Hello — I’m the host from Rocketalgo Official. In this detailed write-up I’ll walk you through today’s market session, our updated RocketAlgo 10.3.1 logic, live examples from Nifty and midcap moves, gold trades, and a candid discussion on auto-traders and risk management. If you follow trading, stock market, NSE, BSE, Nifty updates, this article is written for you — practical, direct, and designed to help you trade smarter.

Table of Contents

- 🔥 What this article covers

- 📌 Understanding candle zones, momentum, and why context beats single candles

- 🚀 RocketAlgo 10.3.1 — what changed and how we beta-tested it

- 📈 How I read angle, breakout and candle money flow — the simple formula

- 💎 Sector examples: Nifty, midcap, gold, and Bitcoin — live observations

- 🎯 Trade sizing, targets, trailing stops, and practical exit rules

- ⚠️ Auto-traders — why I’m skeptical and what to watch for

- 🕒 Practical session: how I trade live (entries, early entries, and safe modes)

- 🧠 Common mindset mistakes and the railway-gate metaphor

- ❓FAQ — Frequently Asked Questions

- ✅ Practical checklist before entering any trade

- 🔚 Conclusion — trade smart, not loud

- 📞 Contact & resources

🔥 What this article covers

- How we read candle zones and momentum in live sessions

- Why zone context matters more than single candles

- What’s new in RocketAlgo 10.3.1 and how we tested it

- Real examples: Nifty intraday, midcap signals, gold and Bitcoin observations

- Entry and exit rules, targets, trailing stop ideas and safe trading

- Why auto-trader promises are dangerous and what to ask before trusting any system

- Actionable checklist and an FAQ to clear common doubts

Throughout the article you’ll see screenshots tied to exact moments of the session to help you visualise the logic. I’ll also explain the simple formula I use so you can apply it across the trading, stock market, NSE, BSE, Nifty universe.

📌 Understanding candle zones, momentum, and why context beats single candles

Let’s begin with a simple but critical observation: a single candle means very little unless you know which zone it’s in. When candles move upward while entering a green zone you have a high chance of catching a strong move. Conversely, when candles move downward entering a red zone, the probability of strong downward momentum increases.

Why does this matter? Because green candles in a red zone or red candles in a green zone almost always lack conviction. They produce sideways, weak trades. If you are trading, stock market, NSE, BSE, Nifty instruments and ignore the zone context, you’re essentially guessing. Zone context is like a compass — it gives direction. Without it, candles wiggle and produce noise.

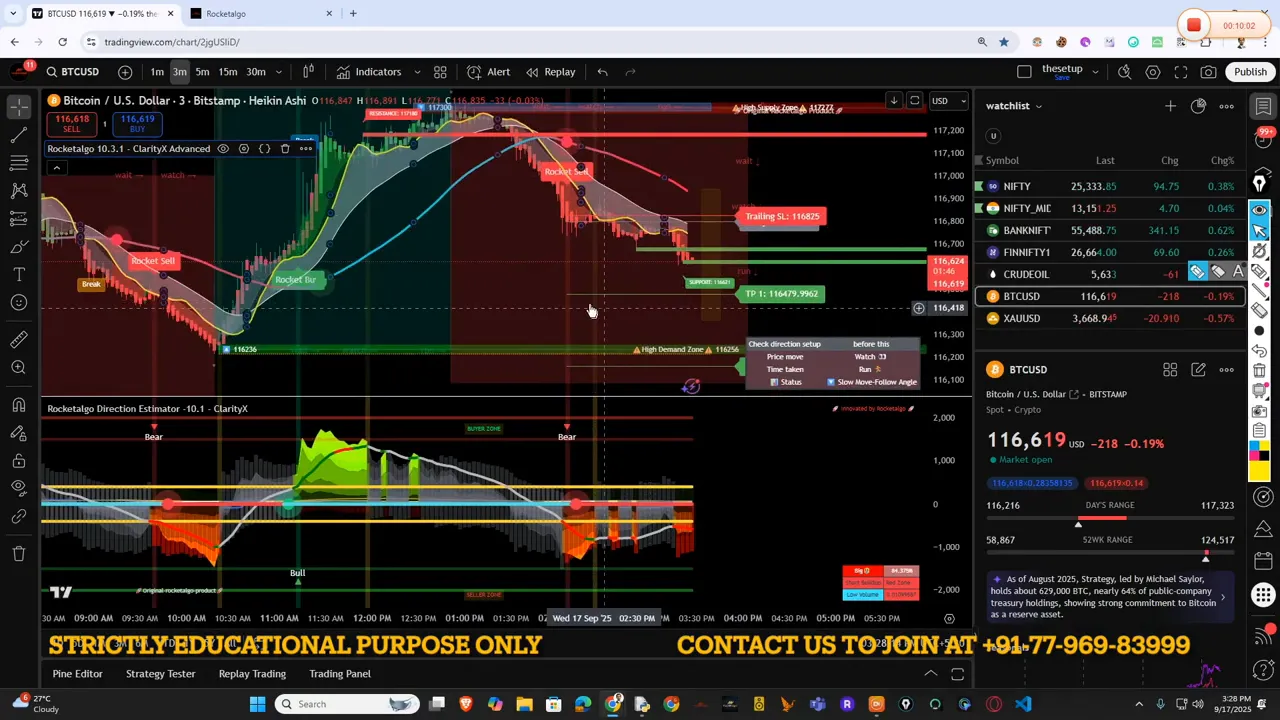

Look at the screenshot above — this was a clean momentum capture of roughly 15–20 points because the green candles were moving into a green zone with angle and volume backing them. Contrast that with situations where candles are trying to rise but encounter resistance and immediately go sideways — the momentum fizzles out.

Key takeaways about candle zones

- Green candle entering green zone = higher probability of sustained upward movement.

- Red candle entering red zone = higher probability of sustained downward movement.

- Green candle in red zone or red candle in green zone = usually weak, sideways trades with no conviction.

- Volume profiling is a necessary filter: if buyers are not supporting a green candle in the green zone, it’s weak.

If you are trading, stock market, NSE, BSE, Nifty, add zone context to every trade decision. This one habit will reduce false breakouts and save you emotional drawdowns.

🚀 RocketAlgo 10.3.1 — what changed and how we beta-tested it

We rolled out RocketAlgo 10.3.1 to many users for beta testing. The update focuses on intelligent zone calculation — it doesn’t just label consolidation or sideways; it quantifies whether a candle’s context makes sense for a trade. We gave the update to a large group: feedback from about 98% was positive; 2% found aspects confusing, which is normal with any upgrade. We listened and refined the UI and the alert logic accordingly.

The new version includes three core filters we emphasize during live trading:

- A — Angle: The direction line or angle must be meaningful (not flat or choppy).

- B — Breakout: Real breakout levels need to show follow-through and volume confirmation.

- C — Candle money flow percentage: How much buying/selling money is moving into the candle cluster — this gives the confidence for targets.

We built in a “safe trade” mode for people who prefer conservative entries — the algorithm waits for a clear angle and breakout confirmation before flashing buy/sell signals. For traders who are comfortable taking slightly earlier entries with more risk, we added logic that allows an “early risk taker” flag — but only if users explicitly enable it. That way both cautious and aggressive traders can use the same system without stepping on each other’s feet.

If you use the free version on TradingView, you’ll still see valuable signals. However, the paid users who joined beta had access to finer alerts like angle dots, breakout bands and zone-based trailing stop suggestions.

📈 How I read angle, breakout and candle money flow — the simple formula

I keep things simple so you can replicate: A for Angle, B for Breakout, C for Candle Money Flow percentage. If any of these is weak, I step back. That’s the core philosophy that we injected into RocketAlgo 10.3.1.

Angle: This is the directional line that must form a recognizable slope. If the angle is weak or flat, candles will likely go sideways even if they look bullish.

Breakout: Look for a breakout level that shows a follow-through. A false breakout is easy to spot — it breaks then recoils to zero or the midpoint. If the breakout has volume and angle backing, it usually has follow-through.

Candle Money Flow %: This is the percentage of trade flow into those candles versus distribution. If the money flow percent is strong and aligns with angle and breakout, targets tend to be hit reliably.

When all three line up, you have a high-probability trade. If one element is missing, treat the signal as weak and either avoid the trade or use smaller size and wider stops.

💎 Sector examples: Nifty, midcap, gold, and Bitcoin — live observations

We saw multiple real-world examples today that highlight how the formula plays out across different instruments.

Nifty — morning ride and momentum capture

This morning Nifty showed a classic clean move. Candles moved into the green zone, angle formed, and volume backed the move. That combination delivered a 15–20 point momentum capture. If you trade Nifty and are monitoring trading, stock market, NSE, BSE, Nifty charts, this is the kind of alignment you want before taking a larger size.

Midcap (Nifty Midcap) — straightforward setup

Midcap provided a straightforward setup with angle formation and subsequent down momentum when the angle flipped. Here, the RocketAlgo indicators were sticky — once the angle indicated a tilt, the instrument followed through to the first target and then rolled to the second. This shows the value of multi-timeframe angle confirmation.

Gold — a textbook trend and retrace

Gold behaved in a predictable manner: volume profiling showed repeated attempts to open below and the trade moved sharply down whenever sellers got control. After profit-booking and a sideways phase, it opened the downside again and continued the move. The same A-B-C logic captured this move cleanly on our charts.

Bitcoin — different beast but same rules

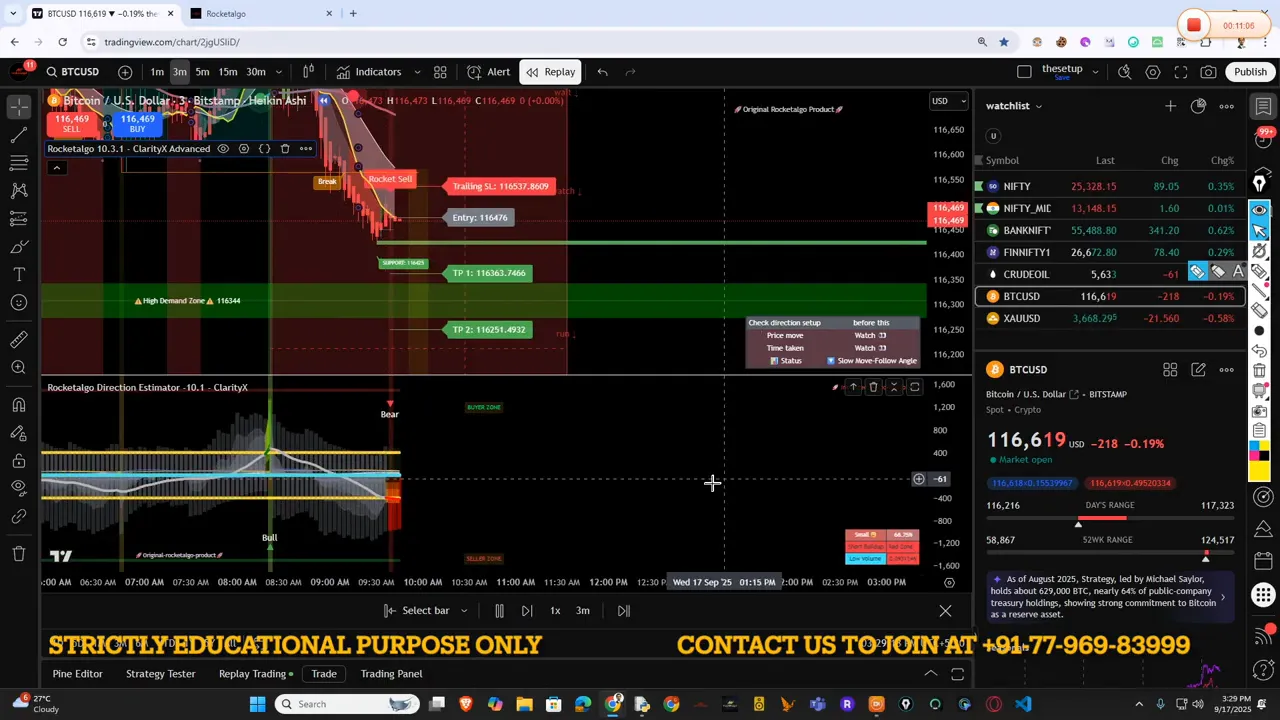

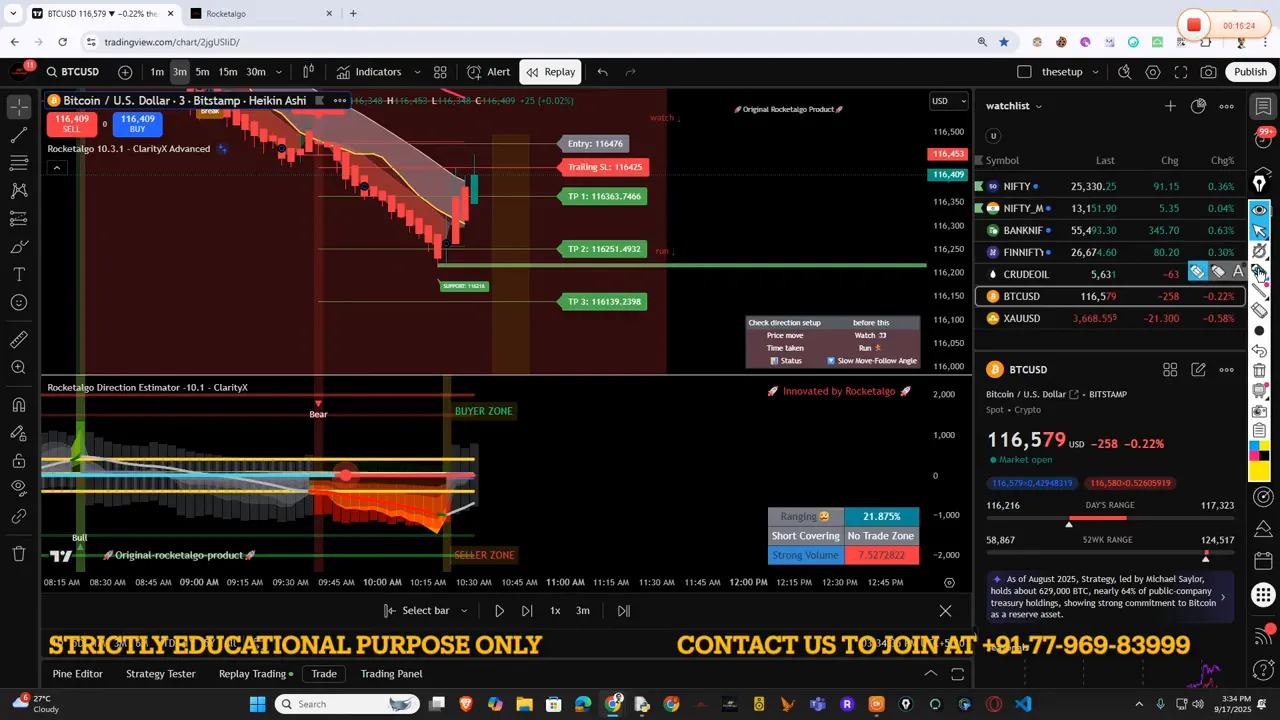

Bitcoin often triggers vocal questions from users: “Should I enter when Rocket shows BUY or SELL?” The answer is the same as for any instrument: the RocketAlgo label is a reference vs the yellow line and the full A-B-C confirmation. If you want early risk, you can use the optional early-entry logic, but the safest practice is to wait for angle formation, breakout confirmation, and money flow backing.

Across all these trades — Nifty, midcap, gold, Bitcoin — the logic is instrument-agnostic. Whether you’re scanning the trading, stock market, NSE, BSE, Nifty or crypto charts, the same filters apply.

🎯 Trade sizing, targets, trailing stops, and practical exit rules

People often ask: “How many targets should I set? Where do I put stops?” My answers are pragmatic and rooted in probability management.

- Three-target approach: We use three targets for reason. The first target is conservative and almost always achievable (high hit rate). The second is size-efficient for moderate gains. The third is the stretch target — valuable if momentum stays intact.

- Trailing stops: Instead of fixed stops, consider trailing stop-loss techniques: either price-based trailing or percentage-based trailing stops. Many users treat our first target like an “unlimited buffet” — they lock partial profit and trail the rest.

- Exit on angle flip: If you entered based on an angle and that angle reverses, most of the time the right action is to exit. RocketAlgo signals also flag angle U-turns to make exits cleaner.

Example: An entry at 116476 in one instrument gave a ~110-point run to the target zone. Our targets are calculated using 1:1 and 1:2 ratios and historical volatility, not guesswork. That’s why having disciplined exits and size control is central if you want consistent returns across the trading, stock market, NSE, BSE, Nifty environment.

⚠️ Auto-traders — why I’m skeptical and what to watch for

This is a blunt section because I see a lot of noise in the market about auto-traders. Many folks are being sold impossible guarantees like “2% daily, guaranteed” or “auto-trader will make you rich with zero effort.” That’s unrealistic. If any autopilot system truly delivered consistent 2% every single trading day, it would produce absurd yearly returns — and it would be a multi-billion-dollar product with a legit corporate presence.

Red flags to watch for:

- No professional website or only Telegram-based communication.

- Different phone numbers for calls and WhatsApp (they expect bans and disappearances).

- Claims of guaranteed returns without a credible track record or audit.

- Pressure to pay large sums to “unlock” higher returns or exclusive access.

We believe in automation where it helps — alerts, pattern detection, and signal generation — but full auto-trading where vendors claim guaranteed returns is often a scam. My team has experience building trading tech in the USA and large enterprise environments; technology-wise it’s possible to automate, but the market dynamics and regulatory constraints make turnkey “get-rich-quick” auto-traders a poor product for most retail traders.

So if someone calls and promises 400% per year with an autopilot, ask yourself why they don’t have a validated, audited website, an office, or a verifiable LinkedIn profile. Most real tech founders and traders are visible on professional networks; scammers avoid traceability.

🕒 Practical session: how I trade live (entries, early entries, and safe modes)

During live sessions I keep the desk simple:

- Watch zone transitions and angle formation.

- Confirm breakout with volume and money flow.

- Decide position size based on conviction (A-B-C confirmation).

- Set targets: 3 levels with trailing stop on the leftover position.

- Exit on angle flip or when the money flow and direction line contradict.

For new traders: start with safe mode. The RocketAlgo safe mode waits for the full A-B-C confirmation before giving an alert. If you are more experienced and accept higher risk, you can enable the early-entry logic for slightly earlier entries. But remember: earlier entries increase the probability of stop-outs; they do not magically increase your edge.

Real-time discipline is everything. Many traders are tempted to chase or overtrade when they hear a loud market call. Instead, watch the candles. If candles are choppy and sideways despite an initial breakout, that signal is not reliable. That’s the difference between trading presence and trading noise.

🧠 Common mindset mistakes and the railway-gate metaphor

Short anecdote: there was a classic TV ad about a railway gate that taught us the value of rules. If someone tells you, “What difference does it make? I’ll try and squeeze through,” often the end result is painful. Same with trading. Rules exist to protect capital. Breaking rules because of impatience or overconfidence leads to emotional distress and capital loss.

Stick to your process. If your process says wait for A-B-C, then wait. If your process allows early entries, size down. Avoid being seduced by fast-talking autopilot sellers or miracle performance screenshots.

❓FAQ — Frequently Asked Questions

Q1: When RocketAlgo shows BUY or SELL, should I enter immediately?

No. Use the RocketAlgo label as a reference. Check the yellow reference line, angle formation and money flow. If you’re comfortable with early risk, you can enable early-entry logic; otherwise, wait for full A-B-C confirmation.

Q2: Does RocketAlgo work on TradingView free version?

Yes. The alert logic works on TradingView free version for basic trading. Pro users receive more granular alerts, angle dots, and breakout bands. The core idea — A-B-C — is valid across both.

Q3: How many targets should I use?

Three targets is the practical method: partial profit at target 1 (the safe one), more at target 2, and trail remaining towards target 3. This balances hit rate and upside capture.

Q4: Is auto-trading safe and should I use it?

Be very cautious. Most “auto-trader” promises are marketing. Ask for audited performance, a professional corporate presence, and reason why they rely on Telegram instead of a corporate website. Automation is useful but not a silver bullet.

Q5: What instruments does the A-B-C logic work on?

It works across asset classes — equities, indices, commodities like gold, and crypto. Whether you are tracking trading, stock market, NSE, BSE, Nifty instruments or crypto, the same filters apply.

✅ Practical checklist before entering any trade

- Zone context: Are candles entering a green or red zone?

- Angle: Is the direction line forming clearly or flat?

- Breakout: Is the breakout clean with follow-through and volume?

- Money Flow %: Is the candle cluster supported by buying/selling money flow?

- Targets & Stop: Predefine three targets and a trailing plan.

- Size: Position size based on your tolerance and account risk.

🔚 Conclusion — trade smart, not loud

Markets reward discipline. The RocketAlgo 10.3.1 update is designed to give you clearer, zone-aware signals with angle and money flow confirmation. Whether you are active in trading, stock market, NSE, BSE, Nifty or exploring commodities and crypto, apply the A-B-C filter before committing capital. Be skeptical of autopilot schemes that promise unrealistic returns. Use filters, manage risk, and treat the market with humility.

If you found this useful, sign up for our learning portal and follow our alerts responsibly. Trade safe, manage risk, and remember — consistency beats flashy promises.

📞 Contact & resources

- Learning Portal: galaxy.rocketalgo.in

- Guides: guide.rocketalgo.in

- Learning App: learn.rocketalgo.in/app

- Official website: rocketalgo.in

- Contact: +91-77-969-83-999

Thanks for reading — this was Rocketalgo Official. See you in the next session, and remember: focus on process, not noise. If you trade within the trading, stock market, NSE, BSE, Nifty framework and follow A-B-C, you’ll make better decisions over time.

Need more help |

|

Contact us by clicking the button below |

|

Click me |