Table of Contents

- 🔔 Introduction: Why this session matters for trading, stock market, NSE, BSE, Nifty

- 🛠️ New Version, Settings & Expert Mode — how to set up for success

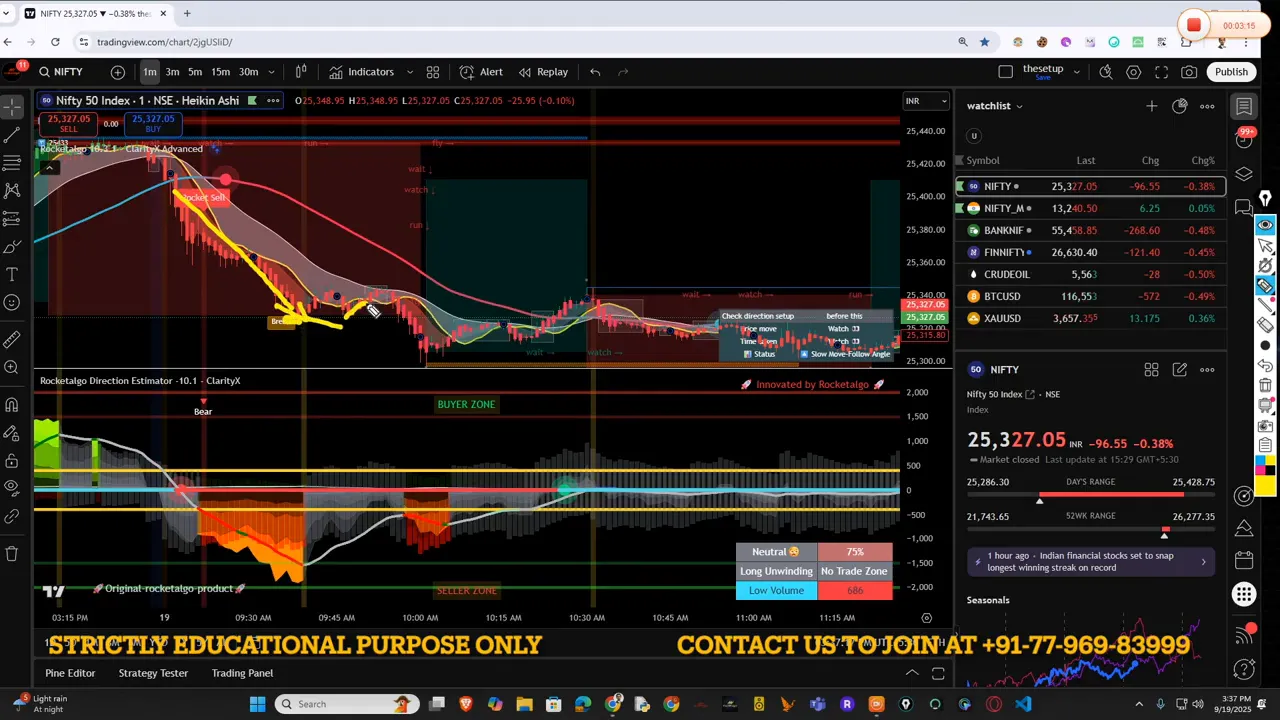

- 📈 Live trade checks — Nifty, Bank Nifty and how we interpret momentum

- 🧠 Rules for re-entry and profit booking 🤑

- 📊 Time, Volatility & Premium — understanding option behavior

- 🗞️ Ignore noisy news — trade the chart, not the headlines

- 🏦 Bank Nifty manipulation & broker behavior — what to watch for

- 💡 False signals, breakouts and how to read them correctly

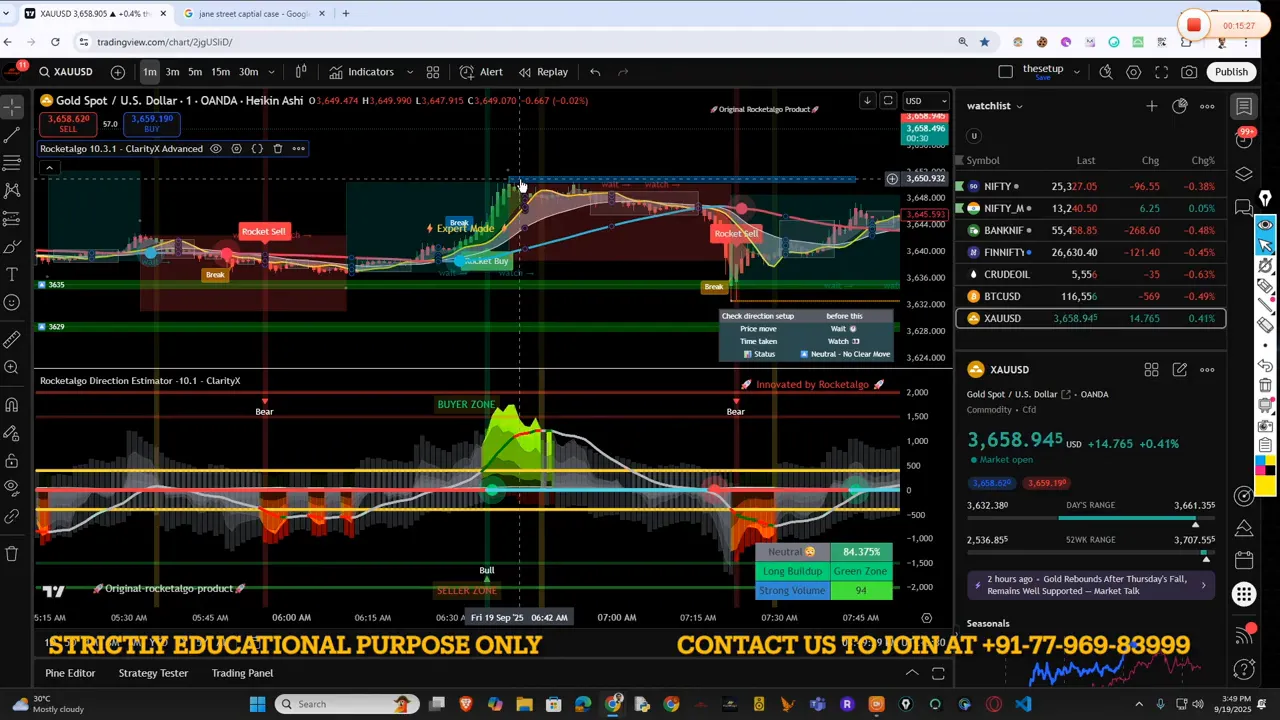

- 🥇 Gold, US markets and cross-market correlations 🌍

- 📚 Learning Portal & courses — how to level up fast

- ✅ Practical checklist before you take any trade

- 📣 My blunt advice: avoid shortcuts and noise

- 🧾 Example trades we discussed (summary)

- 🔍 Final tips: how to think like a professional trader

- ❓FAQ — Frequently Asked Questions

- 📎 Useful resources & next steps

- 📷 More screenshots and replays to study

- 📌 Closing — a final word from Rocketalgo Official

🔔 Introduction: Why this session matters for trading, stock market, NSE, BSE, Nifty

Hello — I’m Aditya from Rocketalgo Official. In our quick overview session on 19th September 2025, I walked through an important product update, live trade checks, and practical rules every trader should follow. If you’re involved in trading, stock market, NSE, BSE, Nifty instruments — or learning to trade intelligently — this write-up condenses the session into a clear, actionable guide.

Throughout the session I spoke plainly: turn off noise, follow your setup, manage re-entries, and respect volatility. I’ll repeat those themes here, expand on them, and share practical checklists and examples so you can apply the ideas right away.

🛠️ New Version, Settings & Expert Mode — how to set up for success

We released a new version of the Rocketalgo tool. First thing I told everyone was how to configure the new UI for best results. The most important steps:

- Click the settings icon in the top bar.

- Uncheck the “Save Trading” option.

- Click OK and confirm.

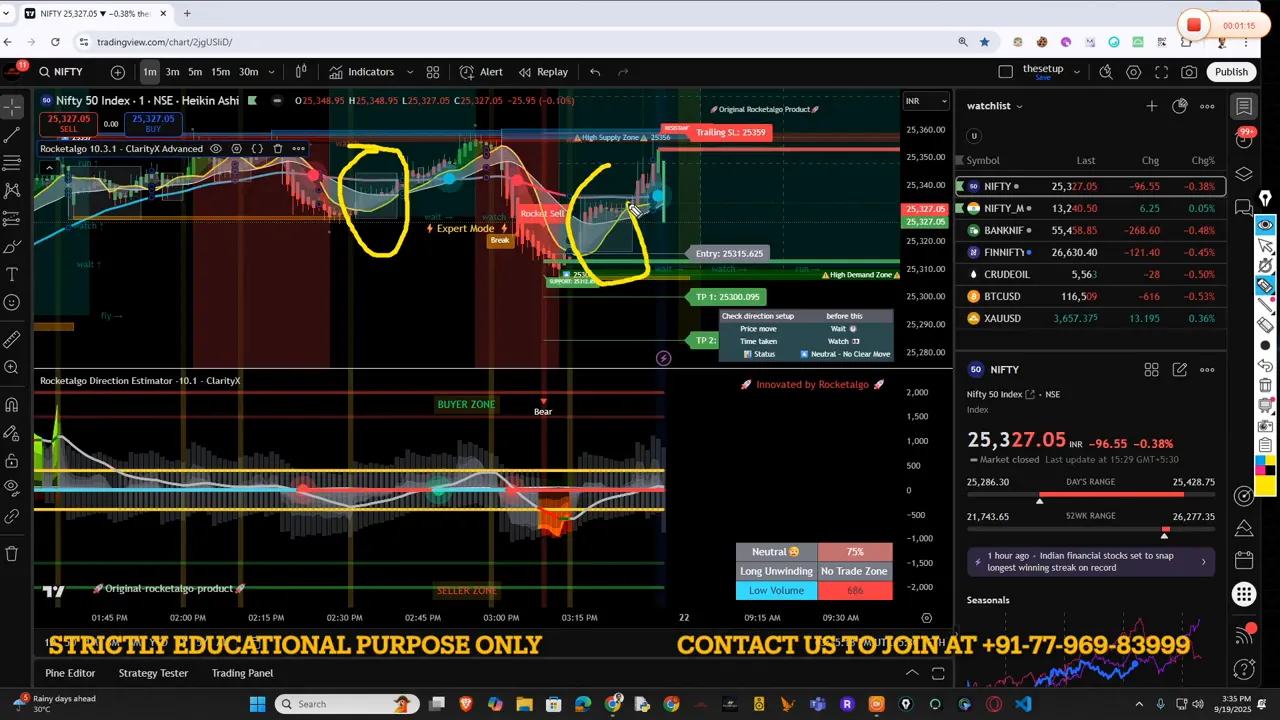

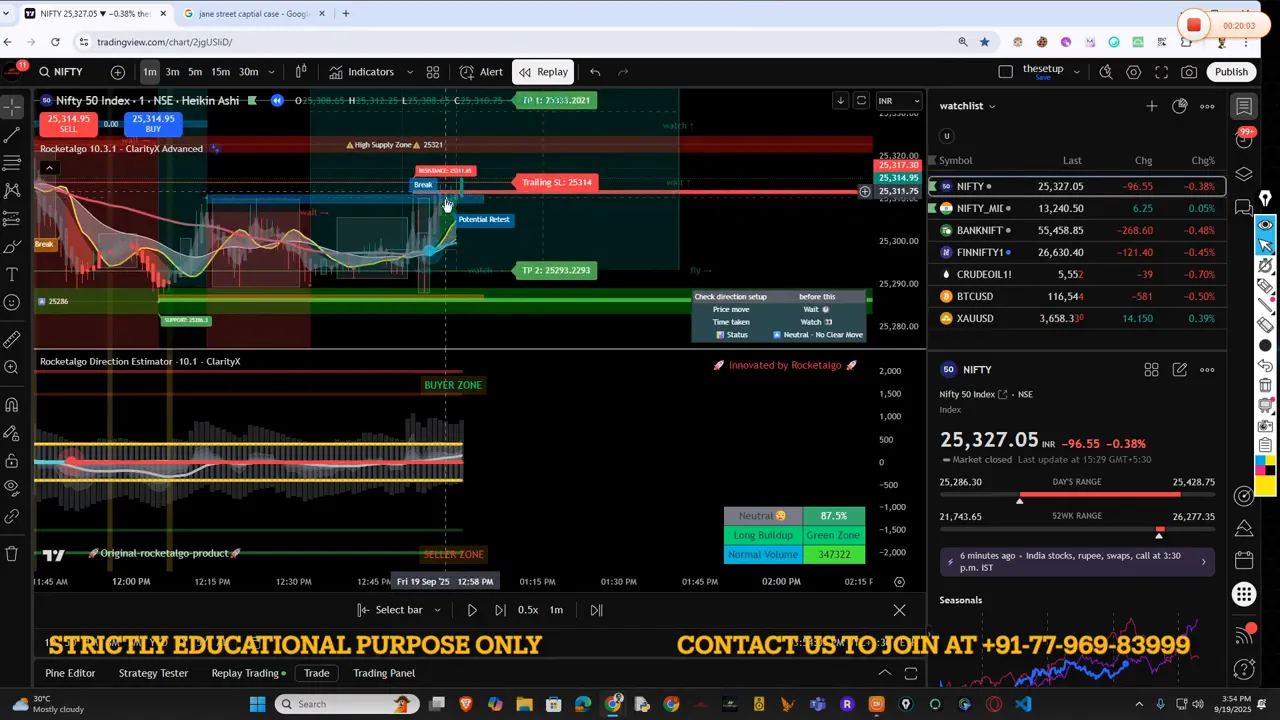

When you turn off Save Trading, the software shifts into Expert Mode. You’ll see a clear message on the screen telling you that you are now in Expert Mode. That’s intentional — Expert Mode is for traders who want to make discretionary decisions around current candles and momentum, not automatic saving or autopilot behavior.

Why this matters: Expert Mode lets you use the tool as a decision-support system rather than a hands-off trading robot. If you prefer automation, keep the saved trading enabled; if you want to actively manage entries, off you go to Expert Mode. I showed this in the session because too many users rely on autopilot without understanding market context.

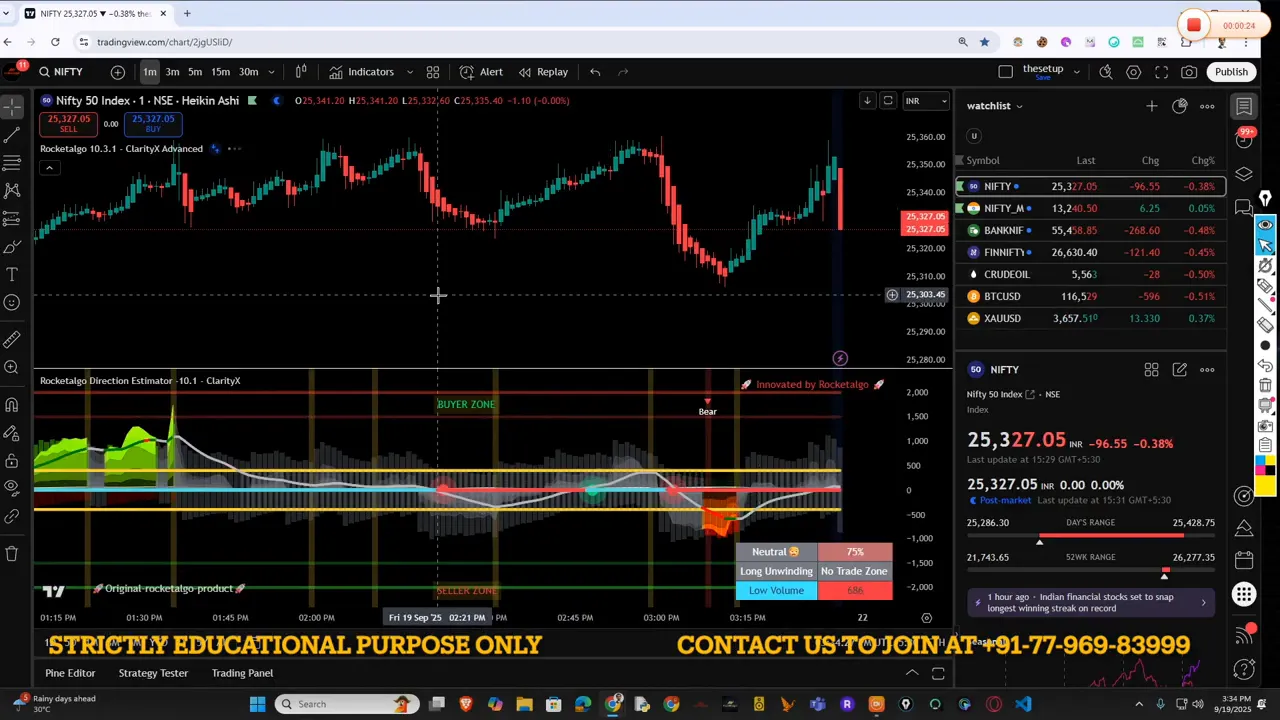

📈 Live trade checks — Nifty, Bank Nifty and how we interpret momentum

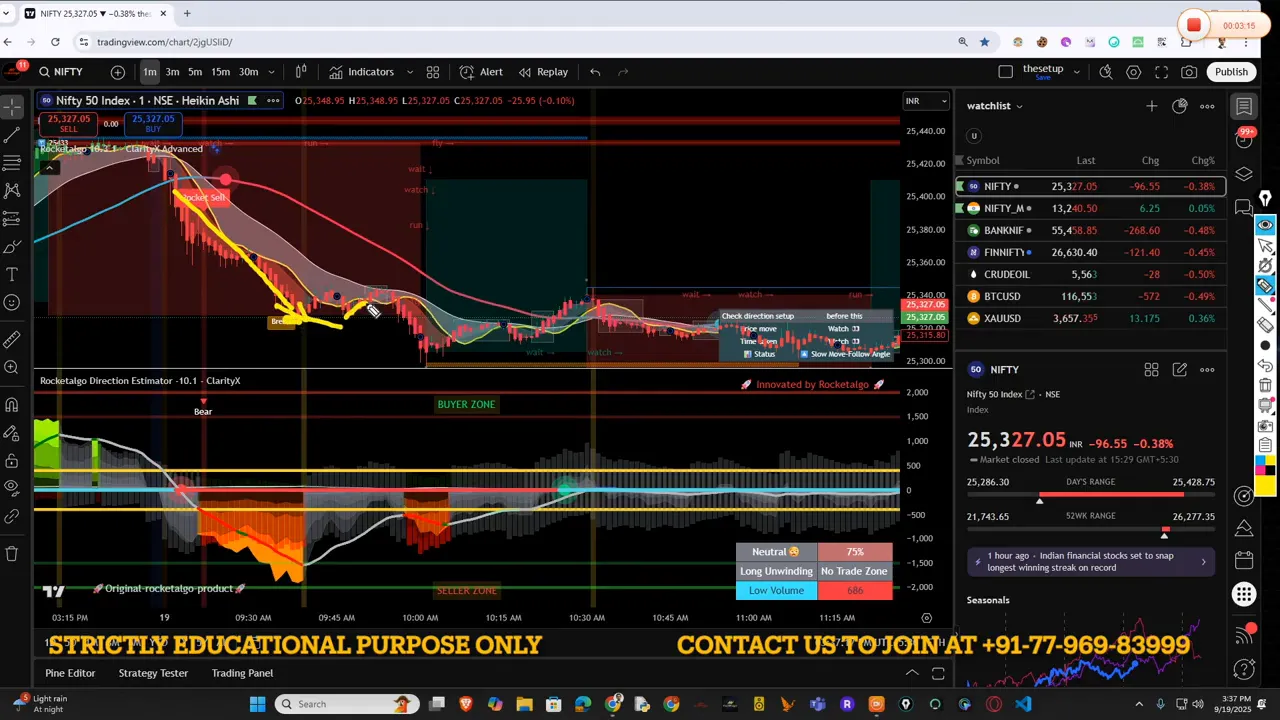

We reviewed live trades and I explained the trade logic behind entries and exits. Here are the practical lessons from those examples:

- One Nifty trade captured a beautiful movement around a clear support zone. We took the entry, rode the momentum, and then booked profit when signs of sideways action appeared.

- When a continuous trade begins and you book profit, if the same trade later tries to re-open by moving slightly down and then recovering, don’t jump back in blindly. Re-entry without a fresh confirmation equals taking unnecessary risk.

- Think of the setup like milking a cow: once you’ve milked it, you can’t expect more milk immediately. If price goes sideways or gets stuck, it will often “bite back” — traps happen and accounts get squeezed.

Trade management principles I emphasized:

- Book profit when your predefined target or signals say so.

- Only re-enter if momentum re-establishes and your setup conditions are met again.

- Consider the timeframe and expected range. If the index gives 20 points per hour versus 50 points, your option premium won’t necessarily move the same way.

🧠 Rules for re-entry and profit booking 🤑

Many beginners think more entries equal more profit. That’s dangerous. I recommended a simple rule: if you’ve already booked profit on a continuous trade and price drops or goes sideways, treat the market like a fresh environment. Don’t assume re-entry will be profitable without new confirmation.

Key re-entry checklist:

- Has the trend clearly re-established (higher highs / lower lows)?

- Is volume and momentum supporting the move?

- Are time and volatility favorable for the instrument you trade (options premium behavior)?

- Does the Expert Mode or your system flag a valid new setup?

Remember: the market doesn’t owe you re-entries. It can and will trap you when you chase stale trades.

📊 Time, Volatility & Premium — understanding option behavior

Options traders need to think differently than equity traders. I reiterated how three factors decide option outcomes: time, volatility, and price movement size. Let me break that down in plain language.

If the underlying index moves 20 points in an hour, your option premium might move only 4–5 points. If the index moves 50 points, premium movement could be larger — but never assume a linear relationship. Option premium depends on:

- Time to expiry (theta decay)

- Implied volatility changes (vega)

- Delta — how much the option’s intrinsic value moves with the underlying

Tip: If you pick a trade where the option is far out-of-the-money and the market hasn’t shown enough momentum to reach it, you can lose the premium fast. I mentioned a user who bought an option that remained out-of-the-money — they learned the hard way. Make sure your entry price, target, and volatility expectations align.

🗞️ Ignore noisy news — trade the chart, not the headlines

I repeated this several times: don’t trade based on sensational headlines. I gave the example of viral political news and tariff rumors — people read noise and assume bullish or bearish bias without data. News channels chase TRP; they are not your trading coach.

How to stay disciplined:

- Check market internals: volume, breadth, and confirmed signals from your system.

- Validate any news-driven move with price action. If price doesn’t confirm, don’t take position yet.

- Avoid making large directional trades solely on unverified headlines.

Real talk: I said it plainly — “India’s news channels are a waste of time” because they often react late and emotionally. Focus on data and your setup.

🏦 Bank Nifty manipulation & broker behavior — what to watch for

We discussed how some trades and instruments, especially Bank Nifty, can appear manipulated due to volume injections or broker-level activity. A few reminders from the session:

- Broking houses and proprietary desks can create volume and momentum to influence short-term moves.

- That’s why your setup and edge matter more than chasing large moves driven by a few players.

- Always be cautious with leverage on indices that can be heavily traded by big players.

I showed the JanStreet/Gen Street reference and SEBI action as an example of how algorithmic strategies can distort price behavior. The key lesson: know the market structure, know how your broker operates, and never trade blindly on a single signal.

💡 False signals, breakouts and how to read them correctly

Breakouts can be deceptive. In the session, I used the software replay to show a breakout level and how the system signals it. Here’s my workflow:

- Identify breakout zones based on historical support/resistance and your system’s breakout indicator.

- Use replay to see how price interacted with the breakout. Did it follow-through or fail quickly?

- When you see a blue breakout marker on the system, pause for one minute and check confirmation candles and volume.

Important: breakout ≠ sustained trend. A breakout often needs volume confirmation and clean momentum. If price breaks and returns inside the range, treat it as a false breakout.

🥇 Gold, US markets and cross-market correlations 🌍

I also covered commodity moves — gold gave a morning bottom and a strong move; I pointed out that 5:30 to 8:30 AM is a time when gold often produces tradable setups. In US markets, we saw pre-market gap-downs which influenced our global exposure decisions.

Practical takeaways:

- For gold: watch early morning sessions and small-range breakouts; systems often catch these moves.

- For US equities: track pre-market gaps and decide currency/instrument exposure accordingly.

- Global correlations matter. A big move in the US pre-market can shape Nifty’s risk-on or risk-off tone.

📚 Learning Portal & courses — how to level up fast

We’re expanding the learning portal to deliver hands-on courses that show setups step-by-step. I highlighted that many questions show up because users haven’t explored the portal. The plan:

- Free course vouchers available in the portal — click & enroll to see our ABC setup approach.

- Advanced modules will cover potential retest, breakout, candle money flow, and percentage rules I use.

- Live sessions will include replay and annotated charts where I draw and explain setups by hand.

If you want to trade in the Indian markets effectively — whether Nifty intraday or Bank Nifty options — formalizing learning beats guessing. Our portal is built to move users from “what is support?” to “I can read momentum and act.”

✅ Practical checklist before you take any trade

Here is the exact checklist I recommended repeatedly. Make this your pre-trade ritual:

- Is my setup valid on the timeframe I trade?

- Is the instrument aligned (Nifty, Bank Nifty, stock) with the higher timeframe trend?

- Is volatility and premium behavior favorable for options trades?

- Have I defined my entry, stop loss and target?

- Have I checked for news that might invalidate the trade within minutes?

- Am I using appropriate position size based on my risk rules?

- If in Expert Mode, do I have discretionary rules to override automatic signals?

📣 My blunt advice: avoid shortcuts and noise

I was blunt in the session: don’t fall for auto-traders, “miracle” strategies or channel hype. If you take my session lightly, you’re making a mistake. Trading requires discipline, learning, and practice. Systems help, but they are tools — not magic.

Shortcuts that lead to losses:

- Blindly following news headlines.

- Using autopilot bots without understanding signals.

- Overleveraging on manipulated or thinly traded moves.

🧾 Example trades we discussed (summary)

To recap some concrete trades and outcomes I discussed:

- One user made a $631 profit on an edge-based setup — demonstrating proper execution.

- Another user made a few thousand dollars across two days by sticking to system signals.

- We captured a small but profitable Amazon move on the US market via our system’s cross-market signals.

🔍 Final tips: how to think like a professional trader

Think process, not outcome. Every single trade is an experiment. The goal is to make the process repeatable and robust. Here’s a concise professional mindset list:

- Respect risk first — profits will follow.

- Maintain a trade journal: entry, exit, reason, lesson.

- Backtest rules and validate them in small size live before scaling.

- Focus on instruments you understand (Nifty, Bank Nifty, a few stocks).

❓FAQ — Frequently Asked Questions

Q: How do I set Expert Mode and why should I use it?

A: Turn off Save Trading in settings to enable Expert Mode. Use Expert Mode if you prefer discretionary control around current candles and momentum. It’s for traders who want to confirm signals and manage entries manually.

Q: How do I avoid false breakouts?

A: Wait one candle or one minute after the breakout marker for confirmation. Check volume and whether the breakout follows through. Use replay to learn where false breakouts occur.

Q: Should I trade based on news like tariffs or political events?

A: No. Trading on headlines without price confirmation is gambling. News can be noisy and delayed — always trade the chart and wait for market confirmation.

Q: How do I manage options premium risk?

A: Understand theta and vega. Match your strike and time-to-expiry with expected movement. If the expected index movement is small, avoid buying far out-of-the-money options that can decay worthless quickly.

Q: What instruments should I focus on as a beginner?

A: Start with Nifty or Bank Nifty (if you understand their behavior) and one or two liquid stocks. Master a setup on these before expanding.

Q: How often should I use automated signals vs. discretionary trades?

A: Use automated signals for consistency, but switch to discretionary (Expert Mode) when you see market structure anomalies or cross-market events. Always paper trade adjustments before applying them live.

📎 Useful resources & next steps

If you want to dive deeper, check out these resources I mentioned:

- Rocketalgo Learning Portal for structured courses and replay sessions.

- Our free voucher courses inside the portal — start with ABC setups.

- Practice replay mode to build pattern recognition and breakout confirmation skills.

And one more time — a short mantra to practice: “Setup first, trade second; news never leads the chart; manage risk always.” If you follow that, you’ll build consistent results in trading, stock market, NSE, BSE, Nifty.

📷 More screenshots and replays to study

Use these screenshots to match visual cues with the rules above. Replay the moments I highlighted and ask: was volume present? did price confirm? was the setup valid?

📌 Closing — a final word from Rocketalgo Official

To everyone who joined the session: thank you. I wrap up the session by reminding you to align your system, follow the setup, and practice in replay and small live size. The market rewards process-driven traders. Keep studying, use the learning portal, and trade safely.

If you want to contact us, enroll in courses, or get support, use the learning portal and our support channels. Trade carefully, respect the market, and keep improving your edge in trading, stock market, NSE, BSE, Nifty.

Thanks for reading — Aditya, Rocketalgo Official.

Need more help |

|

Contact us by clicking the button below |

|

Click me |