Trading in the stock market, especially focusing on NSE, BSE, and the Nifty indices, can be both exhilarating and challenging. With so many variables at play, it’s easy to get overwhelmed. However, understanding the core principles and adopting a strategic mindset can make all the difference. Drawing inspiration from Rocketalgo Official’s latest insights, this article delves deep into the nuances of trading, shares practical advice, and sheds light on the mental game that underpins consistent success in the market.

Table of Contents

- 🔍 Understanding the Basics: What Does Trading Really Mean?

- 💡 Why Some Trading Strategies Can Seem Silly – And How to Avoid Them

- 🧠 The Mindset of a Successful Trader: Control, Consistency, and Confidence

- 📊 Bank Nifty and Market Realities: Dispelling Common Myths

- 📞 Staying Connected and Learning More: Resources and Support

- 📈 Practical Tips for Trading the NSE, BSE, and Nifty Successfully

- ❓ Frequently Asked Questions (FAQ) About Trading in NSE, BSE, and Nifty

- 🚀 Conclusion: Embrace Knowledge and Mindset for Trading Success

🔍 Understanding the Basics: What Does Trading Really Mean?

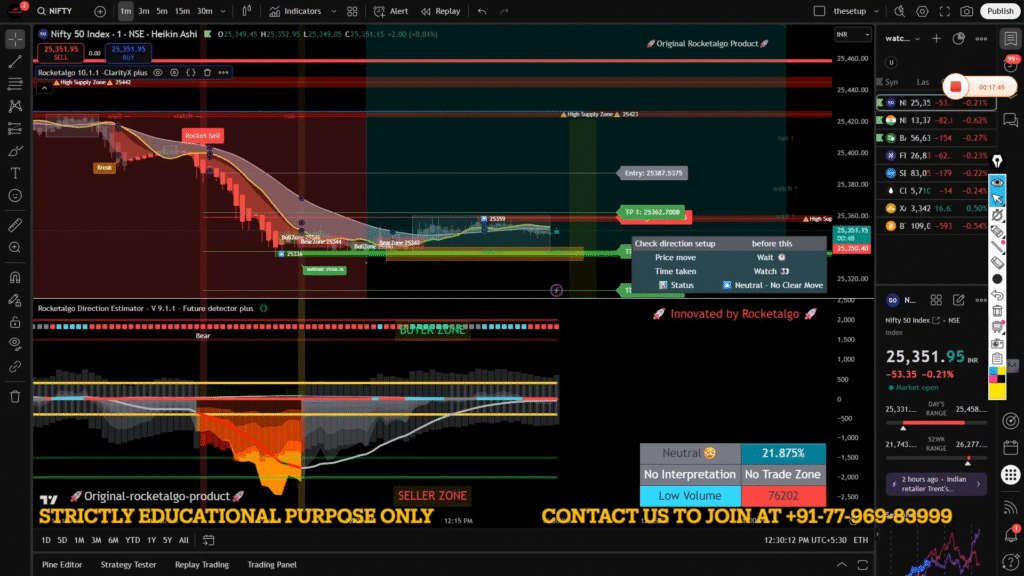

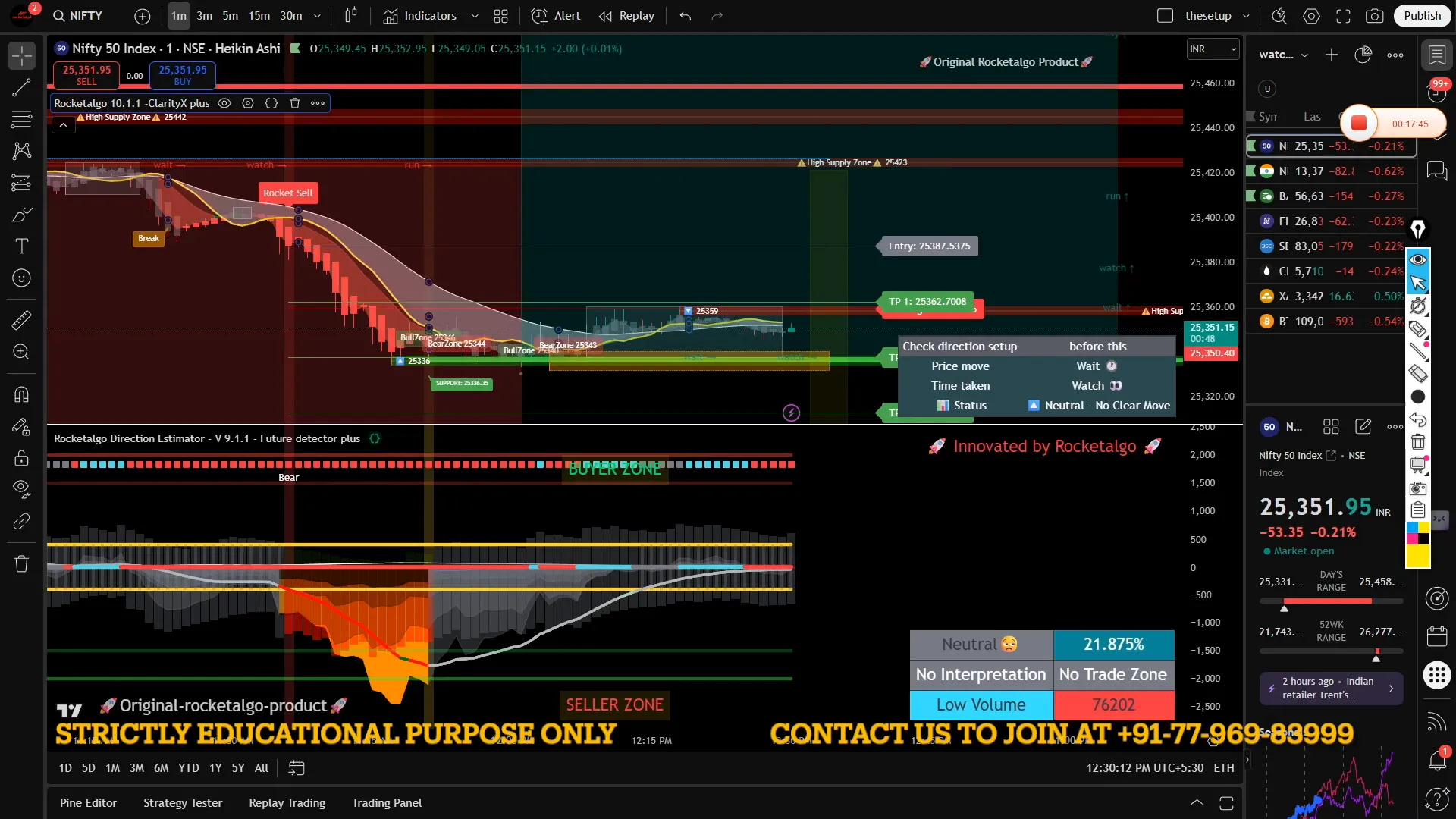

When diving into trading, one of the first things you need to grasp is how price movements work and what impacts them. A key term that often gets tossed around is the “delta change in price with respect to time.” Simply put, this refers to how much the price of a stock or index changes over a specific period.

For example, if you buy a single lot of a stock or an index like the Nifty, you might pay a premium or a price that fluctuates based on market conditions. Rocketalgo Official mentions a figure like “two thousand five hundred” to illustrate how even a small delta change can significantly impact your trading position.

Understanding these fundamental mechanics is crucial because every trade you place is influenced by how prices move over time. The stock market, particularly NSE and BSE, operates on these subtle but powerful changes that can either make or break your trading day.

What is a Lot in Trading?

A lot is a standardized number of shares or contracts traded on the exchange. For indices like Nifty or Bank Nifty, a lot size can vary, and knowing the exact size helps you calculate your exposure and potential profits or losses.

💡 Why Some Trading Strategies Can Seem Silly – And How to Avoid Them

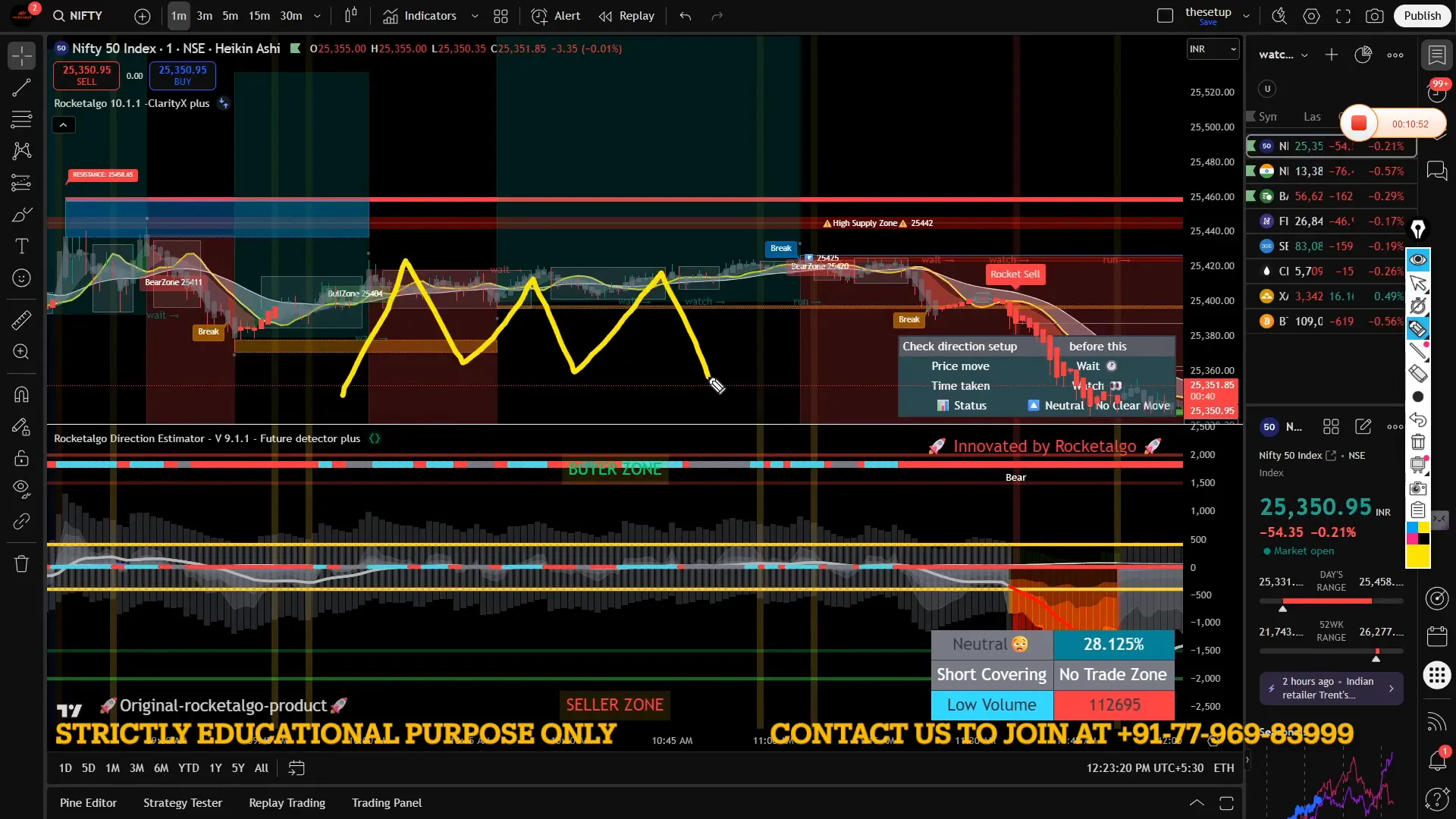

Rocketalgo Official candidly points out that some trading strategies can be “really silly.” This may sound harsh, but it’s a reminder that not all approaches are created equal. Many traders fall into traps by relying on methods that lack consistency or fail to consider the bigger picture.

For instance, blindly buying or selling based on hunches or short-term market noise without analyzing the delta price changes or market trends can lead to losses. The key takeaway here is to develop a methodical approach rather than chasing quick wins.

Consistency, as highlighted, is the cornerstone of successful trading. Whether you are making profits or experiencing losses, your strategy should be consistent in its application. This means sticking to your trading plan, managing risks, and learning from each trade.

Common Silly Mistakes to Avoid

- Overtrading without a plan

- Ignoring risk management

- Reacting emotionally to market movements

- Relying solely on tips without personal analysis

- Failing to review and adapt strategies regularly

🧠 The Mindset of a Successful Trader: Control, Consistency, and Confidence

One of the most profound insights from Rocketalgo Official’s discussion is that trading, whether manual or algorithm-driven, is fundamentally a “game of mindset.” This means that beyond technical knowledge and market analysis, your psychological approach plays a pivotal role.

Trading success is not just about making profitable trades but about being consistent in your decisions, controlling emotions, and maintaining discipline. This is easier said than done, but it’s a truth that every seasoned trader knows well.

Here’s why mindset matters so much:

- Emotional Control: Markets can be volatile and unpredictable. A trader who panics or gets greedy can quickly wipe out gains.

- Patience: Waiting for the right setups and not forcing trades helps avoid unnecessary losses.

- Adaptability: Markets evolve, and so must your strategies and mindset.

- Confidence with Caution: Confidence in your strategy is vital, but it should never turn into overconfidence.

📊 Bank Nifty and Market Realities: Dispelling Common Myths

Many traders have a fascination with Bank Nifty due to its liquidity and volatility. However, Rocketalgo Official openly shares that they are “not a very big fan” of Bank Nifty, which might come as a surprise to some.

The reason? Being old or experienced in the market doesn’t automatically translate into being smart or successful in trading. The market is filled with “fools who also get older,” implying that longevity without learning and adapting doesn’t guarantee profits.

This statement is a powerful reminder that traders should focus on continuous learning and not rest on past laurels or age. Instead of chasing hype or popular instruments like Bank Nifty blindly, it’s better to focus on what fits your trading style and risk tolerance.

Why Not Everyone Should Chase Bank Nifty

- Bank Nifty’s high volatility can lead to significant losses if not managed properly.

- It requires a solid understanding of market dynamics and quick decision-making.

- Many traders get trapped in emotional swings due to its rapid price movements.

📞 Staying Connected and Learning More: Resources and Support

Trading is a journey, and having reliable support and resources can make a huge difference. Rocketalgo Official encourages traders to reach out and connect, emphasizing the importance of clear communication and cooperation in the trading community.

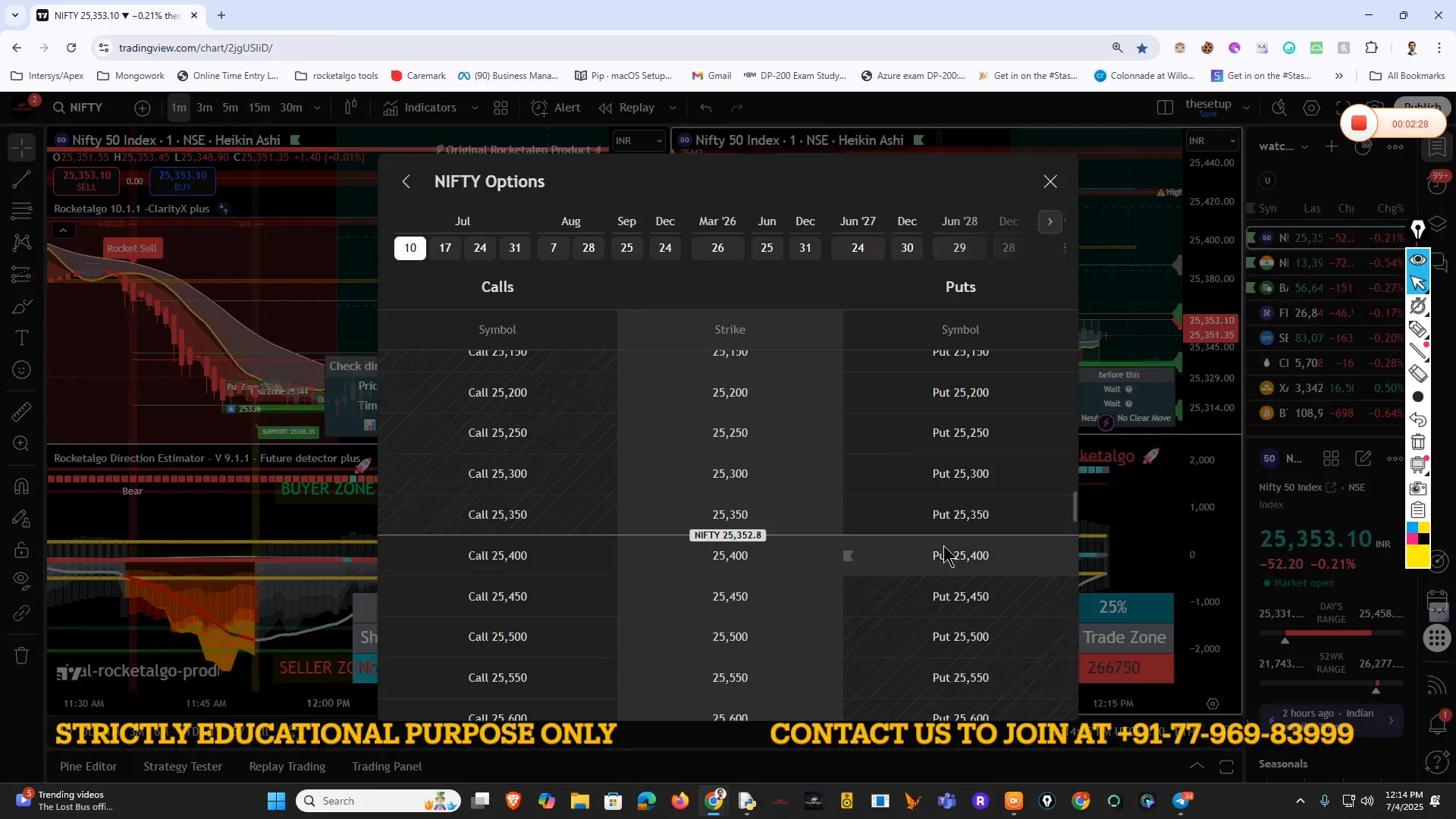

If you want to deepen your understanding of trading on NSE, BSE, or Nifty, or explore algorithmic trading using AI-powered tools, consider leveraging educational platforms and guides. Rocketalgo offers a variety of resources to help traders at all levels:

- Guides: Accessible at guide.rocketalgo.in

- Learning App: Interactive learning through learn.rocketalgo.in/app

- Official Website: For tools and updates visit rocketalgo.in

- Reels and Quick Tips: Follow on Instagram at www.instagram.com/rocket_algo/reels/

For personalized assistance or inquiries, you can contact Rocketalgo directly at +91-77-969-83-999. Being part of an active trading community and having access to expert advice can elevate your trading game significantly.

📈 Practical Tips for Trading the NSE, BSE, and Nifty Successfully

Based on the insights shared, here are some actionable tips to help you improve your trading results in the stock market:

- Understand the Delta Price Movements: Pay attention to how price changes over time affect your positions, especially when trading lots of Nifty or Bank Nifty.

- Develop a Consistent Strategy: Avoid impulsive trading. Stick to a plan that has been tested and refined.

- Manage Your Mindset: Practice emotional control, patience, and discipline. Remember, trading is as much psychological as it is technical.

- Choose Instruments Wisely: Don’t just follow popular trends; choose instruments that match your risk profile and expertise.

- Leverage Technology: Use AI-powered trading bots and algorithmic tools to assist in decision-making but never rely solely on automation.

- Keep Learning: Stay updated with market news, new strategies, and community insights to adapt to changing market conditions.

- Risk Management: Always apply stop-losses and avoid risking more than a small percentage of your capital on any single trade.

❓ Frequently Asked Questions (FAQ) About Trading in NSE, BSE, and Nifty

Q1: What is the difference between NSE and BSE?

The NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) are two major stock exchanges in India. NSE is known for its electronic trading system and high liquidity, while BSE is the oldest stock exchange in Asia. Both offer trading in equities, derivatives, and other financial instruments.

Q2: How important is mindset in trading?

Mindset is crucial. Trading is not just about strategies but also about emotional control, discipline, and consistent decision-making. A strong mindset helps traders handle losses and stay focused on long-term success.

Q3: Should I trade Bank Nifty if I am a beginner?

Bank Nifty is highly volatile and can be risky for beginners. It requires quick decision-making and good risk management. Beginners should start with less volatile instruments and gradually move towards Bank Nifty as they gain experience.

Q4: Can AI trading bots guarantee profits?

No trading bot or algorithm can guarantee profits. AI tools can assist in analyzing data and executing trades, but market unpredictability always carries risk. It’s essential to use these tools as aids rather than complete solutions.

Q5: How can I improve my trading consistency?

Consistency comes from following a tested strategy, managing risks, maintaining emotional control, and continuously learning. Keeping a trading journal and reviewing your trades can also help identify patterns and improve decision-making.

🚀 Conclusion: Embrace Knowledge and Mindset for Trading Success

Trading in the stock market, whether on NSE, BSE, or through indices like Nifty, is a complex but rewarding endeavor. The key to success lies not only in understanding market mechanics such as delta price changes but also in mastering the mental game. As Rocketalgo Official emphasizes, trading is fundamentally a mindset game — one where discipline, consistency, and emotional control determine your long-term outcomes.

By avoiding common pitfalls, choosing your instruments wisely, and leveraging the right educational resources and tools, you can enhance your trading performance. Remember, age or experience alone doesn’t make you a smart trader — continuous learning and adaptability do.

Stay connected with reliable platforms, seek guidance when needed, and always trade safely by managing your risks. With the right approach, you can navigate the exciting world of stock market trading confidently and successfully.