Hi, I’m Aditya from Rocketalgo Official. In this session I walked traders through what’s happening in the markets today, why momentum is weak, and what you should and should not do. This article captures that discussion in a practical, plain‑spoken way so you can use these ideas directly in your trading, stock market, NSE, BSE, Nifty decision making. I’m sharing lessons from the session, real examples from options and index behaviour, and actionable rules for protecting capital and staying sharp when markets are slow.

Table of Contents

- 🔍 Quick summary: What happened today and why it matters

- 📉 Market structure today: Range, no angle, slow momentum

- 🧭 Options and market‑maker behaviour: Why Bank Nifty felt different

- ⚠️ Beware of tipsters, broker cold calls, and scripted groups

- 🛠️ Practical rules to trade this kind of slow market

- 📈 Examples from today: Gold, Nifty, and Bitcoin mentions

- 🌐 Macro and geopolitical context: Why external news matters

- 📬 Communication and community: Rocketalgo updates and training

- 🔎 Real stories: Why patience is a traded skill

- 🧾 Checklist before you place any trade in this environment

- 💬 Live Q&A highlights and community questions

- ❓ Frequently Asked Questions (FAQ) — trading, stock market, NSE, BSE, Nifty

- 🔔 Final thoughts: patience, process, and the value of doing nothing

🔍 Quick summary: What happened today and why it matters

Today the market was unusually slow — low momentum, low volume, and a clear rangebound movement in the indices. Bank Nifty and Nifty were both struggling to create directional conviction. From an options and market‑maker perspective, this low‑pressure environment often happens when big players are confused or waiting for regulatory clarity, macro news, or directional triggers.

Key takeaways:

- Range structure dominates: price oscillates between support and resistance without clean trend angles.

- Low momentum = avoid chasing trades. Staying out of “bogus trades” is itself profitable.

- Brokers, tipsters, and market makers influence short‑term order flow — be mindful of tip noise and potential manipulation.

- Macro or geopolitical events (e.g., news from international markets) can suddenly change sentiment and cause volatility.

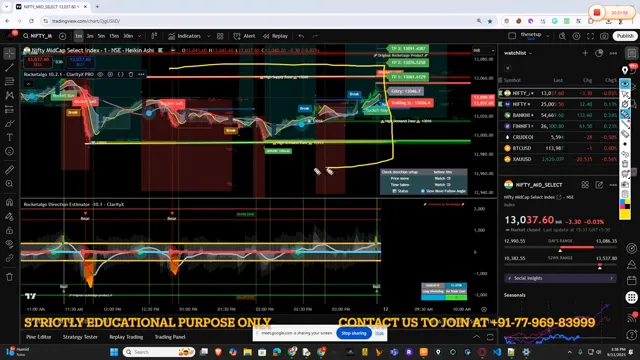

📉 Market structure today: Range, no angle, slow momentum

When I map today’s session, what stands out is the range. The structure is simple: price hits upper boundary, fails to break, falls back to lower boundary, and repeats. Drawing two parallel lines and a box on the chart makes this obvious. In such a period the “angle” that our setup looks for — a clear trending slope — is absent. That’s a red flag for aggressive entries.

In plain terms: if your setup requires an angle or momentum confirmation and that confirmation is missing, do not force the trade. I repeatedly emphasize this: a missed trade is often better than a losing trade. Protecting capital is the priority.

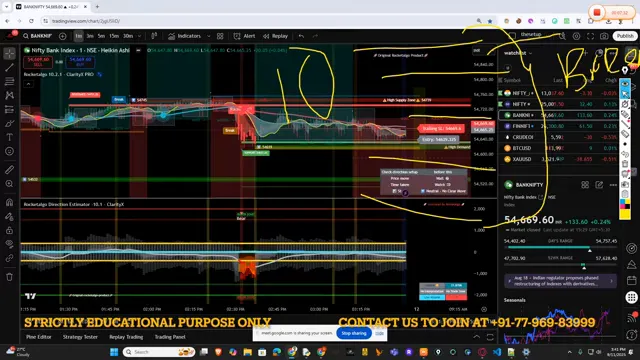

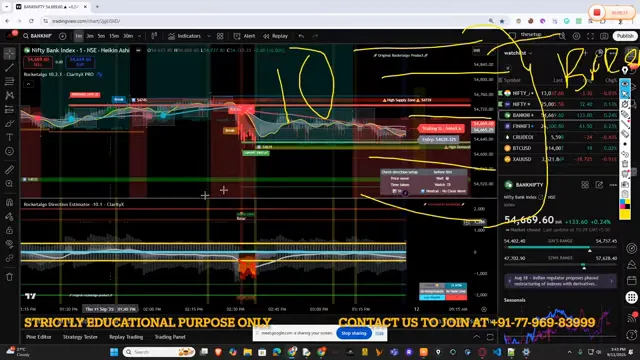

🧭 Options and market‑maker behaviour: Why Bank Nifty felt different

One reason Bank Nifty behaved oddly compared to Nifty is the presence of broker‑houses tied to bank constituent stocks. These entities often have significant flow and internal accounts, so options and order‑flow dynamics can be different. The options data that retail participants see may lag or be interpreted differently than what certain brokers see internally.

Remember:

- Bank Nifty often has concentrated participation from proprietary desks and large broker houses.

- When those participants step back, the index can lack the momentum needed to break ranges.

- If you’re a retail trader, assume you are not the first to see large institutional flow — act conservatively.

⚠️ Beware of tipsters, broker cold calls, and scripted groups

I highlighted a critical point: tipsters and broker cold calls can cloud judgment. Many retail traders have experienced “hot tips” from Telegram channels, WhatsApp groups, or even brokerage phone calls. After regulatory action by SEBI and investigations into fraudulent tip networks, we’ve seen that some tip services operate from a single room under multiple aliases, using scripted operators to phone clients.

Why this is dangerous:

- Tipsters often sell a narrative that creates FOMO — encourage impulsive participation in low‑probability trades.

- Broker incentives can bias communication. A broker earns commission when a client trades; tip calls can be an engagement tool rather than a quality signal.

- After enforcement actions, some tip networks go underground and become more aggressive in selling “sure things.”

If someone calls offering high‑probability tips during a low‑momentum session, ask for clear logic and refuse to trade from FOMO. Sometimes doing nothing is your best trade.

🛠️ Practical rules to trade this kind of slow market

Below I lay out a checklist of practical rules I follow and teach in our systems. These are simple, repeatable, and focused on risk control.

- Respect structure: If the market is rangebound, trade range setups with defined edges — buy near support, sell near resistance, use tight stops.

- Avoid angle‑dependent trades: If your trading system looks for a trending angle and the angle isn’t there, stand aside.

- Volume confirmation: Require volume or liquidity confirmation for breakout trades. No volume = no breakout.

- Keep position size small: In low‑signal environments, reduce size and risk per trade. Preserve margin for high‑probability setups.

- Be skeptical of tips: Evaluate any external tip as an idea, not instruction. Always corroborate with price action and options flow.

- Check options open interest: Watch where large OI clusters and strikes are. They can act as magnets or barriers during range days.

- Use time filters: If your setup typically works within certain time windows (e.g., 15 minute intraday structure), only take signals within those windows.

📈 Examples from today: Gold, Nifty, and Bitcoin mentions

Today, gold showed a support near 3615 INR — an important micro‑level that we discussed. Gold’s behavior, like other commodities, can carry large ranges that tempt traders into shorting based on news or subjective expectation. I pointed out how traders who shorted gold repeatedly when it continued to rise experienced cumulative losses: shorting a strong instrument without structural confirmation can chew through P&L.

Similarly, for indices like Nifty and Bank Nifty, avoiding shorts in the absence of momentum was a practical recommendation. We also discussed Bitcoin briefly — the Rocketalgo setups detect algorithmic setups across instruments. For crypto and other volatile instruments, define your entries strictly and use risk control.

🌐 Macro and geopolitical context: Why external news matters

Markets do not operate in a vacuum. We discussed a breaking international news event: the attack on an American activist figure (Charlie Kirk in the session’s context) and how such targeted geopolitical or security events can ripple through global markets. Even if news originates in another country, the global financial ecosystem reacts — especially when headlines trigger concerns over safety or policy direction in major economies.

Implications for traders:

- Short‑term volatility spikes can come from geopolitical or high‑profile incidents. These spikes may temporarily override technical signals.

- Risk premia can rise quickly: options implied volatility may jump even if spot price moves modestly.

- Always be ready to tighten risk or step aside when global headlines amplify uncertainty.

📬 Communication and community: Rocketalgo updates and training

We’re rolling out a WhatsApp Newsletter and research system for members. The idea is to deliver concise Rocketalgo insights directly to your phone: setups, alerts, and learning materials. If you’re part of our community, this gives you timely setups and reduces the noise from random tips.

I also mentioned training: we run live sessions that go deeper into setups and point‑by‑point execution. If you trade intraday or with small timeframes, attending those nightly sessions helps you internalize the rules and manage emotions in real time.

🔎 Real stories: Why patience is a traded skill

I prefer to share real client experiences because they teach faster than theoretical charts. One user shared that they achieved two targets in gold using patient entries rather than forcing shorts. Another noted how following scripted tips led to repeated small losses; the breakthrough was learning to “hand‑rest” — a practical habit of not trading impulsively.

What is hand‑rest?

- It’s an operational habit where you deliberately refrain from trading for a fixed time window (for example, 15 minutes) after a noisy or conflicting signal.

- This prevents revenge trading, overtrading, and emotional chopping when the market lacks clarity.

🧾 Checklist before you place any trade in this environment

Before you put on a trade when the market is slow, run through this short checklist:

- Is the trade aligned with the current market structure (range vs trend)?

- Is there volume or options confirmation for a directional move?

- Have I validated the trade against higher timeframe structure (daily/4‑hour)?

- Is position size reduced given the ambient uncertainty?

- Am I trading from a tip or research source? If a tip, have I verified it against price action?

- Do I have a clear stop and a realistic target? If not, don’t trade.

💬 Live Q&A highlights and community questions

During the session viewers asked practical questions — like why some brokers’ clients get frequent tips, or how to handle repeated short losses on gold. My answers were direct:

- Brokers may call because brokerage revenue depends on client turnover. That does not mean the tip has a favourable edge.

- If your short bias keeps losing, re-evaluate: either timing, entry technique, or structural assumptions are wrong.

- Trade smaller, wait for confirmation, and treat tips as hypotheses to be validated before execution.

❓ Frequently Asked Questions (FAQ) — trading, stock market, NSE, BSE, Nifty

Q1: When the Nifty or Bank Nifty is rangebound, which instrument should I prefer?

A: In range markets, consider trading instruments with tight spreads and sufficient liquidity — Nifty futures/Bank Nifty futures for index play, or liquid stocks within NSE/BSE that respect support/resistance. Use smaller size and focus on mean‑reversion or structural breakout retests.

Q2: How do I know whether a tip is reliable?

A: Ask for rationale (technical levels, OI data, risk parameters), check price action, OI, and implied volatility. Reliable information will be testable and replicable on your charts; vague calls or those promising big returns with no logic are suspect.

Q3: Should I follow the broker phone calls offering trade ideas?

A: No — treat broker calls as marketing. If a broker provides a well‑documented research note and you verify it with chart structure and risk levels, then it is usable. Otherwise, be cautious and limit trade size.

Q4: How can I protect myself from “scripted tip groups”?

A: Verify the tip’s logic, cross-check across multiple independent sources, look up any enforcement news from SEBI, and maintain strict position sizing. Do not blindly copy trades from anonymous channels.

Q5: How does global news affect local indices like Nifty?

A: Global news affects risk sentiment, inflows, currency volatility, and sector rotation. Major headlines from the US or geopolitical events can change volatility regimes. Monitor global markets, currency moves, and flows to anticipate such effects.

Q6: What should I do when I feel FOMO during low momentum sessions?

A: Implement “hand‑rest”: step away for a short fixed period, reduce position size, or trade only pre‑verified setups. Journal your emotions and track how often FOMO trades lose versus disciplined trades win.

🔔 Final thoughts: patience, process, and the value of doing nothing

Markets cycle. Some days you will find high momentum and many tradable setups; other days you will get quiet, rangebound action where the best profit is preservation of capital. Today was one of those quiet sessions. I emphasized repeatedly: being calm, patient, and disciplined is as profitable as making winning trades. If your system needs an angle, and the angle’s missing, the correct trade is to wait.

We’re improving our research system and launching a WhatsApp newsletter to deliver clear, timely Rocketalgo ideas to members. If you want to sharpen your approach to trading, stock market, NSE, BSE, Nifty instruments, focus on structure, risk management, and learning to ignore noise from tips and scripted groups.

Thank you for reading — trade smart, keep a disciplined checklist handy, and treat every session as a practice in process and patience. If you’re interested in our courses, research system, or the WhatsApp newsletter, you’ll find links and contact details on the Rocketalgo channels and learning portal.

Key resources mentioned:

- Rocketalgo learning portal and apps

- WhatsApp Newsletter for direct research updates

- Live training sessions for point‑by‑point execution

Stay safe, focus on the process, and remember: sometimes your best trade is no trade. — Aditya, Rocketalgo Official

Need more help |

|

Contact us by clicking the button below |

|

Click me |