Hello — I’m Aditya from Rocketalgo Official. In our live session on 22 September 2025 I walked traders through how Rocketalgo’s setups performed across multiple instruments and why the day turned into a teaching moment for intraday discipline. This article captures everything we discussed: the setups, the live trade behavior, profit-booking tactics, and the practical rules you can use when trading, stock market, NSE, BSE, Nifty instruments.

If you were in the session or watched later, you know the tone: straight talk, real-time chart reading, and no sugarcoating. I called out crowd psychology, explained why price moved the way it did, and shared simple, repeatable guidance to improve how you trade the trading, stock market, NSE, BSE, Nifty environment. Below I’ll break down the entire live session into a coherent guide you can use on your trading desk.

Table of Contents

- 🔍 Session Summary — What We Covered and Why It Matters

- 📈 How Rocketalgo Setups Performed Today (Nifty & Bank Nifty)

- 🛢️ Crude, Gold, Bitcoin — Correlation and Confirmation

- 🧠 Why News Noise and “Market Gurus” Mislead Traders

- 💡 Practical Profit Booking Tactics I Shared

- 📊 Real Trades, Real Screenshots, Real Users

- 🧩 The Psychological Rules: What I Told Traders Face-to-Face

- 📚 Rules I Always Trade By (Actionable Checklist) 📝

- 🔁 How to Apply These Lessons to Options (Premiums and Greeks)

- 📉 When the Market is Down — The Practical Playbook

- 🛡️ Risk Management: The Non-Negotiable

- 📌 Common Questions From the Live Session (and My Answers)

- ❓ FAQ — Frequently Asked Questions

- 🧾 Key Takeaways — The One-Page Summary

- 📲 Where to Practice and Learn More

- ✍️ Final Words — Be a Better Trader Today Than Yesterday

🔍 Session Summary — What We Covered and Why It Matters

In the session I covered:

- How Rocketalgo setups performed in Nifty and Bank Nifty on the morning of 22 September 2025.

- Behavior of other instruments: crude oil, gold, and Bitcoin, and how they confirmed broader sentiment.

- Real examples of profit booking and how setups showed clear support/resistance and demand zones.

- Common mistakes retail traders make when influenced by media noise and fake gurus, and practical fixes.

Why this matters: if you trade intraday or options on the trading, stock market, NSE, BSE, Nifty — the difference between a good day and getting beaten up is following structure, understanding when to book profits, and not being distracted by random noise.

📈 How Rocketalgo Setups Performed Today (Nifty & Bank Nifty)

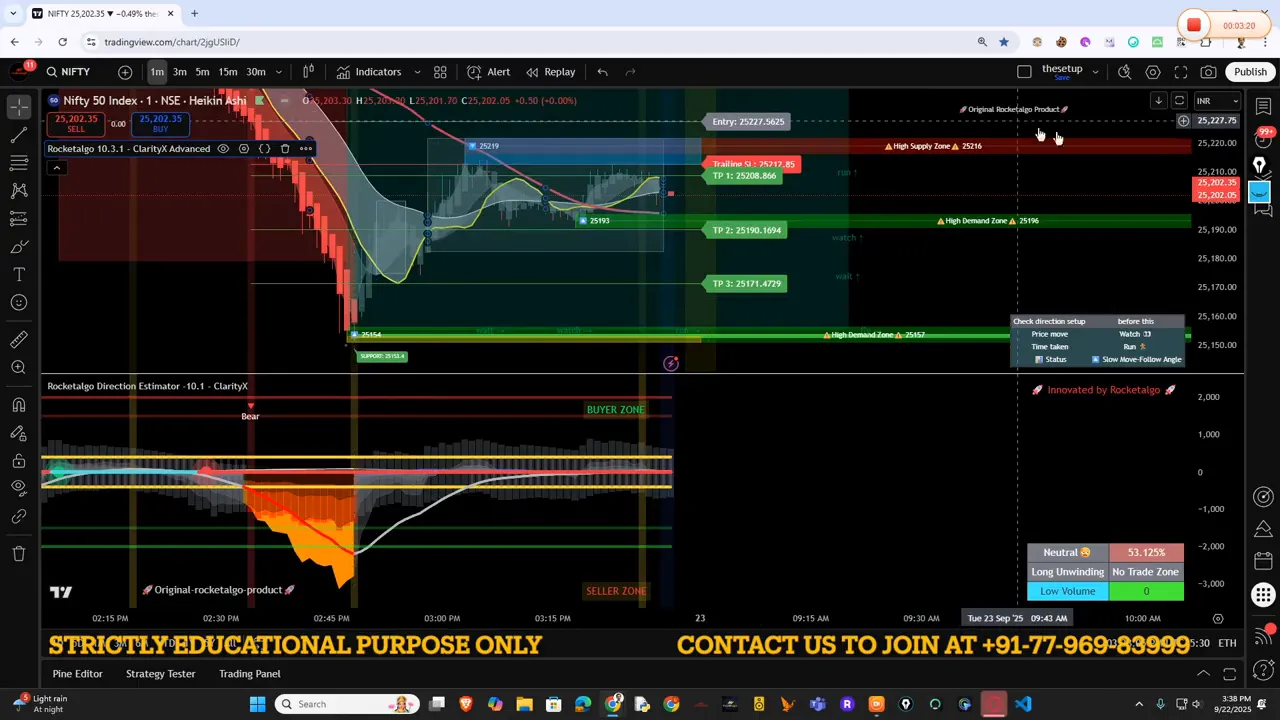

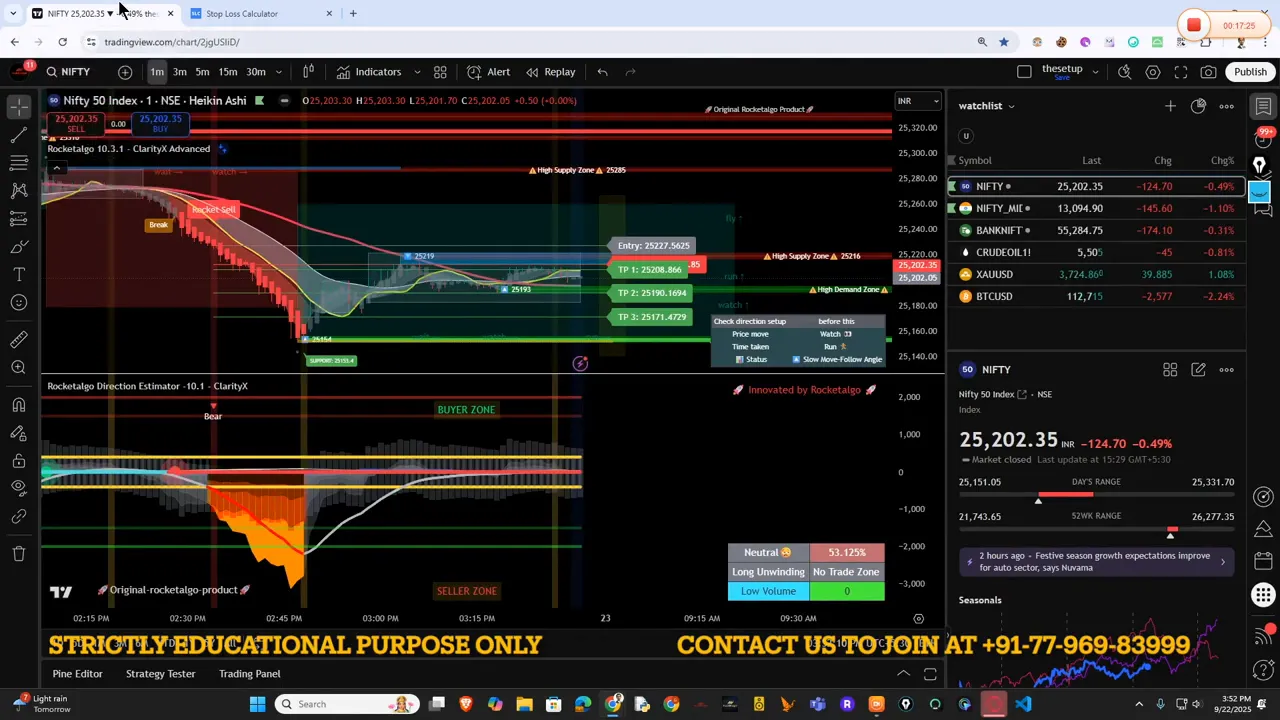

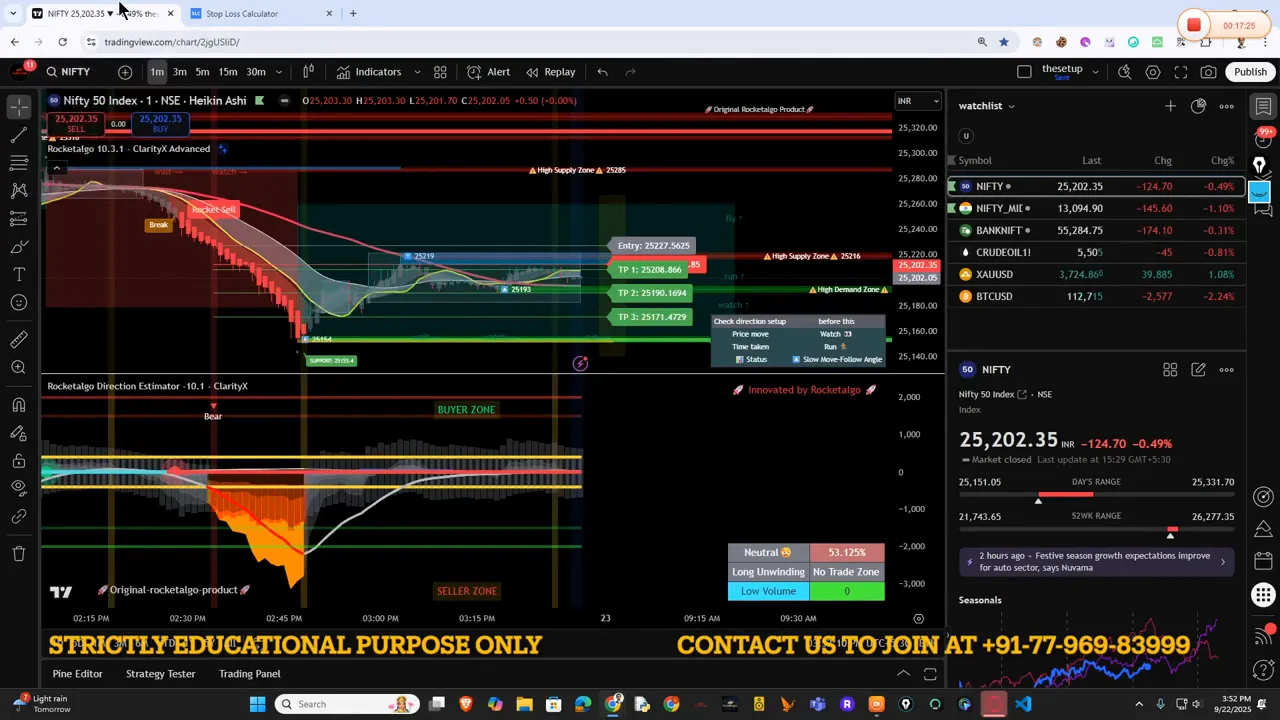

Let’s start with Nifty. Early in the session Nifty produced a strong red move — a clear directional momentum that our algorithm picked up. The call at the 65–66 contract level ran up quickly, with prices stretching to the 112–113 range on that premium move. For anyone trading options or underlying, that kind of move is exactly what good setups look like: clear entry, clear momentum, clear target areas.

Rocketalgo flagged multiple support and high-demand zones that lined up. When several support levels match with high demand, the trade becomes much cleaner — and as I said in the session, that’s when you should stay quiet and not fight the setup. If you start overtrading or doing the opposite of what the setup tells you, you can quickly reverse a winning trade into a losing one.

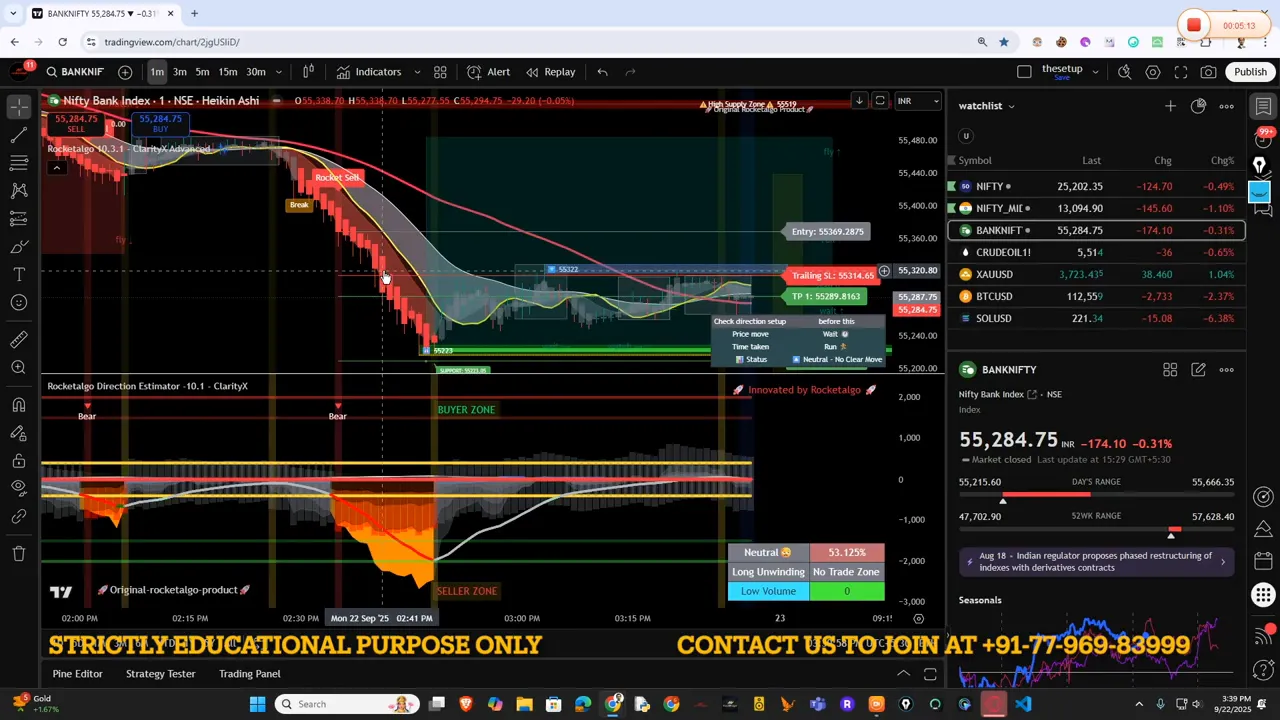

In Bank Nifty, the algorithm highlighted a similarly beautiful trade — a red momentum that found follow-through. I showed a short video clip to the group and later uploaded it to YouTube shorts: live status of Nifty and premium behavior in near real time. When the algorithm’s directional read is strong, price action often ignores candle patterns or volume noise and simply follows sentiment. That’s what happened on Bank Nifty today: clear trend and follow-through.

🛢️ Crude, Gold, Bitcoin — Correlation and Confirmation

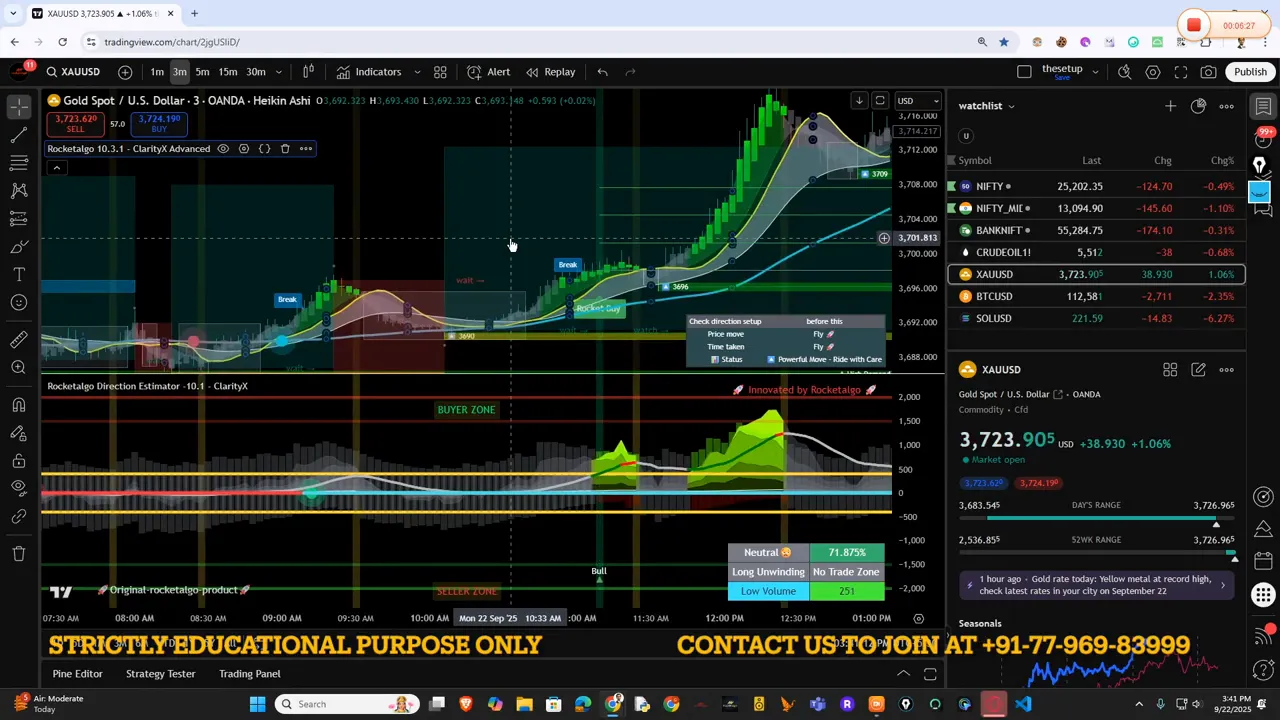

We also looked beyond indices. Crude oil broke down; an A4 angle formed and C4 candles worked lower with money flow declining. That’s classic confirmation of negative sentiment in commodities. When crude fell, it reinforced the broader risk-off tone.

Gold behaved as the textbook says: when markets crash or risk-off sentiment spikes, gold tends to rise. That principle held — and paid-off traders who understood the macro rule benefited. I criticized so-called “experts” telling people to hold gold forever or shouting “all-time highs” without regard to current context. The market doesn’t follow permanent slogans; it follows current sentiment.

Bitcoin also showed a strong drop earlier and then sideways price action. The pattern looked like a completed downtrend and then consolidation. This is important because crypto’s behavior often gives early hints of global risk appetite. When Bitcoin led lower, it added confirmation to the short-side bias in the trading, stock market, NSE, BSE, Nifty space.

🧠 Why News Noise and “Market Gurus” Mislead Traders

I spent part of the session calling out how news channels and so-called gurus push narratives that confuse traders. They sell certainty: “Hold for 15 days,” “This is a multi-week trade,” or “Buy when I say buy.” But markets react to current sentiment in the moment, not to future promises shouted on TV.

Trading in the trading, stock market, NSE, BSE, Nifty requires peeling away noise. For example, a TV anchor can exaggerate macro stories, but the market’s immediate behavior is what matters. If the market is selling off intraday and your setup gives you a short signal, holding a long for 15 days because a guru says so makes no sense.

I told the group: do not chase tomorrow predictions or listen to “I know what will happen next” claims. Nobody knows for certain what the next day will do — not Trump, not TV, not any “expert.” Rely on structure, on what the charts tell you right now, and on disciplined risk management.

💡 Practical Profit Booking Tactics I Shared

One of the most practical parts of the session was profit booking. Many traders asked: “When should I book profits?” Let me summarize the methods I taught in the session — repeatable rules you can follow in the trading, stock market, NSE, BSE, Nifty environments.

- Preset Profit Targets — If you enter and your setup promises a certain premium move, book at predefined levels. Example: we took a call on Nifty around 66 premium. If you seek a 5% return on premium, book at 70; if you want a larger target, book at 74. The idea is to predefine and avoid emotional exits.

- Trailing Stop-Loss — Use a trailing stop when a trade shows strong momentum. If price keeps moving in your favor, let profits run but protect them as price reverses.

- Support + High Demand Confluence — If a trade falls back to a strong support line that aligns with a high-demand zone, that’s a region to watch closely. If it holds, you can add or hold. If it breaks, it’s time to exit.

These are not theoretical ideas — they’re practical rules I applied during the session. Users who followed setups and profit-booking rules recorded screenshots of wins. Consistency in following the setup produces consistent returns; being emotional does not.

📊 Real Trades, Real Screenshots, Real Users

During the session I showed many users’ screenshots from the group — some had booked good profits and shared them. That’s encouraging because it proves the setups can be followed by retail traders with discipline. One of our experienced users, Jitendra, has been consistent and his results show that following the setup exactly, without guesswork, works.

Consistency is a skill. If you see a setup and you follow the rules (entry, target, stop, trailing stop), you’ll get regular small wins. They add up. The session emphasized process over predictions — process beats guessing.

🧩 The Psychological Rules: What I Told Traders Face-to-Face

Three psychological points I kept repeating in the session:

- Trade the setup, not the news. The market will react to news, but your edge is reading price action and structure.

- Be humble about predictions. No one knows the future. You can have a probabilistic edge, not certainties.

- Control your emotions. Book small wins and protect capital. Emotion-driven exits are the largest killer of intraday returns.

I told stories about being in the U.S. and working large projects — the point was simple: do your work, be professional, stop acting like instant gurus on TV. Trading is a job; do the work, follow rules, and focus on process. The media noise about “India is cheap labor” or “Apple will make iPhones in India” is not your trading plan. Your job is to read price on the trading, stock market, NSE, BSE, Nifty charts and make disciplined decisions.

📚 Rules I Always Trade By (Actionable Checklist) 📝

Here is the checklist I shared in the session — apply it each day before you trade the trading, stock market, NSE, BSE, Nifty:

- Identify major support/resistance and high-demand/high-supply zones on your intraday chart.

- Check global cues (Bitcoin, crude, gold) for confirmation of sentiment.

- Enter only when the Rocketalgo setup or your rules align with price structure.

- Predefine profit targets and place stops—use trailing stops for running trades.

- Ignore sensational media narratives during market hours.

- Record trades and review daily — consistency compounds over time.

🔁 How to Apply These Lessons to Options (Premiums and Greeks)

Many traders in the session are options players. Options require extra attention because premium moves amplify P&L. I explained how to handle premiums during intraday moves:

- If you buy premium (call or put), treat the premium like any other position — have profit targets and stops.

- Define what percentage gain you want on premium (for example, 10% or 20%) and book systematically.

- Use a mix of preset booking and trailing stop depending on volatility. When IV spikes, be more aggressive in booking.

Example from the session: a Nifty call purchased near 66 premium that moved toward 112–113 in another scenario would be managed by either taking partial profits at intermediate targets or trailing stop to capture the large move. The key: define rules before entering.

📉 When the Market is Down — The Practical Playbook

Let’s be blunt: crashes and fast down moves are stressful. Today we saw pressure and called the chance of markets going down. When that happens, follow these steps in the trading, stock market, NSE, BSE, Nifty context:

- Lock in small wins early if the edge becomes unclear.

- Look for continuation patterns (angles like A4, C4 candles discussed in the session) and trade in the direction of momentum.

- Don’t average into losing trades without structural confirmation — adding without evidence is emotional and costly.

We watched crude and Bitcoin confirm the risk-off tone — when multiple asset classes align, trust the multi-asset signal. That’s a core lesson from the session.

🛡️ Risk Management: The Non-Negotiable

Risk management is where many traders fail. In the session I repeatedly emphasized protecting capital over chasing big wins. Set acceptable loss per trade, use stops, and size positions so you survive bad days. Consistency over time is far more valuable than a few big wins followed by a blow-up.

For traders of the trading, stock market, NSE, BSE, Nifty: define position size based on volatility and available capital. Don’t go all-in based on emotional conviction. If you need rules, use our basic risk template: risk 0.5–1% of capital per intraday trade; adjust for your personal risk tolerance and timeframe.

📌 Common Questions From the Live Session (and My Answers)

Traders asked similar questions during the session. Here are the common ones and my concise answers:

- Q: “When should I book profits?”

A: Use preset targets, trailing stops, and watch confluence zones. Book a part at the first reasonable target and trail the rest. - Q: “Do I follow news or charts?”

A: Follow charts and structure. Use news as a context tool, not a trigger for trades unless your setup confirms it. - Q: “How much should I hold options?”

A: Options are a short-term tool for most intraday players. If you plan to hold multi-day, plan for gamma/decay and protect premiums with spreads.

❓ FAQ — Frequently Asked Questions

Q: What exactly is a Rocketalgo setup and how does it help me trade Nifty?

A Rocketalgo setup is a structured signal that combines price action, demand/supply zones, and internal angles we use to read momentum. It identifies tradeable levels so you can execute on Nifty moves with predefined entries, stops, and targets. When trading, stock market, NSE, BSE, Nifty, the rocket setup reduces guesswork by giving you a probabilistic edge framed by structure.

Q: How do I decide between booking profits early or trailing?

If noise or reversal signs appear at your first target, consider booking early or booking partially. If momentum is strong and confluence supports continuation, you can trail a stop to capture extended moves. The rule of thumb I taught: predefine the approach before entering the trade.

Q: How should I manage trades when global cues disagree with Indian markets?

Always give weight to global cues (Bitcoin, crude, gold, US indices) but prioritize domestic price structure for intraday trades. If global risk-off is strong and your domestic setups show weakness, treat it as confirmation to be cautious or short. If global cues are mixed, rely more on local structure and demand/supply confluence.

Q: Is it safe to hold trades overnight during volatile periods?

No — not without adjusting risk. Overnight moves can be large due to news. For the typical intraday trader focusing on trading, stock market, NSE, BSE, Nifty, I recommend avoiding unnecessary overnight exposure unless you have a clear reason and risk plan.

Q: How can I overcome emotion-driven exits?

Use preset targets, automated trailing stops, and position sizing that you’re comfortable with. Also, maintain a trade journal. Seeing patterns in your own behavior helps reduce emotional mistakes over time.

🧾 Key Takeaways — The One-Page Summary

- Rocketalgo setups worked well on 22 Sep: clear momentum in Nifty and Bank Nifty, supported by crude and Bitcoin moves.

- Profit booking is a planned action: set targets, use trailing stops, and watch support + demand confluence.

- Ignore noise from media and TV “gurus.” Trade structure in the charts.

- Use multi-asset confirmation (crude, gold, Bitcoin) to read global sentiment.

- Risk management and consistency are the long-term edge for trading, stock market, NSE, BSE, Nifty.

Follow these steps and you’ll begin to see small wins add up. The secret isn’t in predicting tomorrow — it’s in executing a disciplined process today.

📲 Where to Practice and Learn More

If you want to practice the setups I discussed, use a paper trading account or small position sizes to follow the Rocketalgo rules. We share real-time updates and chart clips in our group, and the aim is to build consistency. Remember: practice is not glamorous, but it’s the most effective teacher.

Finally, keep in mind that trading, stock market, NSE, BSE, Nifty is a marathon, not a sprint. Stick to your rules, record your trades, and get better each day.

✍️ Final Words — Be a Better Trader Today Than Yesterday

My message is simple: stop chasing noise. Look at what the chart is telling you. Respect support, respect demand zones, and respect your stop. Profit booking is not an admission of defeat — it’s disciplined money management. The trading, stock market, NSE, BSE, Nifty environment rewards process over prediction. If you follow the setups and the rules I shared, your edge will grow.

Thanks for joining the session. Keep practicing, keep a trade journal, and trade safely.

If you have more questions, post them in the comments section of our channel or reach out to the admin — I’ll address common themes in the next live session. Take care and trade responsibly.

Need more help |

|

Contact us by clicking the button below |

|

Click me |