, showing a slow momentum phase. This suggests that traders should wait for a clear breakout before entering aggressive trades.

⏳ The Role of Time and Price in Market Momentum

One of the most enlightening concepts explained is the relationship between price movement and the time taken to achieve that movement. The market’s momentum depends not only on how far the price moves but also on how fast it moves within a given time frame.

Imagine standing in Mumbai and wanting to reach Delhi. If you remain stationary in Mumbai, you won’t reach Delhi no matter how much money or resources you have. Similarly, in trading:

- If the price is in a “wait zone” (not moving significantly) and time is also not advancing (no strong momentum), then the market is neutral and no trade should be initiated.

- When price moves fast but time is slow, it indicates a “developing trend” but not yet a strong momentum.

- When both price and time move fast, it signals a powerful momentum and a strong trend, ideal for aggressive trading.

This concept helps traders avoid premature entries and focus on trades with a higher probability of success.

🔥 Identifying Slow Movement vs. Running Trends

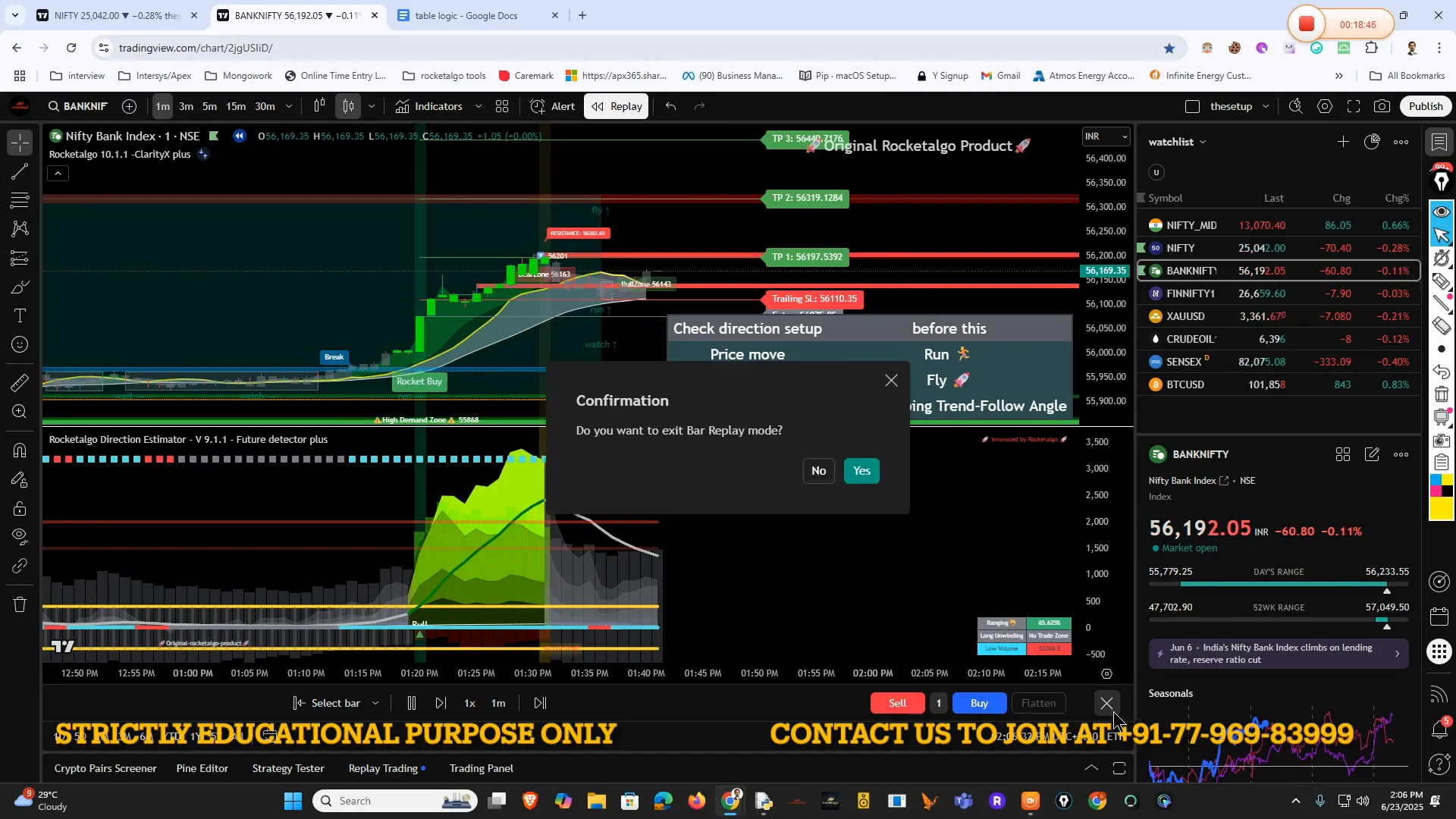

The RocketAlgo setup clearly differentiates between “slow movement” and “running” trends using its momentum indicators:

- Slow Movement: Price moves gradually, often within a range. This phase is crucial for traders to observe and prepare but not to enter aggressively.

- Running Trend: Price moves rapidly with strong momentum, often breaking out of previous ranges. This is the time to enter trades and capitalize on the momentum.

One practical tip is to “follow the angle” during slow movement phases and prepare to enter when the angle increases, indicating a transition to a running trend.

For example, in the Gold market observed during the session, a fast downward trend was identified as a “running train,” signaling a strong momentum for short trades. Conversely, in Nifty, the movement was slow and neutral, advising caution.

💡 Profit Booking and Trade Management Strategies

Profit booking is an essential aspect of trading that is often overlooked. The RocketAlgo setup provides clear signals for when to book profits, especially when the angle reverses or when resistance levels are reached.

Key points on profit booking include:

- When the angle starts to reverse or flatten, it’s a sign that institutions might be booking profits.

- Watch for candle patterns stopping upward movement—this often signals the need to exit or book profits.

- Use the setup’s resistance lines and breakout channels as reference points for profit booking.

For example, when the system indicated a reversal angle and the price stopped rising, it was a clear signal to book profits to avoid sudden reversals and losses.

🤖 Real User Insights: Success Stories with RocketAlgo

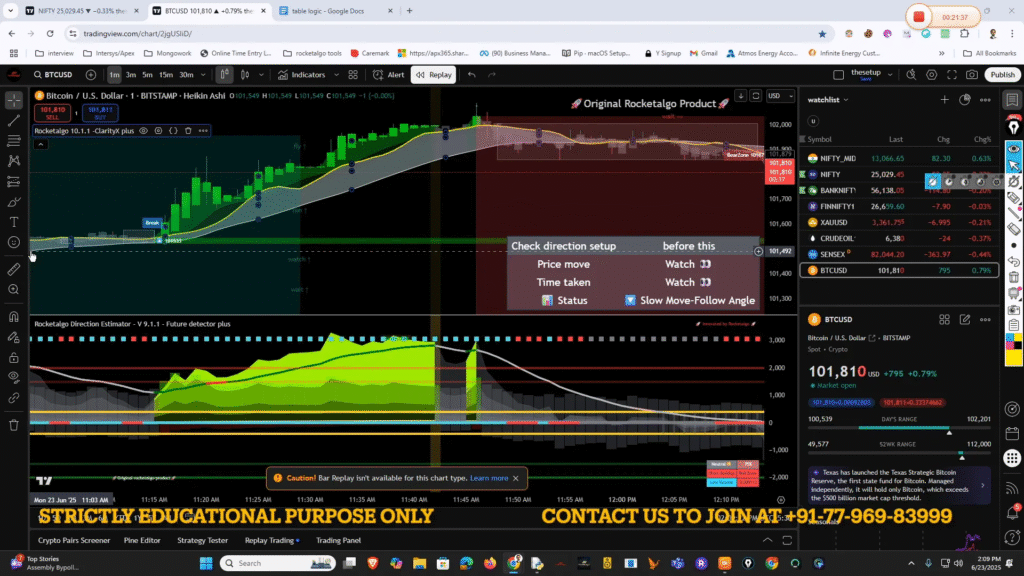

Beyond theory, the session also highlighted real user experiences, particularly in Bitcoin trading. One user shared impressive profits achieved over a few days using the RocketAlgo setup:

- Consistent profits of over $600 in a short period.

- Trades aligned with breakout angles and momentum signals from the setup.

- Use of the setup to assist in entry points while relying on market direction for booking profits.

This real-world validation underscores the practical value of RocketAlgo’s latest version for traders seeking reliable tools in volatile markets like cryptocurrency and stock indices.

📉 Common Mistakes to Avoid and Best Practices

Even with powerful tools, traders can fall into common pitfalls. The session emphasized the following best practices:

- Avoid Market Orders: Using market orders can result in poor entry prices. Always use limit orders to control your entries.

- Don’t Rush Trades: Wait for clear momentum signals rather than chasing the market impulsively.

- Understand Market Neutrality: Recognize when the market is neutral (no momentum) and avoid trading in such conditions.

- Follow the Angle: Use the angle indicator as a reliable guide to trend strength and direction.

By adhering to these principles, traders can reduce risk and improve the quality of their trades, especially in fast-moving markets like NSE, BSE, and Nifty.

🔍 FAQ: Your Questions About Trading and RocketAlgo’s Setup Answered

Q1: What is the significance of “slow movement” in trading?

Answer: Slow movement indicates a phase where the market is consolidating or neutral. It’s a time to observe and prepare but not to enter aggressive trades as momentum is weak.

Q2: How does the RocketAlgo setup help in identifying breakout opportunities?

Answer: The setup uses angle measurements and momentum indicators to signal when a trend is developing or running, helping traders pinpoint breakout points accurately.

Q3: Why should I use limit orders instead of market orders?

Answer: Limit orders allow you to set your desired entry price, preventing slippage and ensuring better trade execution, which is crucial for managing risk.

Q4: Can RocketAlgo’s setup be used for cryptocurrency trading like Bitcoin?

Answer: Yes, users have successfully applied RocketAlgo’s setup to Bitcoin trading, leveraging its momentum and angle indicators to make profitable trades.

Q5: How does time factor affect momentum in trading?

Answer: Momentum depends on how fast the price moves within a given time. Fast price movement with slow time consumption signals strong momentum, whereas slow price movement with passing time indicates a weak trend.

🔑 Conclusion: Harnessing RocketAlgo’s Latest Version for Smarter Trading

Trading in the stock market, especially on platforms like NSE, BSE, and Nifty, can be challenging without the right tools and insights. RocketAlgo’s latest version 10.1.1 offers traders a sophisticated yet practical setup to understand market momentum, manage trades better, and capitalize on breakout opportunities.

By focusing on the relationship between price movement and time, following the angle of trends, and applying disciplined trade management strategies like profit booking and limit orders, traders can significantly improve their chances of success.

Remember, the market rewards patience, preparation, and precision. With RocketAlgo’s enhanced setup, you are better equipped to navigate the complexities of trading and make informed decisions that align with market realities.

Stay disciplined, follow the momentum, and trade smartly!