Trading in the stock market, especially on platforms like the NSE and BSE, is a thrilling yet challenging activity. Whether you’re dealing with Nifty, Bank Nifty, or other indices, understanding the dynamics of price movements, timing, and strategic execution is crucial to success. In this article, we dive deep into a concise yet powerful overview of trading concepts inspired by Rocketalgo Official, a trusted name in AI-powered trading strategies and market predictions.

This guide aims to provide you with actionable insights into how to approach trading with precision, focusing on essential elements such as price moments, timing your trades, and following market angles to optimize your decisions. So, if you want to enhance your trading skills and gain clarity on how to navigate the stock market’s fast-paced environment, read on!

Table of Contents

- 📈 Understanding Price Moments in Trading

- ⏳ Timing Your Trades: The Importance of Watch Time

- 🎯 Aligning with Market Angles: Follow the Trend

- 🎟️ The Role of Tickets and Trade Execution

- 🔑 Key Takeaways for Successful Trading on NSE and BSE

- 🤔 Frequently Asked Questions (FAQ)

- 🚀 Conclusion: Elevate Your Trading Game with Smart Strategies

📈 Understanding Price Moments in Trading

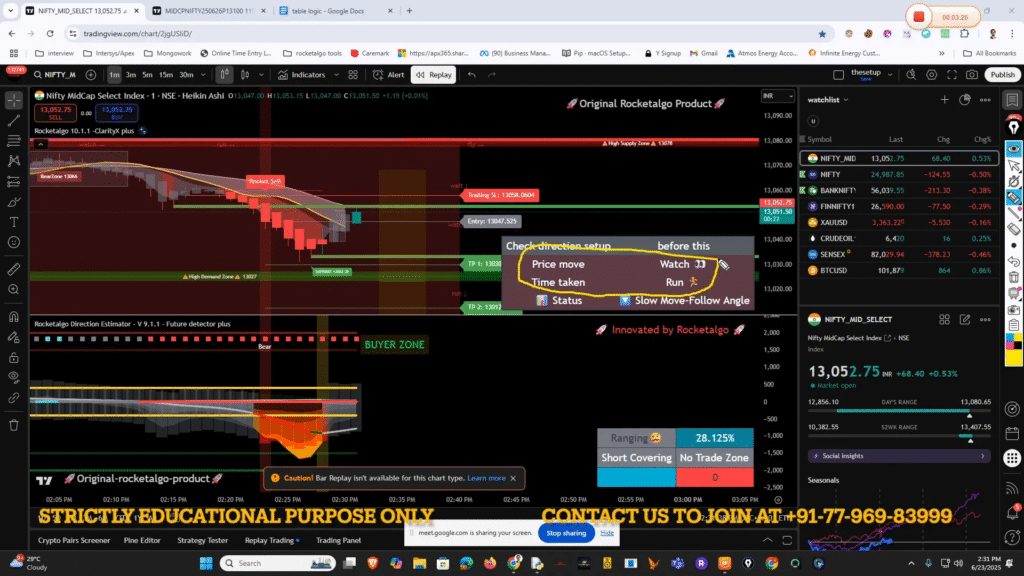

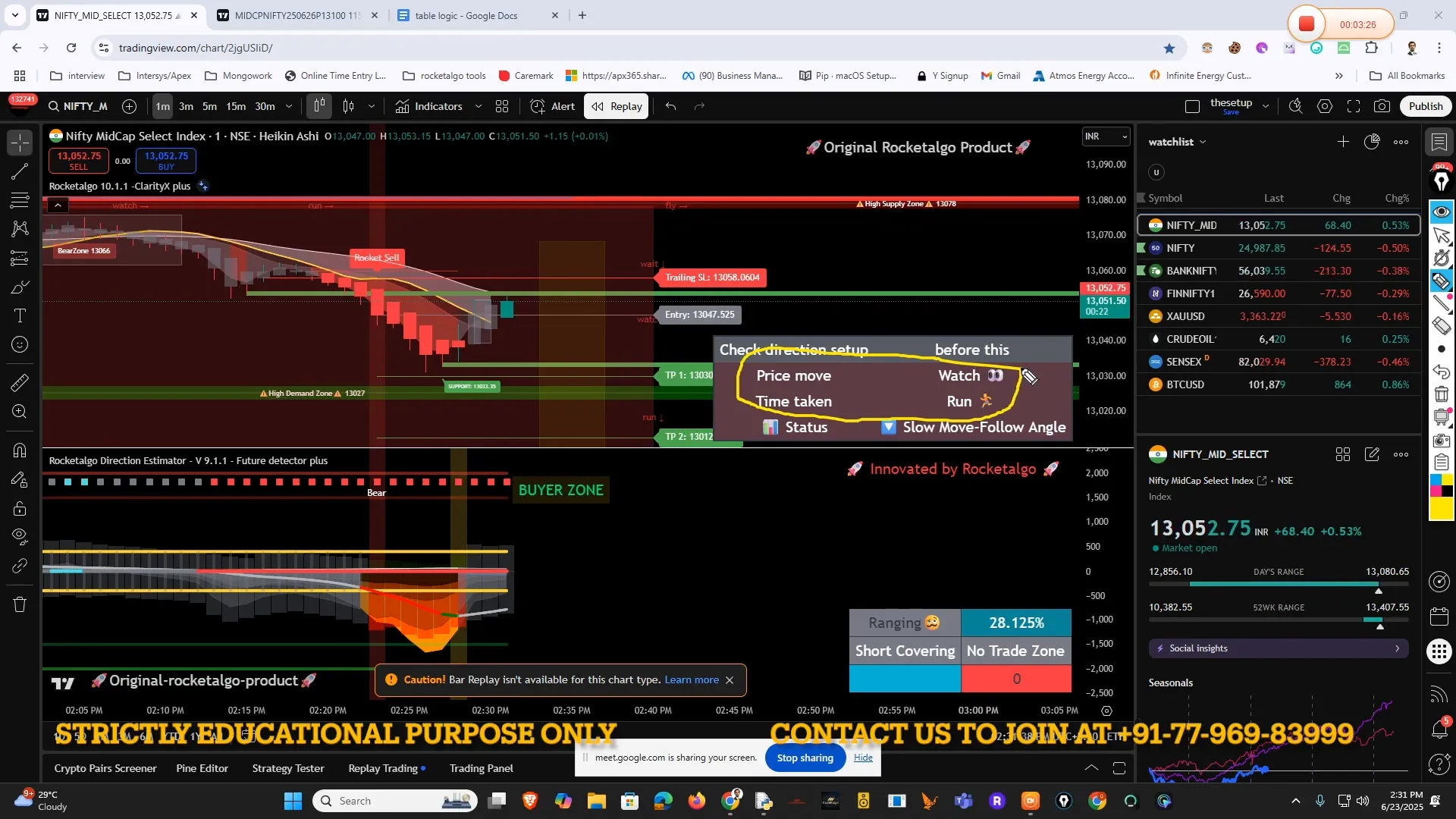

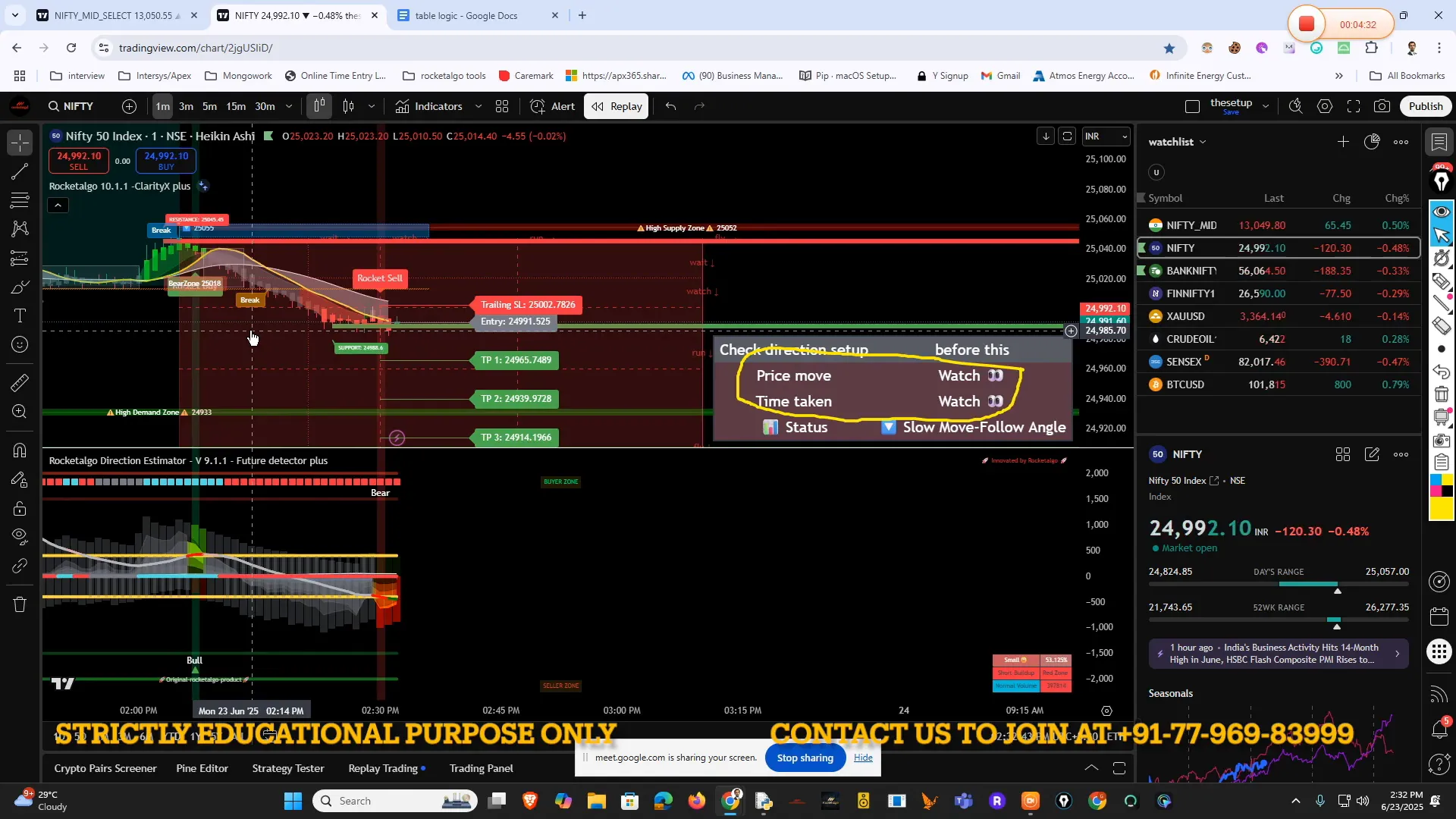

One of the fundamental concepts every trader should grasp is the price moment. This refers to the specific instances when the price of a stock or index exhibits significant movement, either upward or downward. Recognizing these moments is key to entering or exiting trades at the right time.

Price moments are often influenced by market sentiment, news, and technical indicators. For example, during intraday trading, sudden spikes or drops can signal opportunities for quick profits or warnings to avoid losses. The challenge lies in distinguishing between genuine price moments and false signals.

To master this, traders need to watch the price action closely—observing candlestick patterns, support and resistance levels, and volume changes. By doing so, you can anticipate potential breakouts or reversals, allowing you to make informed decisions rather than impulsive moves.

⏳ Timing Your Trades: The Importance of Watch Time

Successful trading is not just about what you trade but when you trade. The concept of watch time in trading refers to the duration you observe the market before making a move. It involves patiently monitoring price trends, momentum, and market conditions to identify the optimal moment to run your trade strategy.

Rushing into trades without adequate watch time often leads to poor outcomes. Instead, a disciplined approach where you give yourself enough time to analyze charts and market behavior can improve your win rate dramatically.

For instance, in intraday trading of Nifty or Bank Nifty, you might watch the price action for several minutes or even hours to confirm a trend before executing your order. This reduces the chances of getting caught in volatile price swings and helps you capitalize on consistent momentum.

🎯 Aligning with Market Angles: Follow the Trend

Another crucial aspect highlighted is the idea of following the time angle or market angle. This essentially means aligning your trades with the prevailing market trend or angle of movement. Trading against the trend often results in losses, while riding the trend can maximize your profit potential.

Market angles can be interpreted through trendlines, moving averages, or other technical indicators that show the direction of price movement over time. By following these angles, traders can make more strategic decisions, entering trades that conform to the broader market momentum.

For example, if the Nifty index is showing a strong upward angle supported by volume and positive market news, it’s usually wise to take long positions or buy calls. Conversely, a downward angle might signal a sell or short opportunity.

🎟️ The Role of Tickets and Trade Execution

In trading jargon, a ticket refers to the order or trade entry you place in the market. Executing your ticket at the right time and price is vital for achieving your trading objectives.

When you identify a favorable price moment and align it with the appropriate market angle, placing your ticket efficiently ensures you capture the intended movement. Delayed execution or incorrect ticket placement can erode potential profits or increase losses.

Modern trading platforms and AI-driven bots, like those offered by Rocketalgo, can assist in automating ticket execution, reducing human error and latency. This approach is especially beneficial in fast-moving markets like NSE and BSE, where milliseconds can make a difference.

🔑 Key Takeaways for Successful Trading on NSE and BSE

- Watch price moments: Stay vigilant to catch significant price actions that can create trading opportunities.

- Manage your watch time: Be patient and analyze market behavior before committing to trades.

- Follow the market angle: Align your trades with the prevailing trend to increase your chances of success.

- Execute tickets efficiently: Place your orders promptly and accurately to capitalize on market movements.

- Use technology wisely: Leverage AI and automated trading tools to improve precision and reduce emotional bias.

🤔 Frequently Asked Questions (FAQ)

What is a price moment in trading?

A price moment is a specific time when a stock or index shows a notable price movement, either up or down, which can signal a trading opportunity.

How important is timing in stock market trading?

Timing is critical. Observing the market for the right amount of time before entering a trade can enhance your chances of success by avoiding premature or delayed actions.

What does following the market angle mean?

It means aligning your trades with the prevailing trend or direction of the market, which helps in taking trades that have a higher probability of moving in your favor.

How can AI trading bots help in trading?

AI trading bots can automate trade execution, analyze market trends in real-time, and reduce human error, making trading more efficient and potentially more profitable.

Is trading on NSE and BSE risky?

Yes, trading carries risk, including the possibility of significant losses. It’s essential to do your own research, use risk management strategies, and consult financial advisors before trading.

🚀 Conclusion: Elevate Your Trading Game with Smart Strategies

Remember, effective trade execution through well-placed tickets is the final step in turning your analysis into profits. Embracing technology and AI-driven tools can further enhance your capabilities, making your trading journey smoother and more informed.

Whether you are a novice trader or an experienced one, these principles serve as a solid foundation for navigating the complexities of trading Nifty, Bank Nifty, and other indices. Keep learning, stay disciplined, and trade safely!

For more insights and advanced trading strategies, consider exploring Rocketalgo’s guides and learning apps, which provide valuable resources for traders at all levels.