Welcome to our comprehensive overview of the daily market insights shared by Rocketalgo. In this article, we will delve into the key points discussed during the session held on May 7, 2025, focusing on the trading environment, stock market trends, and specific insights on Nifty and Bank Nifty. The aim is to provide valuable information for traders and investors looking to enhance their understanding of the current market dynamics.

Table of Contents

- 🌟 Current Market Overview

- 🚀 Trading Opportunities in Nifty and Bank Nifty

- 📉 Understanding Market Volatility

- 💡 Key Trading Strategies

- 📊 The Impact of Geopolitical Events

- 🔍 Analyzing Crude Oil Prices

- 📈 Leveraging Rocketalgo for Trading Success

- ❓ Frequently Asked Questions

- 🔑 Conclusion

🌟 Current Market Overview

As we kick off today’s market analysis, it’s important to note that the current state of the market has been influenced by various geopolitical factors. Recently, there has been talk regarding the economic conditions in Pakistan and how they might impact the Indian market. It’s crucial to understand that, as highlighted in our previous discussions, the Indian market remains resilient despite external pressures. The fluctuations caused by international tensions should not lead to panic among traders.

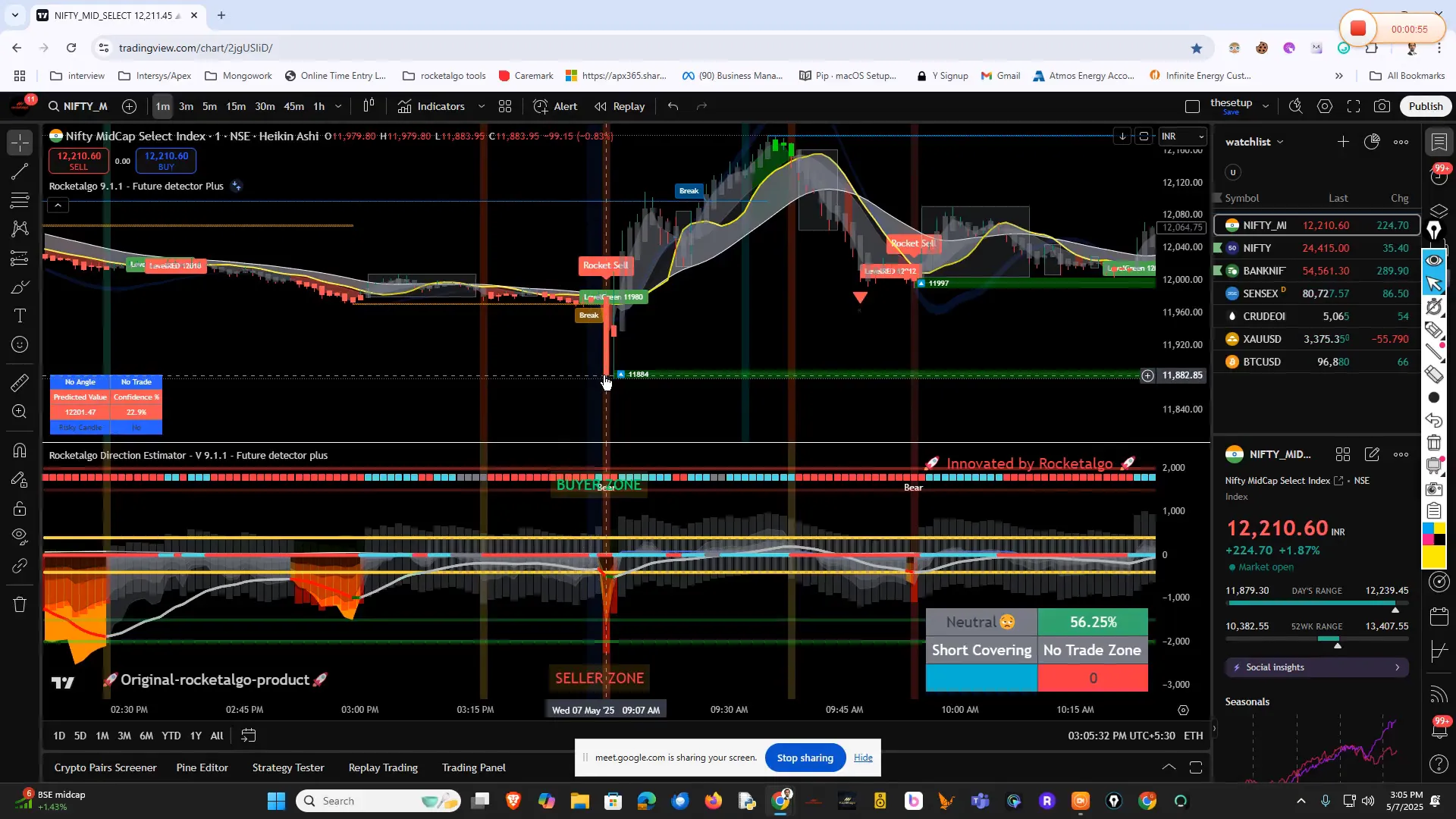

In fact, the market witnessed a temporary crash this morning, driven by market manipulators attempting to sow fear. However, this was short-lived, and the market quickly recovered, showcasing its inherent strength. The mid-cap segment experienced a notable dip but rebounded as traders regained confidence. As we analyze the day’s trading patterns, we noticed a series of fluctuations that provided opportunities for skilled traders.

🚀 Trading Opportunities in Nifty and Bank Nifty

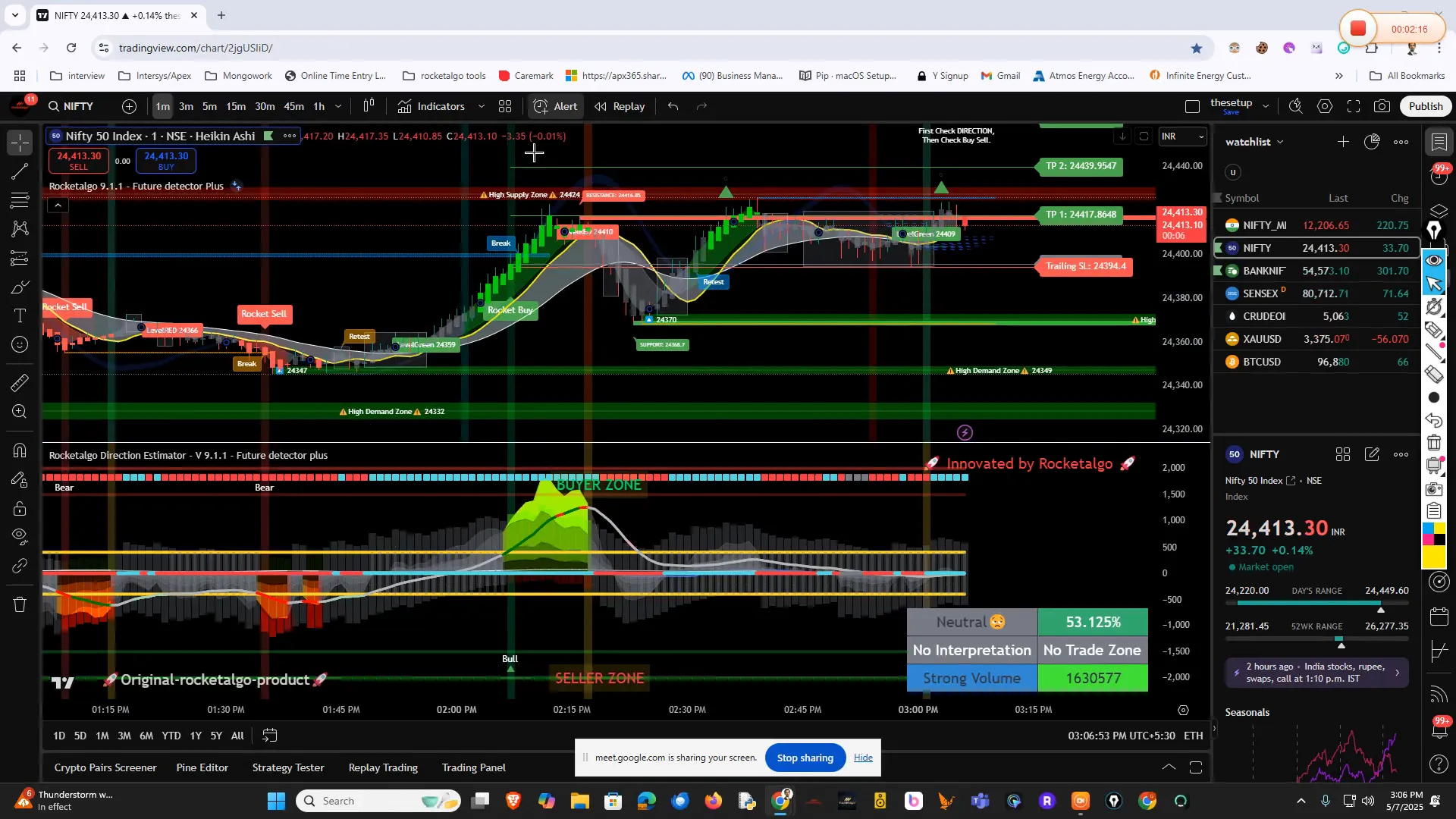

Today’s session presented some exciting trading opportunities, particularly in Nifty. Traders who utilized the Rocketalgo setup were able to capitalize on significant momentum. For instance, Nifty provided a robust trading setup that delivered exceptional results even in a low-volume environment. The reason for the reduced volume today can be attributed to ongoing geopolitical tensions, particularly India’s recent military actions in neighboring regions.

Despite the overall market calm, Nifty displayed impressive trades that were executed flawlessly. The setup provided by Rocketalgo allowed traders to identify key levels and make informed decisions. The momentum seen in Nifty was a clear indication of the underlying strength in the market.

📉 Understanding Market Volatility

One of the key takeaways from today’s session is the importance of understanding market volatility. As traders, it’s essential to recognize that periods of low volatility can lead to frustrating trading conditions, with contracts struggling to maintain movement. Today, many traders experienced this firsthand, as contracts fluctuated minimally, making it challenging to achieve substantial gains.

However, traders who remained patient and adhered to the Rocketalgo setup were able to identify a few excellent trades. For example, around 11:30 AM, a significant trade setup emerged that capitalized on the slight upward momentum. This reinforces the idea that even in a sluggish market, opportunities exist for those who are diligent and prepared.

💡 Key Trading Strategies

In today’s market overview, we emphasized the importance of certain trading strategies that can help traders navigate challenging conditions. Here are some essential strategies to consider:

- Patience: Waiting for the right setup is crucial. Avoid rushing into trades, especially when the market is showing signs of low volatility.

- Understanding Supply and Resistance: When supply and resistance levels align, it often indicates potential reversal points. Be cautious during these scenarios as they can lead to sideways movements or reversals.

- Utilizing Momentum: Identifying momentum in trades can significantly improve your chances of success. Focus on setups that exhibit strong momentum, as they are more likely to yield positive results.

By integrating these strategies into your trading routine, you can enhance your decision-making process and improve your overall trading performance.

📊 The Impact of Geopolitical Events

As mentioned earlier, geopolitical events play a significant role in shaping market sentiment. Today, India’s military actions have led to a cautious approach among larger traders, who are waiting to see how these events unfold before making significant moves. The response from neighboring countries, particularly Pakistan and China, adds layers of complexity to the trading environment.

China’s recent statement expressing concern over the situation indicates that international players are closely monitoring developments. This dynamic can create volatility in trading, and it’s essential for traders to stay informed and adjust their strategies accordingly.

🔍 Analyzing Crude Oil Prices

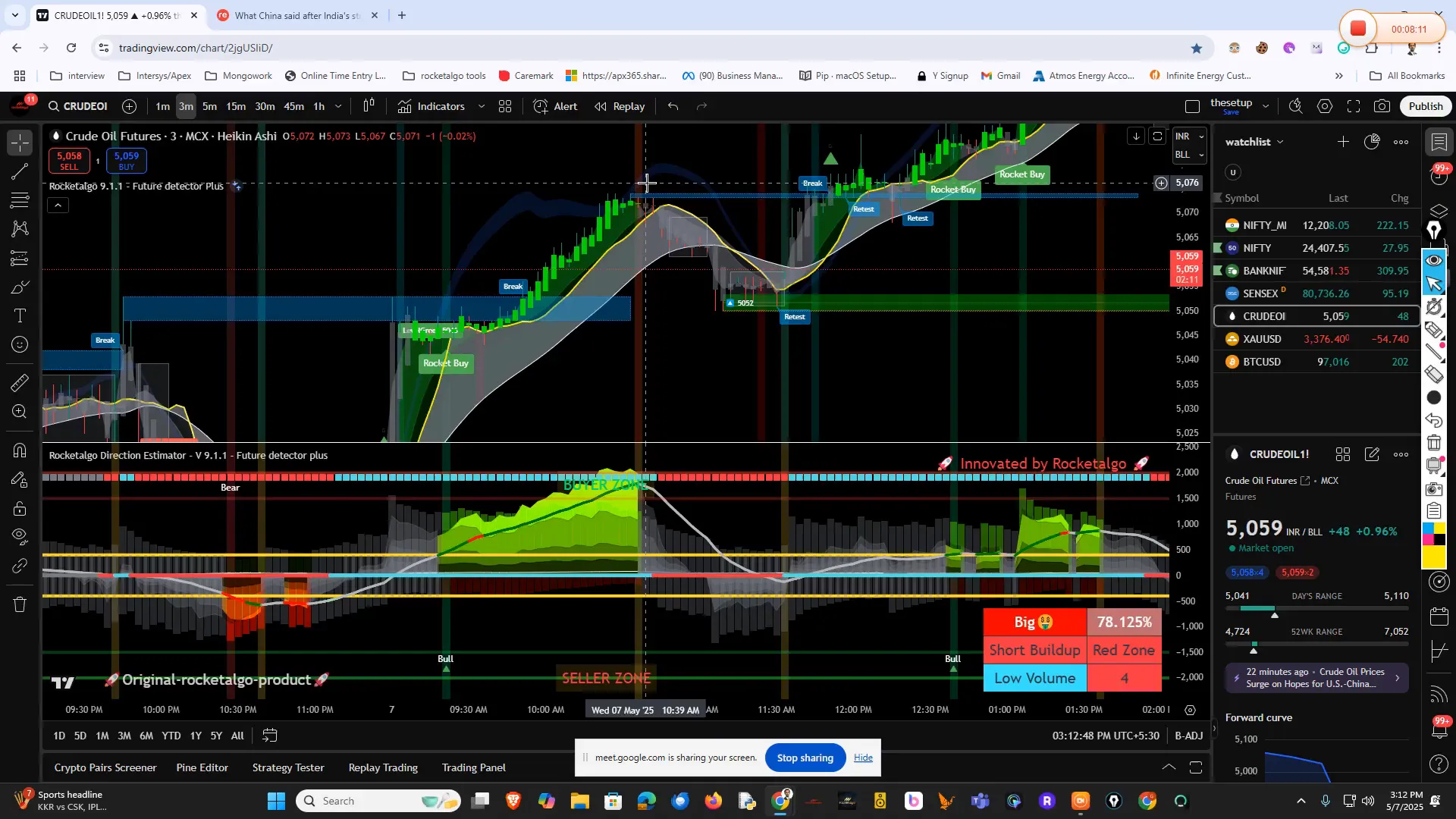

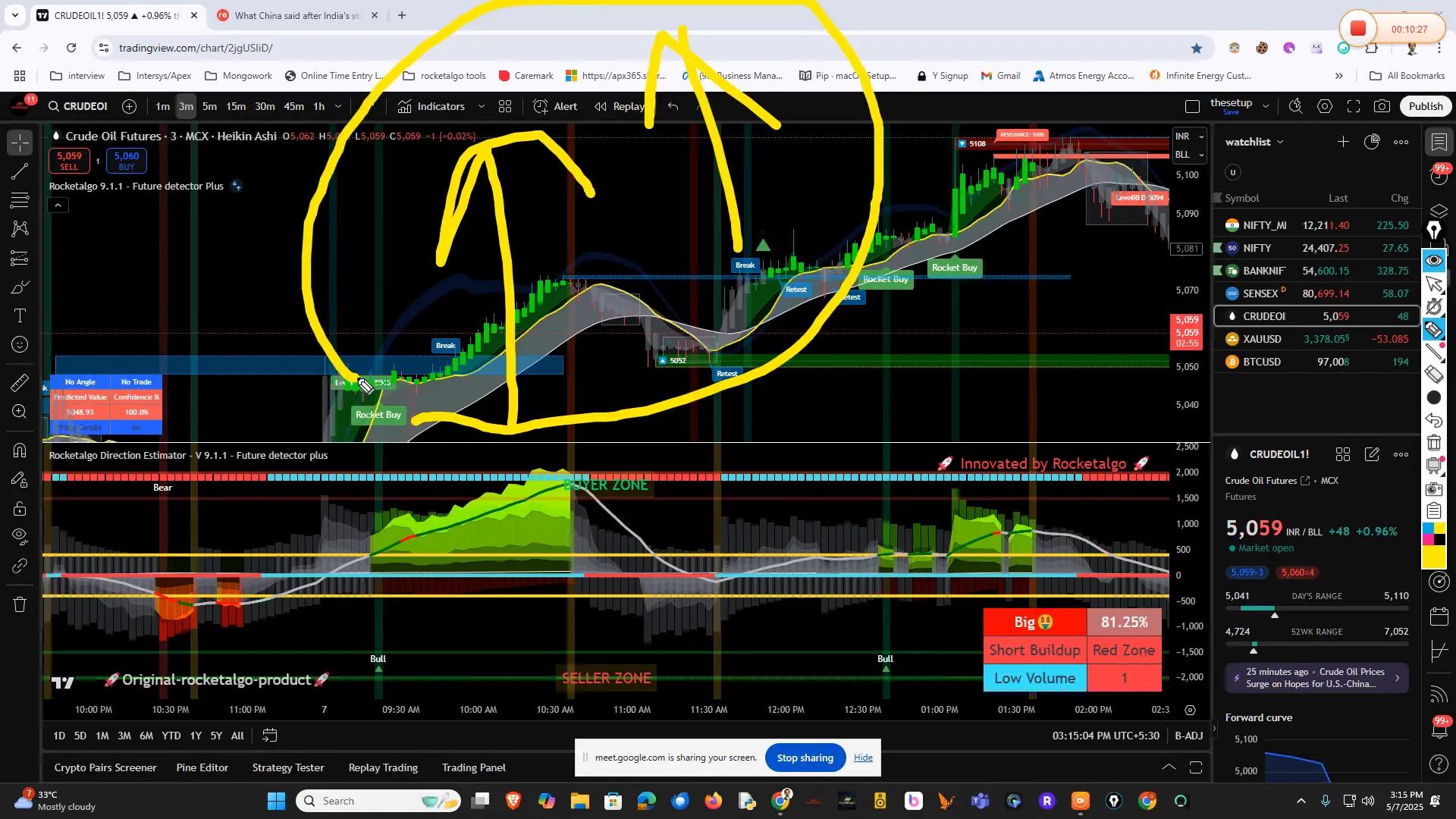

Another aspect discussed in today’s session was the movement of crude oil prices in relation to geopolitical tensions. Historically, during times of conflict, the demand for crude oil tends to increase as military operations require substantial resources. This trend was evident today, as crude oil prices surged following news of military actions.

Traders should pay close attention to how crude oil prices react to ongoing geopolitical developments. The correlation between military engagements and oil demand can provide valuable insights for trading strategies. For instance, if oil prices are set to rise, it may be an opportune time to invest in oil-related stocks or commodities.

📈 Leveraging Rocketalgo for Trading Success

At Rocketalgo, we provide traders with the tools and insights necessary to navigate the complexities of the stock market. Our setup incorporates advanced algorithms that analyze market conditions, helping users make informed trading decisions. Today’s session illustrated the effectiveness of our platform in identifying profitable trades, even in less-than-ideal market conditions.

We encourage traders to trust the process and utilize the features available on our platform. The feedback from users has been overwhelmingly positive, and we continue to refine our system to ensure optimal performance for all traders.

❓ Frequently Asked Questions

What is Rocketalgo?

Rocketalgo is a trading platform that utilizes advanced algorithms to assist traders in making informed decisions. Our setup analyzes market conditions and identifies potential trading opportunities.

How can I join Rocketalgo?

You can join Rocketalgo by contacting us at +91-77-969-83999 or visiting our website at rocketalgo.in.

What types of markets does Rocketalgo cover?

Rocketalgo provides insights and trading setups for various markets, including the stock market, NSE, BSE, and forex trading.

How does Rocketalgo help with trading?

Our platform offers real-time market analysis, trade setups, and insights that help traders identify profitable opportunities and make informed decisions.

Can I trade commodities like crude oil through Rocketalgo?

Yes, Rocketalgo allows traders to engage in various commodities trading, including crude oil, with insights tailored to market conditions.

🔑 Conclusion

In today’s market overview, we explored the current trading environment, focusing on Nifty and Bank Nifty, while addressing the impact of geopolitical events and market volatility. The insights shared during the session emphasize the importance of patience, strategy, and leveraging advanced trading tools like Rocketalgo.

As we move forward, staying informed and adapting to changing market conditions will be key to achieving trading success. Remember, the stock market is a dynamic environment where opportunities abound for those who are prepared. We encourage you to continue exploring the features offered by Rocketalgo and engage in our daily sessions for ongoing market insights.

Thank you for joining us today. For more information, feel free to reach out to us through our contact details provided. Happy trading!