Welcome to our deep dive into the world of trading with Rocketalgo! If you’ve ever felt overwhelmed by the complexities of the stock market, you’re not alone. In this article, we’ll break down the essentials of trading, particularly focusing on the Rocketalgo setup. Whether you’re navigating the NSE, BSE, or looking to maximize your Nifty investments, this guide is tailored for you.

Table of Contents

- Understanding Market Cycles 📈

- Types of Trading Opportunities 💼

- Long Buildup and Short Buildup 📊

- The Role of Institutions in Trading 🏦

- Direction Parameters in Rocketalgo 🚀

- Understanding Money Flow 📉

- Identifying Trading Patterns 🔍

- Profit Booking Strategies 💰

- Conclusion: Mastering Trading with Rocketalgo 🌐

- FAQs ❓

Understanding Market Cycles 📈

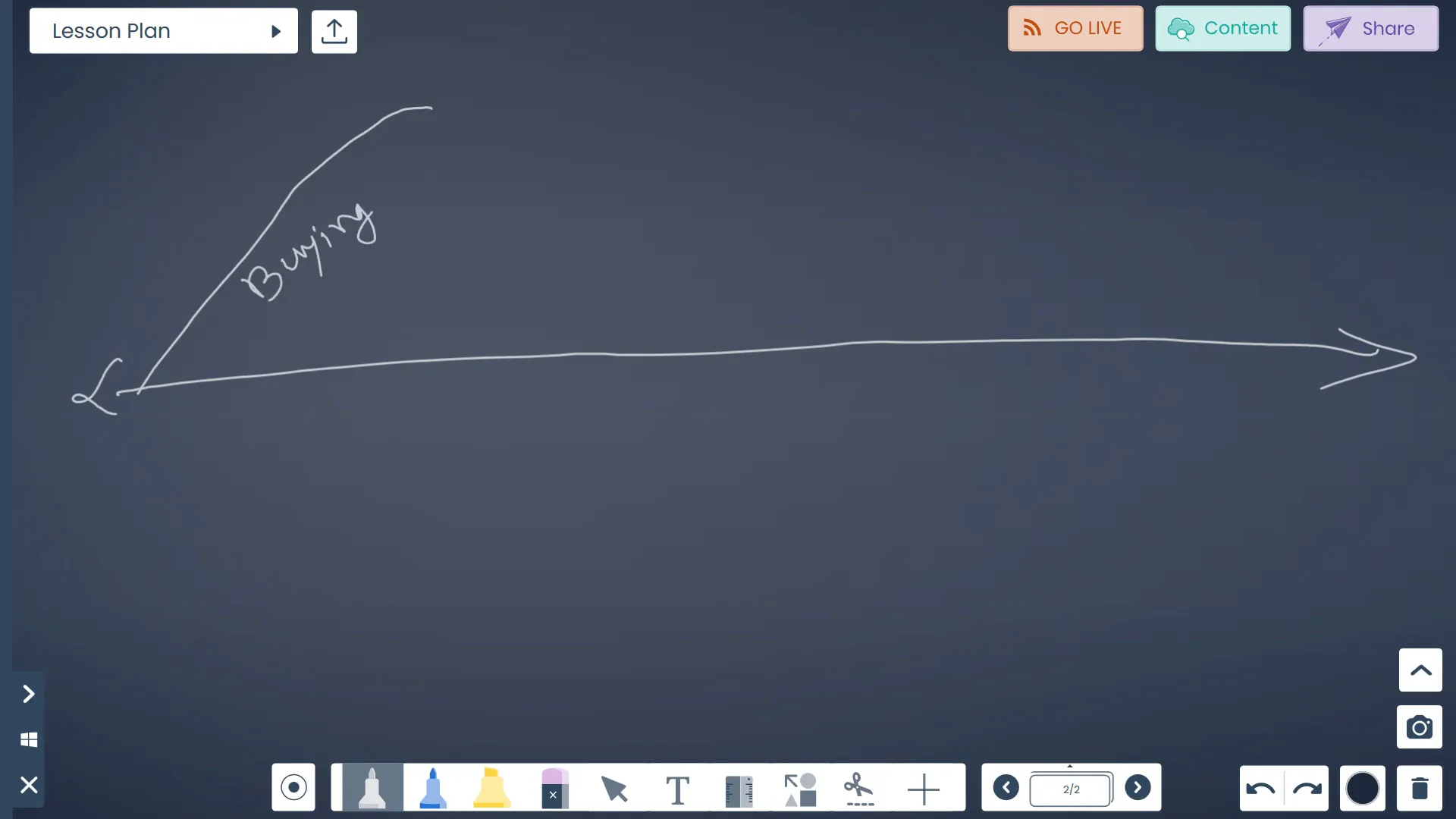

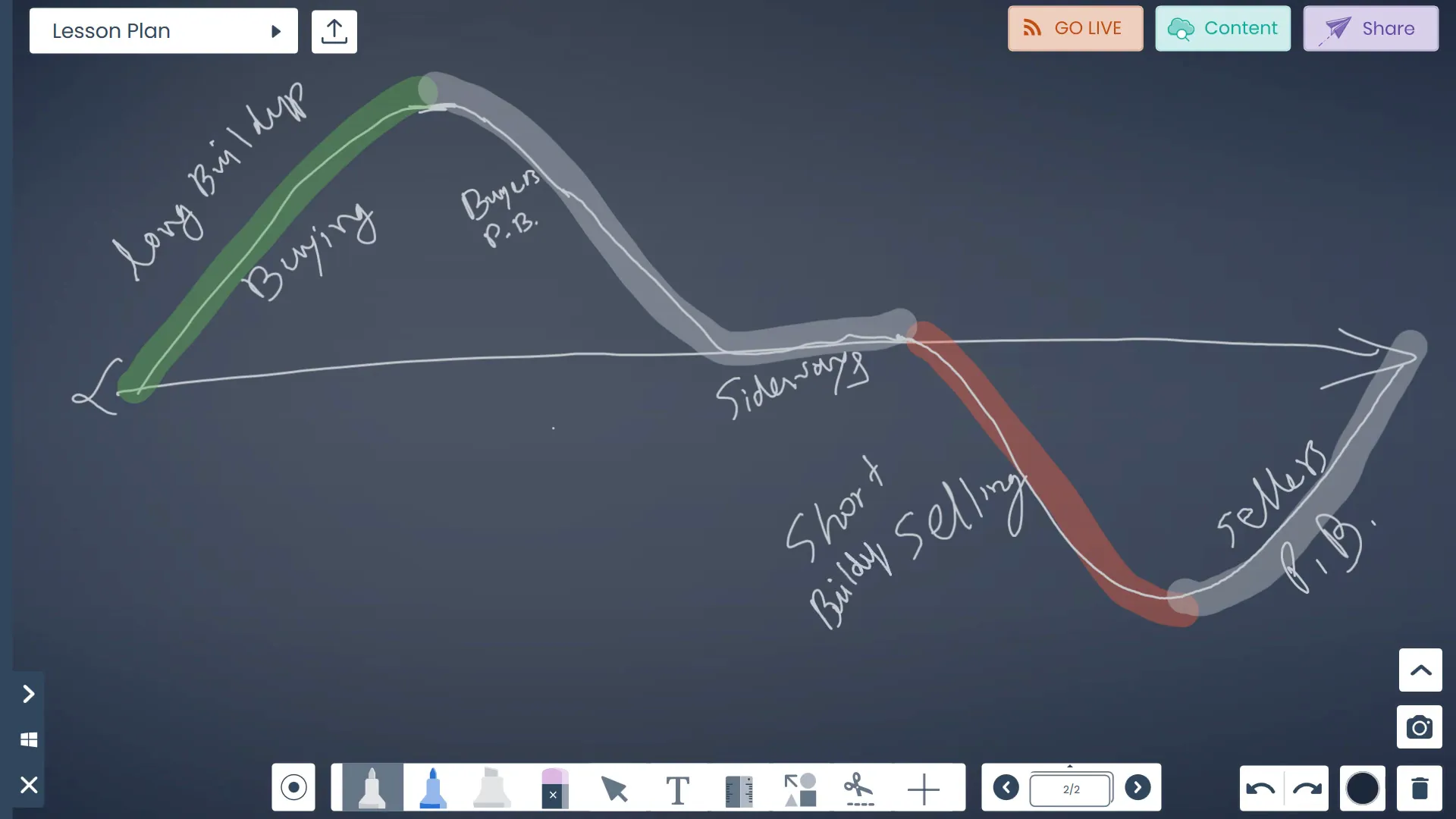

The first concept we must grasp is the market cycle. The stock market doesn’t just move in one direction; it goes through cycles. As a trader, recognizing these cycles can significantly enhance your trading strategy. The market typically oscillates between upward trends (bull markets) and downward trends (bear markets), with periods of consolidation in between.

When the market is on the rise, it’s often referred to as a buying trend. This is when traders are optimistic, and prices are expected to go up. However, as we see prices climb, profit booking often occurs, leading to a phase where the market may not immediately drop but instead move sideways. This sideways movement can be a tricky time for traders.

Understanding these cycles will help you identify when to enter or exit trades effectively. It’s crucial to ask yourself: how many types of trading exist in the stock market? What do you think?

Types of Trading Opportunities 💼

In trading, there are primarily two types of opportunities: buying and selling. As traders, we focus on these two aspects to maximize our profits. For instance, during a buying phase, we can purchase options, while in a selling phase, we can look to capitalize on downward movements.

In the stock market, there are five types of trading cycles that traders need to be aware of:

- Upward Trends

- Downward Trends

- Sideways Trends

- Profit Booking Phases

- Consolidation Phases

Even with expensive classes and resources, many traders still struggle to understand these cycles. Yet, with the right guidance, you can navigate these waters smoothly.

Long Buildup and Short Buildup 📊

Once we understand market cycles, we can delve into more specific trading strategies like long buildup and short buildup. A long buildup occurs when the market is rising, and traders are accumulating positions, anticipating further price increases. Conversely, a short buildup happens when traders are selling off their positions, expecting prices to fall.

Understanding these concepts is crucial. For instance, if you notice a long buildup, it might be a good time to enter the market, expecting prices to rise. On the flip side, if there’s a short buildup, it might be wise to exit your positions or even take a short position yourself.

The Role of Institutions in Trading 🏦

One of the most significant influences in the stock market comes from large institutions. These players have the capital to move markets significantly. When these institutions enter a trade, they bring a level of confidence that can sway the market in their favor. This is why understanding their sentiment is vital.

In Rocketalgo, we’ve developed a system to analyze institutional sentiment and map it to our trading strategies. This allows us to align our trades with the big players, increasing our chances of success in the market.

Direction Parameters in Rocketalgo 🚀

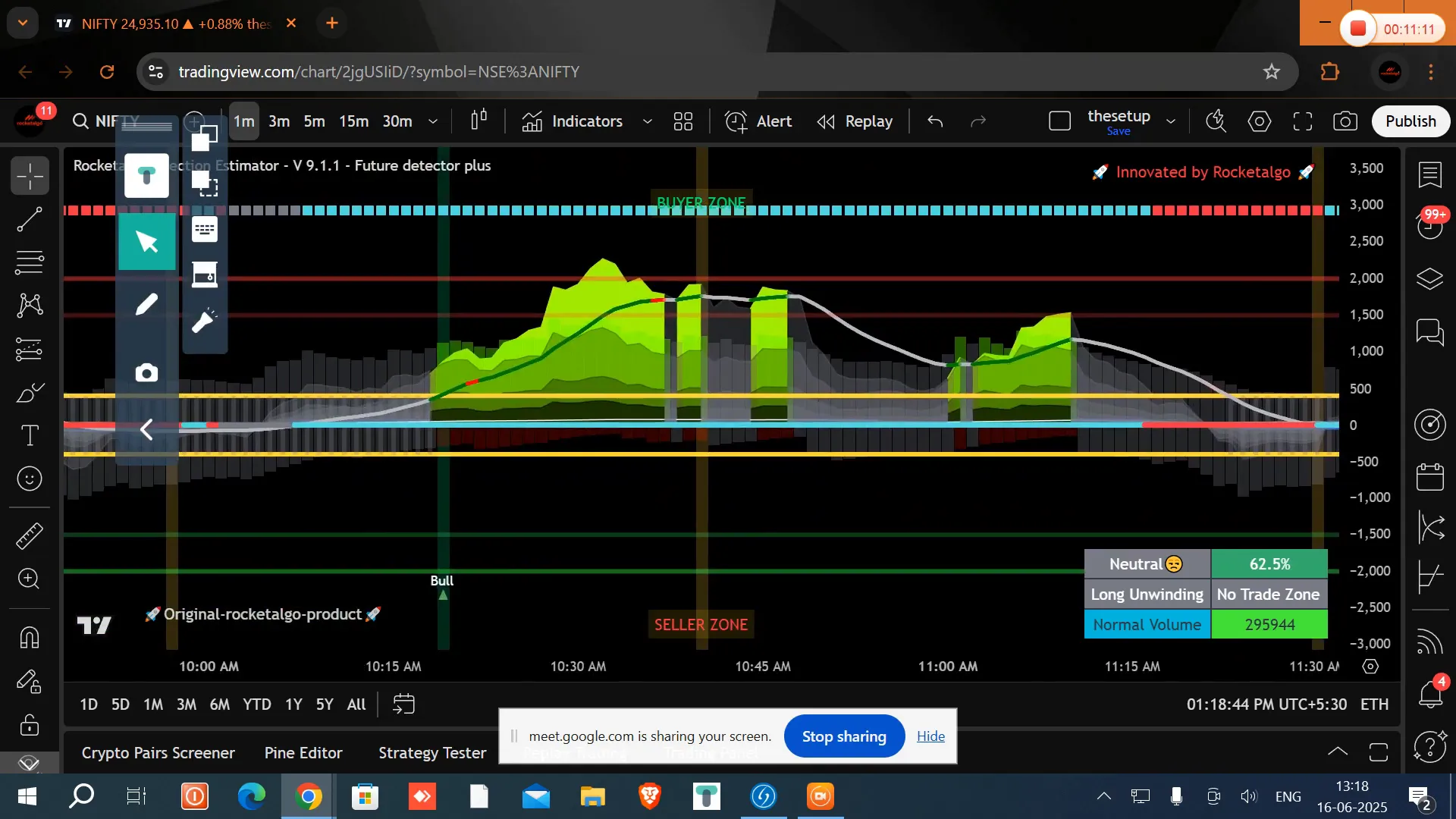

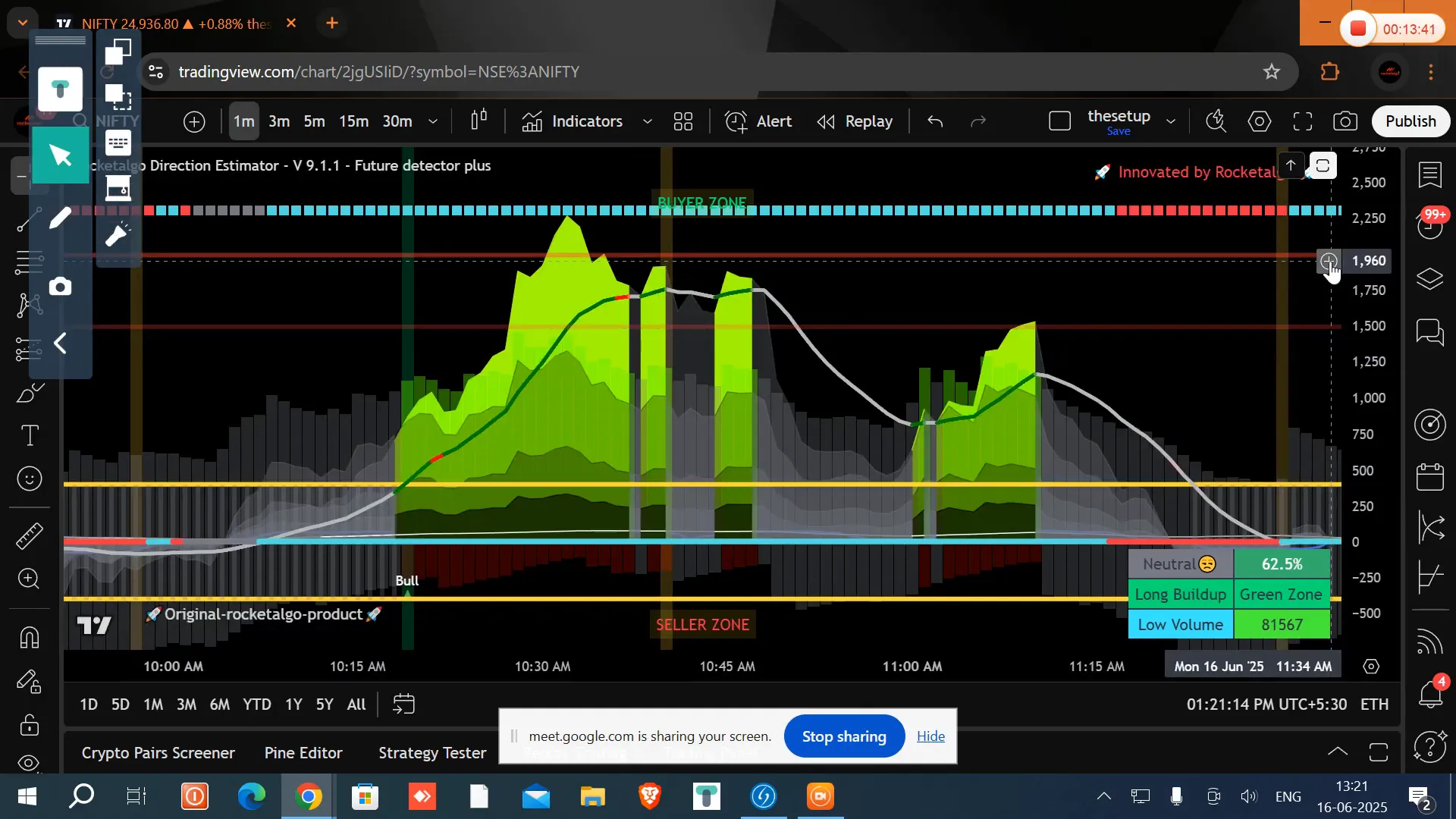

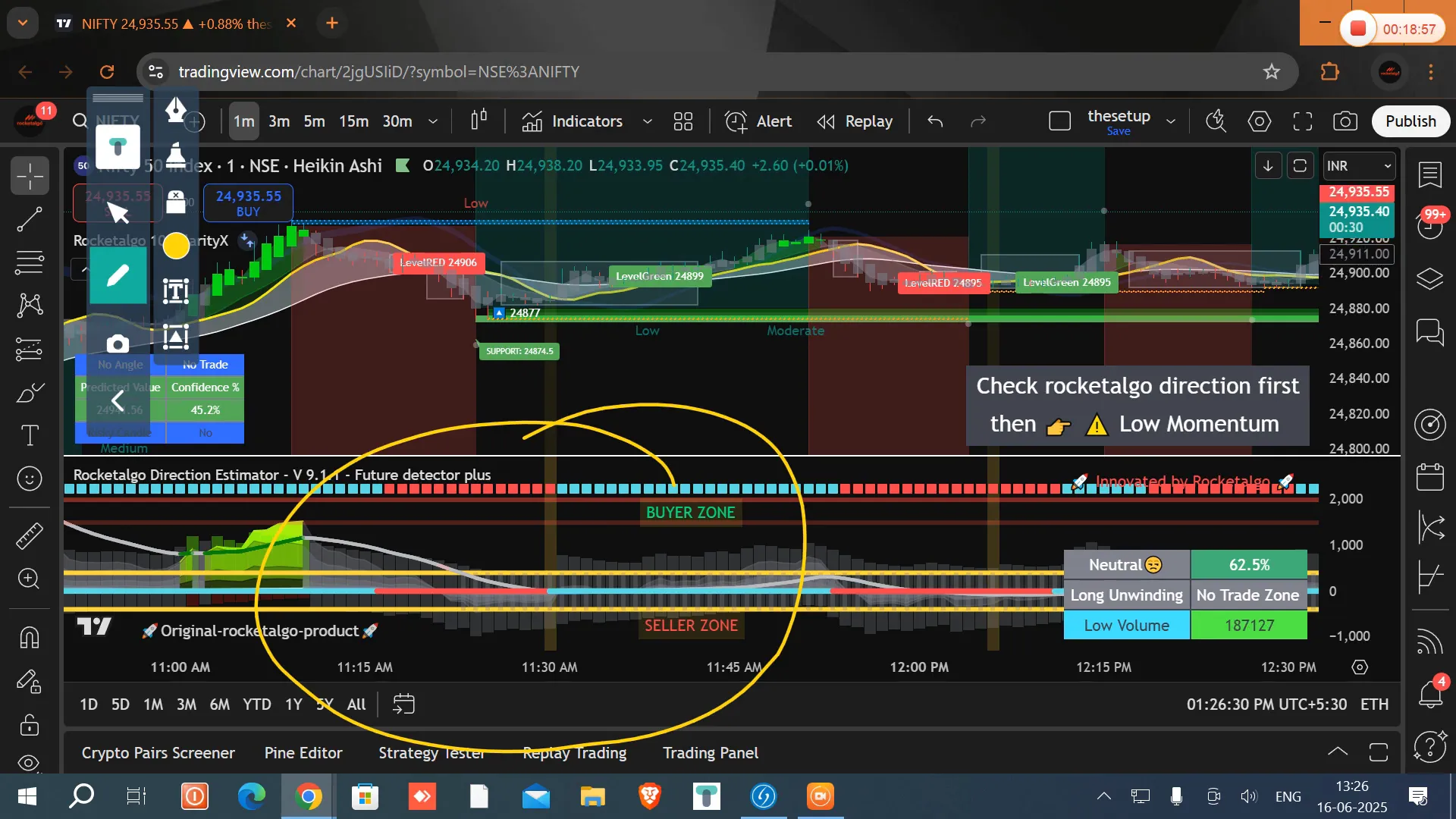

Rocketalgo has a unique feature called the direction parameter, which helps traders identify market trends based on institutional activity. By analyzing where institutions are placing their bets, we can better understand which way the market is likely to move.

For instance, if institutions are heavily buying into a stock, that’s a strong signal that prices are likely to rise. On the other hand, if they’re selling off, it’s a warning sign that you might want to reconsider your position.

Understanding Money Flow 📉

Money flow is another critical concept in trading. It refers to the net flow of money into or out of a stock or market. A strong money flow indicates that more money is entering the market than leaving, which typically correlates with rising prices.

In Rocketalgo, we analyze money flow alongside price movements to provide a comprehensive view of market conditions. If the money flow is positive and prices are rising, it’s generally a good time to buy. Conversely, if money is flowing out and prices are falling, it may be time to sell.

Identifying Trading Patterns 🔍

As traders, we must also recognize various trading patterns. These patterns can signal potential market movements. For example, a higher high pattern indicates that prices are consistently moving upward, while a lower low pattern suggests a downward trend.

These patterns can help us make informed decisions about when to enter or exit trades. By combining the understanding of market cycles, institutional sentiment, and money flow, we can create a robust trading strategy.

Profit Booking Strategies 💰

Profit booking is an essential strategy for any trader. It involves selling your positions once a certain profit level is reached. This can help lock in gains and minimize losses. However, timing your profit booking can be tricky. You want to ensure that you’re not exiting too early or too late.

In Rocketalgo, we provide tools to help you determine the best times to book profits based on market conditions. By analyzing trends, money flow, and institutional sentiment, you can make more informed decisions about when to take profits.

Conclusion: Mastering Trading with Rocketalgo 🌐

Trading can be a daunting task, but with the right tools and strategies, it becomes manageable and even enjoyable. Rocketalgo offers an innovative approach to trading by combining technical analysis with institutional sentiment and money flow analysis.

By understanding market cycles, recognizing trading opportunities, and implementing effective profit booking strategies, you can enhance your trading performance. Remember, the key to success in trading is not just about making profits; it’s also about managing risks effectively.

FAQs ❓

1. What is Rocketalgo?

Rocketalgo is a trading platform that provides tools and insights to help traders make informed decisions in the stock market.

2. How does Rocketalgo analyze market cycles?

Rocketalgo uses advanced algorithms to track price movements and identify market cycles, allowing traders to understand when to buy or sell.

3. What is the importance of institutional sentiment in trading?

Institutional sentiment can significantly influence market movements. By aligning your trades with institutional activity, you increase your chances of success.

4. How can I start using Rocketalgo?

You can join Rocketalgo by visiting our website and signing up for an account.

With this comprehensive understanding of Rocketalgo and trading strategies, you’re now equipped to navigate the stock market confidently. Happy trading!