Welcome to our latest exploration of trading strategies and market trends! In this article, we will unpack the essential insights shared by Rocketalgo Official regarding the current landscape of trading, specifically focusing on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Whether you’re a seasoned trader or just starting, understanding these emerging trends can significantly impact your trading decisions.

Table of Contents

- 🚀 Understanding the Emerging Trend

- 📉 Low Conviction and Market Momentum

- 📊 Analyzing Bank Nifty Prices

- 📈 Testing Chart Patterns for Confirmation

- 🔍 The Importance of Trend Confirmation

- 💡 Navigating Through Bogus Channels

- ❓ Frequently Asked Questions (FAQ)

- 📅 Conclusion: Stay Informed and Trade Wisely

🚀 Understanding the Emerging Trend

In the world of trading, trends are the lifeblood of making informed decisions. As we navigate through the complexities of the stock market, recognizing emerging trends can provide traders with a competitive edge. The recent discussions have highlighted an “emerging trend” that is capturing the attention of investors. This trend suggests a shift in market dynamics, potentially offering new opportunities for long and short trades.

The term “emerging trend” isn’t just a buzzword; it encapsulates the changing nature of how assets are traded in the market. The phrase “long buyers, long short long” indicates a complex interplay where traders are looking at both buying and selling opportunities, often simultaneously. This dual approach can be particularly advantageous in a market characterized by low conviction and exhaustion.

📉 Low Conviction and Market Momentum

What does it mean when we talk about “low conviction” in trading? Low conviction refers to a lack of strong belief among traders regarding the direction of the market. When this happens, market momentum tends to dwindle, leading to a period of consolidation or indecision. Traders are often left in a state of uncertainty, which can be nerve-wracking.

In our current trading environment, we see that “low momentum” is a prevailing theme. This means that while the market is still active, the enthusiasm that typically drives prices up or down is lacking. Traders are advised to be cautious and stand by, waiting for clearer signals before making significant moves.

📊 Analyzing Bank Nifty Prices

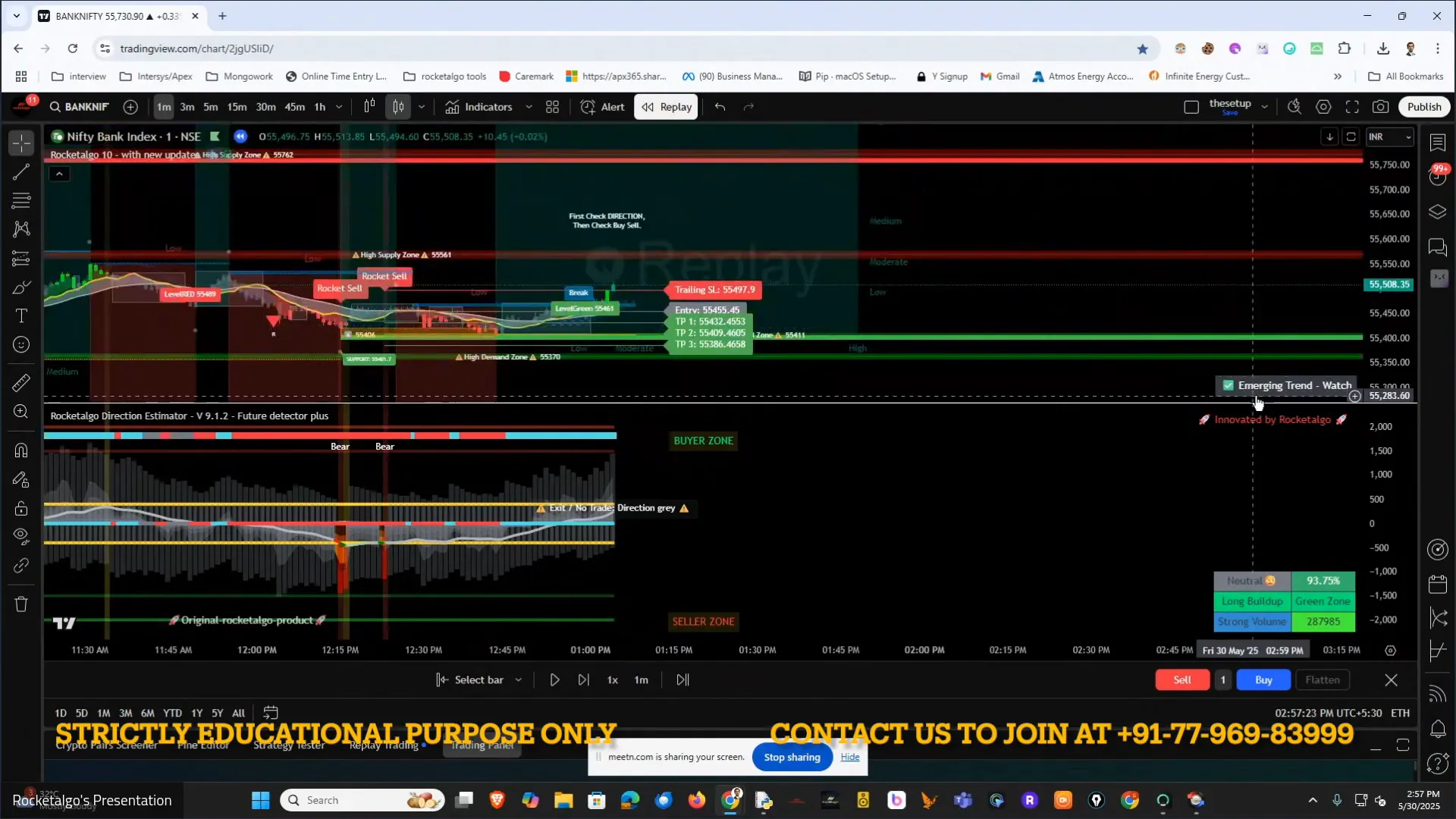

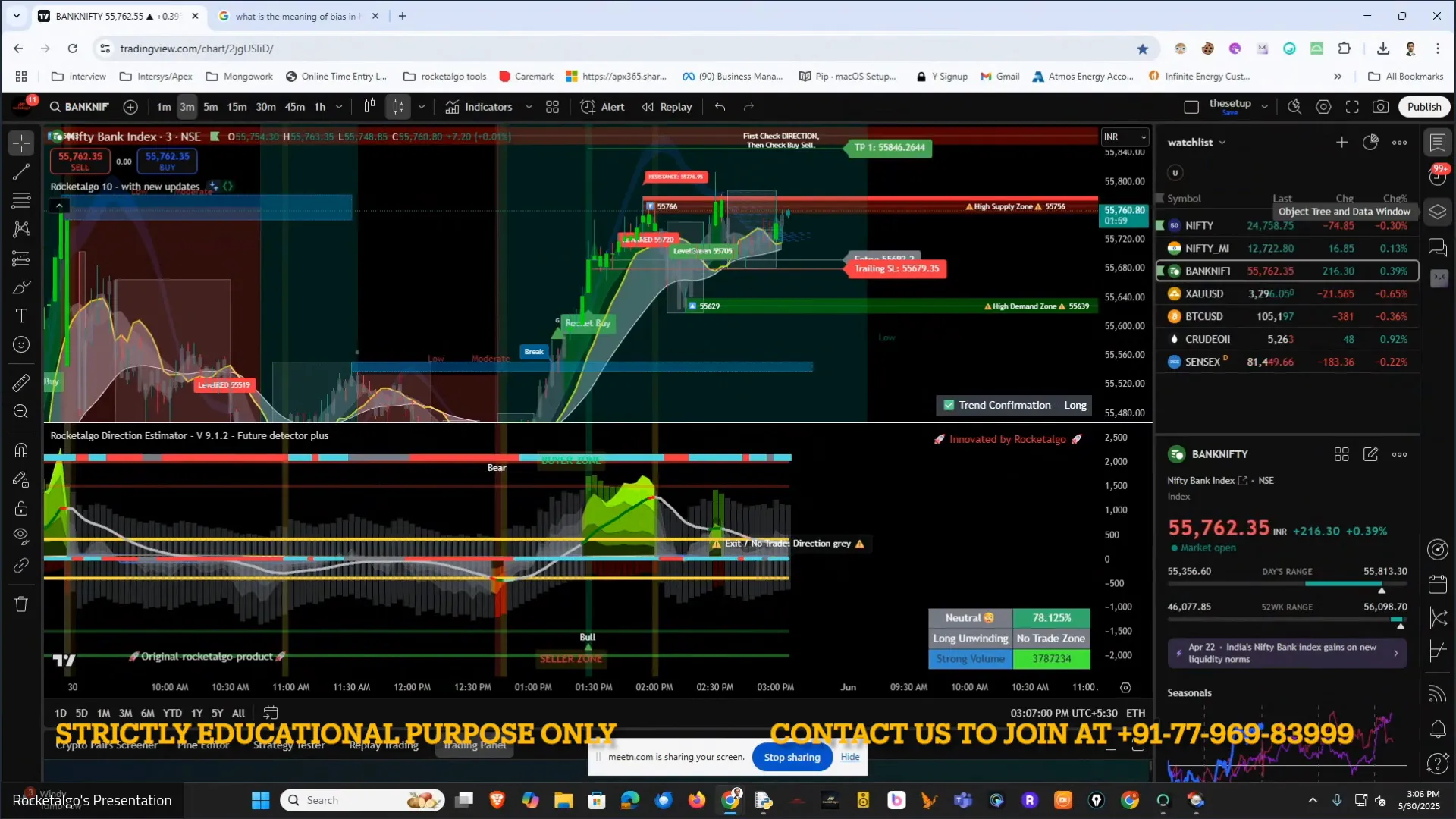

When examining market trends, one of the key indices to consider is the Bank Nifty. This index comprises the most significant banking stocks listed on the NSE, making it a critical barometer for the financial sector’s health. The current trading patterns suggest that prices are fluctuating, and traders should closely monitor these movements.

Understanding the Bank Nifty’s price action can offer insights into broader market sentiment. For instance, if the Bank Nifty shows signs of strength, it might indicate a bullish outlook for the overall market. Conversely, weakness in this index could signal caution for traders.

📈 Testing Chart Patterns for Confirmation

As traders, we rely heavily on charts to analyze price movements and make informed decisions. Testing chart patterns is essential for confirming the emerging trend. The ability to recognize these patterns can provide traders with a roadmap for potential price movements. A robust charting strategy can help traders identify entry and exit points effectively.

In our analysis, we focus on how values continuously fluctuate and how traders can confirm trends through consistent chart testing. This method can help identify whether the market is genuinely moving in a specific direction or if it’s merely a temporary blip.

🔍 The Importance of Trend Confirmation

Trend confirmation is crucial in trading. It involves verifying that the price movements align with the identified trend. For instance, if you spot a potential upward trend, you want to see corresponding increases in volume and price stability to confirm that this trend is genuine and not just a fleeting moment.

When looking at the CDSL (Central Depository Services Limited), we see both long and down-train confirmations. Such confirmations are vital for traders looking to capitalize on price movements. It’s not just about identifying a trend; it’s about validating it through data and patterns.

💡 Navigating Through Bogus Channels

In any trading environment, it’s essential to be cautious of “bogus channels.” These refer to misleading signals or patterns that can trick traders into making poor decisions. The best way to navigate this landscape is to remain informed and skeptical of any trend that seems too good to be true.

Joining credible channels and communities can help mitigate the risks associated with bogus channels. It’s important to learn from reliable sources and engage with traders who have a proven track record. Always remember, trading is as much about psychology as it is about strategy.

❓ Frequently Asked Questions (FAQ)

What is the significance of low conviction in trading?

Low conviction indicates a lack of strong belief among traders, often leading to decreased market momentum and potential indecision.

How can I confirm an emerging trend?

Trend confirmation can be achieved through consistent chart testing and monitoring for volume increases that align with price movements.

Why is Bank Nifty important for traders?

The Bank Nifty index serves as a critical gauge for the financial sector, helping traders understand broader market sentiment.

What are bogus channels, and how can I avoid them?

Bogus channels refer to misleading signals in trading. To avoid them, engage with reputable trading communities and always verify information before acting on it.

📅 Conclusion: Stay Informed and Trade Wisely

Understanding the dynamics of the stock market, especially the NSE and BSE, requires constant learning and adaptation. The insights shared in this analysis aim to equip you with the knowledge to navigate the complexities of trading effectively. Remember, the market is ever-evolving, and staying informed is your best strategy.

As we continue to explore the depths of trading strategies, we encourage you to engage with our community. Join Rocketalgo today for more insights and resources that can help you make informed trading decisions. Don’t forget to check out our guides and learning app for further assistance!

Trade safely, and may your trading journey be prosperous!