Welcome to an in-depth guide crafted for traders and investors eager to sharpen their skills in the stock market, specifically focusing on trading strategies around NSE, BSE, and Nifty. Drawing inspiration and expert insights from Rocketalgo Official, this article unpacks how to effectively use the Rocketalgo setup to capture profitable trades, understand market momentum, and navigate the complexities of support and resistance zones. Whether you are a seasoned trader or a beginner, this article will help you decode the nuances of market trends, mid cap stocks, and the importance of emotional discipline in trading.

Table of Contents

- 📈 Understanding ABC and P Zones: The Backbone of Trading Support and Resistance

- 🧠 Emotional Discipline: The Key to Successful Trading

- 🔍 Why Mid Cap Stocks Matter in Your Trading Strategy

- 🌏 The Indian Market: Why It Remains a Powerhouse Despite Global Concerns

- 🚀 Capturing Momentum with Rocketalgo’s Setup

- 📚 Free Courses and Learning Opportunities with Rocketalgo

- 📊 Real Examples of Trades and Profitability

- 🔧 Automation and Community Support for Traders

- 🎯 Key Components of the Rocketalgo Trading Setup Explained

- ❓ Frequently Asked Questions (FAQ) 🤔

- 🔑 Conclusion: Elevate Your Trading Journey with Rocketalgo

📈 Understanding ABC and P Zones: The Backbone of Trading Support and Resistance

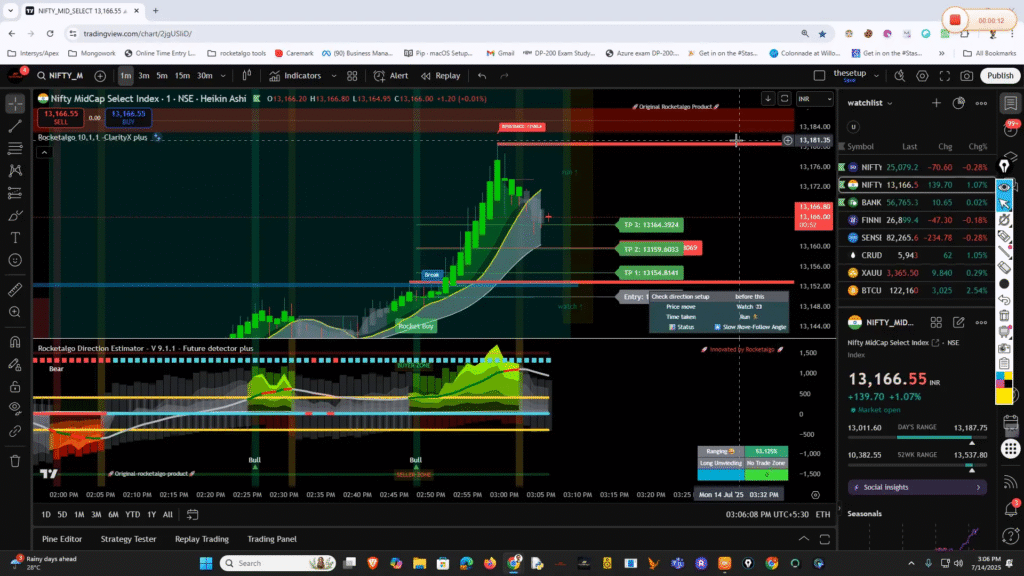

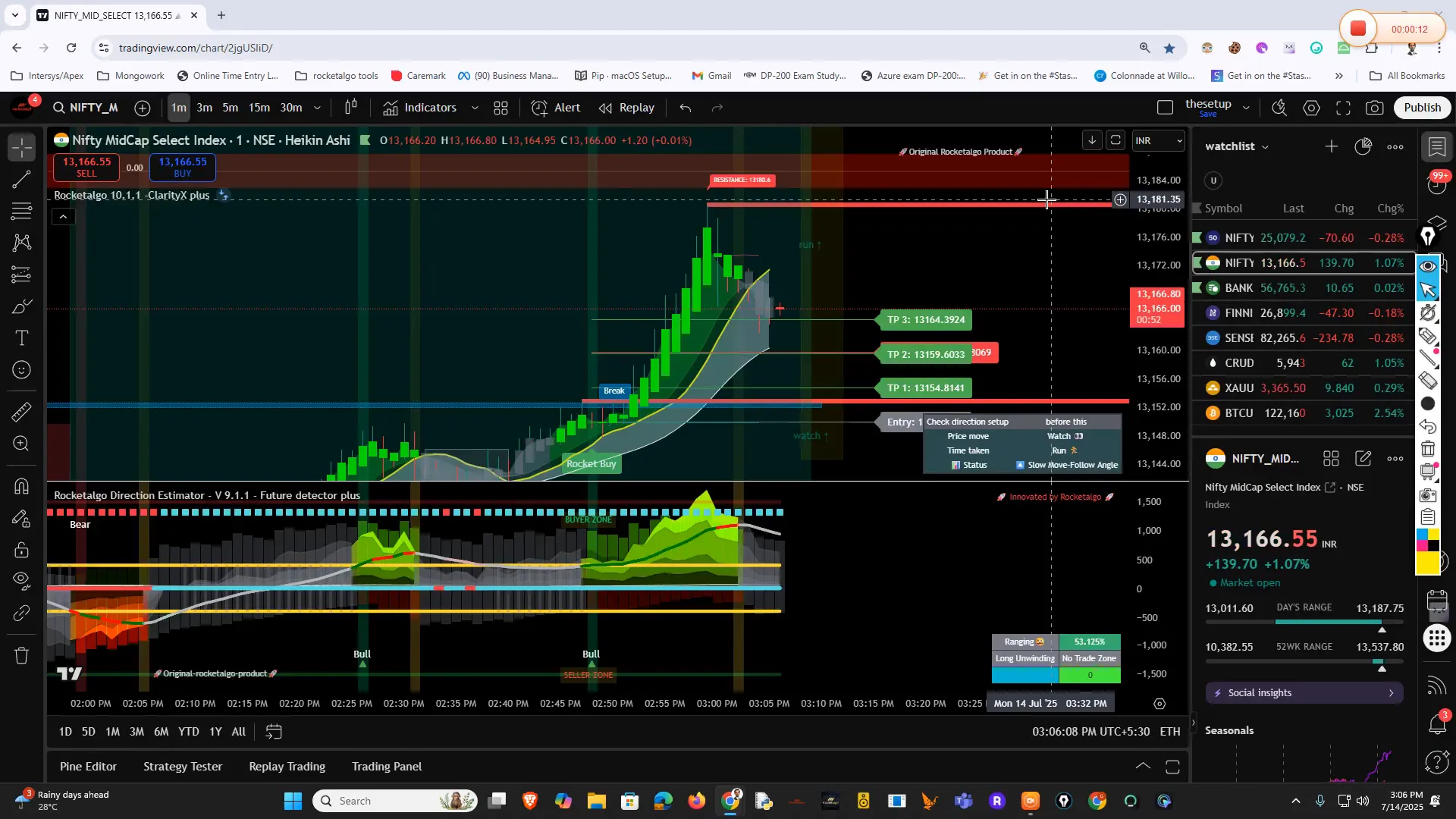

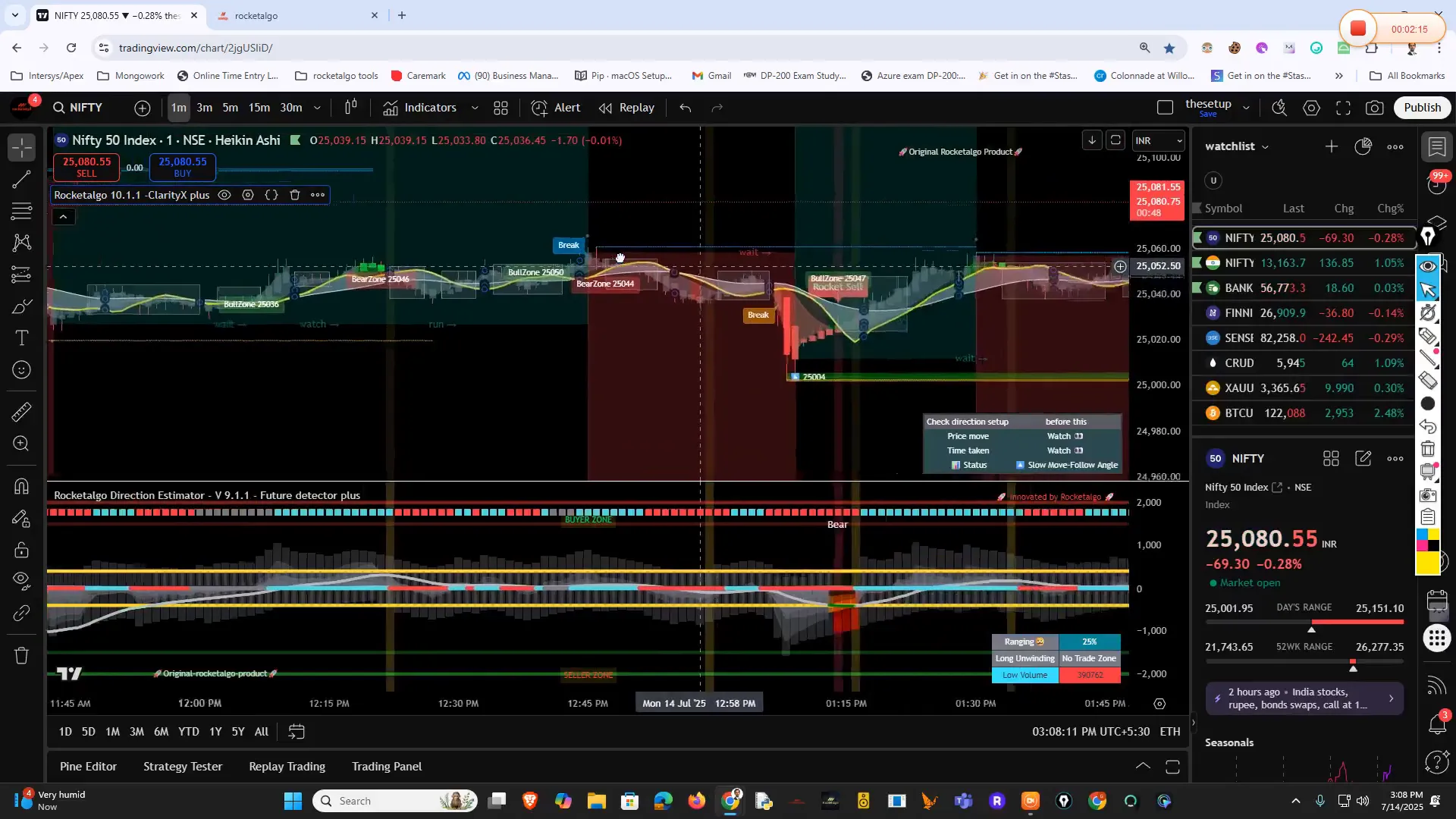

One of the foundational aspects of successful trading is understanding the concepts of support and resistance zones. In Rocketalgo’s system, these are referred to as the A, B, C, and P zones. These zones help identify where the price of a stock or index might find support during a downtrend or face resistance during an uptrend.

Support zones (A and B zones) indicate price levels where buyers tend to enter the market, preventing the price from falling further. Resistance zones (C and P zones), on the other hand, are levels where sellers dominate, capping upward price movements. Recognizing these zones can prevent traders from falling into common traps such as chasing sideways markets or reacting emotionally to price fluctuations.

Rocketalgo emphasizes that understanding these zones is critical for developing a disciplined trading approach. The system combines these zones with momentum indicators to guide entry and exit points, helping traders avoid emotional decisions.

🧠 Emotional Discipline: The Key to Successful Trading

One of the most important rules shared by Rocketalgo is to never get emotional or try to outsmart the market. Trading is not about predicting every move perfectly but about following a strategy consistently. Sideways markets, where prices move within a narrow range, are particularly tricky. The advice here is simple: don’t get excited or anxious when the market is sideways. Avoid jumping in just because you think the price will go up or down based on hearsay or unverified tips.

Patience and sticking to the setup’s signals are vital. Rocketalgo’s approach helps traders maintain composure during these phases by focusing on momentum and zone indicators rather than speculation.

🔍 Why Mid Cap Stocks Matter in Your Trading Strategy

Rocketalgo expresses a strong preference for mid cap stocks for multiple reasons. Mid caps often present a balance between volatility and stability, offering exciting trading opportunities without the extreme unpredictability of small caps or the sluggishness of large caps.

The setup uses specific parameters to analyze mid caps, including:

- T for Target Angle – measures trend direction strength

- B for Breakout – identifying breakouts from critical price levels

- C for Candle Patterns – analyzing candlestick formations for entry signals

- M for Money Flow – tracking capital inflow and outflow

- P for Percentage – assessing price movement percentages for momentum

This multi-faceted analysis allows traders to spot strong trends in mid caps, Nifty, and Bank Nifty, which often deliver reliable trading opportunities. The focus on mid caps also aligns with the broader market trends seen on the NSE and BSE, helping traders capitalize on growth sectors.

🌏 The Indian Market: Why It Remains a Powerhouse Despite Global Concerns

In recent discussions, questions about the future of the Indian market, especially with concerns like FIS exiting India, have surfaced. Rocketalgo offers a grounded perspective: India is the world’s largest economy by population, and that consumer base is a formidable force driving market growth.

Understanding this is critical for traders who might be influenced by sensational headlines or hype on social media. The Indian stock market’s strength lies in its vast consumer population, digital ecosystem (Facebook India, WhatsApp India, YouTube India), and growing economic footprint. These factors mean that large players are unlikely to abandon the market abruptly.

Rocketalgo cautions against falling for hype or misinformation and encourages traders to use common sense and fundamental market understanding when making decisions.

🚀 Capturing Momentum with Rocketalgo’s Setup

Momentum is the driver of profitable trades, and Rocketalgo’s system is designed to identify and capitalize on momentum shifts across various instruments including stocks, indices, and cryptocurrencies like Bitcoin.

Key momentum indicators include:

- Price movement combinations

- Breakout confirmations

- Money flow metrics

- Percentage price changes

The setup is particularly effective in spotting breakout trades, where a strong price move beyond a resistance level signals a potential profitable entry. For example, Bitcoin trades have been highlighted with breakout points like 11981, which can be used as reference levels for entries and exits.

Mini and micro lot trading options are also supported, allowing traders to manage risk better while participating in these momentum moves.

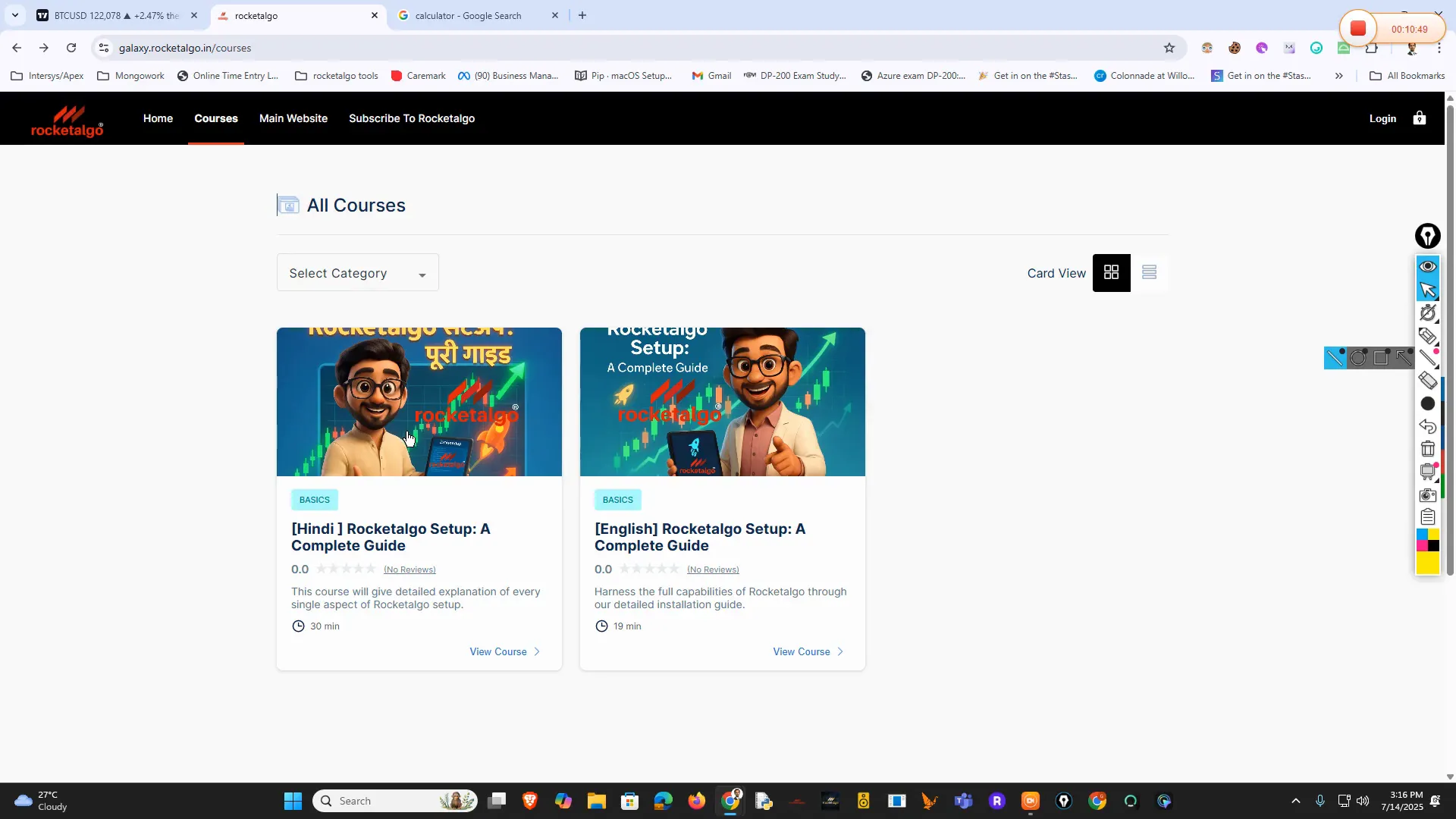

📚 Free Courses and Learning Opportunities with Rocketalgo

Rocketalgo provides free educational resources for traders interested in options and forex trading. These courses are designed to teach the Rocketalgo setup comprehensively, covering everything from the basics of support and resistance to advanced trade signal confirmation techniques.

The courses are available in both English and Hindi, catering to a wide audience. While these foundational courses are free for subscribers, upcoming specialized courses in forex and options trading will be offered to subscribers at no additional cost, but non-subscribers will be charged a nominal fee.

This approach ensures that dedicated traders receive continuous learning material to improve their trading journey without being overwhelmed by costs.

📊 Real Examples of Trades and Profitability

To demonstrate the effectiveness of the Rocketalgo setup, real trade examples were discussed. For instance, a trade at the entry point 5964366 yielded a profit of 100 rupees, with breakout signals guiding the entry and exit points.

Other examples included trades in downtrends and uptrends, with profits ranging from 35 points to more significant gains. These examples underscore the importance of not underestimating the power of a well-structured product and the need to develop personal acumen to interpret signals correctly.

Traders are encouraged to trust the setup but also develop their own understanding rather than blindly following tips or market noise.

🔧 Automation and Community Support for Traders

Rocketalgo also integrates automation tools to support traders in executing decisions confidently. Automation helps in reducing emotional interference and ensures trades are executed as per the predefined strategy.

Additionally, a community and backend portal exist where subscribers can interact, share insights, and get their doubts clarified. This collaborative environment fosters confidence and helps traders stay updated with market developments and strategy enhancements.

🎯 Key Components of the Rocketalgo Trading Setup Explained

The setup revolves around the ABCMP framework, which stands for:

- A – Angle: The directional strength of the price movement

- B – Breakout: Confirmation of price breaking key levels

- C – Candles: Candlestick patterns indicating market sentiment

- M – Money Flow: Tracking where the money is moving in the market

- P – Percentage: Quantifying price changes for momentum assessment

This multi-criteria approach results in high probability trade entries and greater confidence in trading decisions. The setup also uses color-coded zones — green zones for buy signals and red zones for sell signals — to simplify decision-making.

❓ Frequently Asked Questions (FAQ) 🤔

Q1: What makes Rocketalgo’s setup different from other trading systems?

A1: Rocketalgo combines multiple technical factors like angle, breakout, candle patterns, money flow, and percentage changes to create a comprehensive, high-probability trading setup. It emphasizes emotional discipline and avoids overtrading, which sets it apart.

Q2: Can beginners use Rocketalgo’s free courses effectively?

A2: Absolutely. The courses are designed for traders of all levels, available in both English and Hindi, and cover everything from basics to advanced strategies. Beginners can build a strong foundation before moving to more complex trades.

Q3: How does Rocketalgo help in sideways markets?

A3: Sideways markets are challenging, but the setup advises patience and not to get emotionally involved. By waiting for clear momentum signals and breakout confirmations, traders can avoid losses during such phases.

Q4: Are there any charges for Rocketalgo courses?

A4: The basic options and forex trading courses are free for subscribers. Specialized courses may have a nominal fee for non-subscribers, but subscribers get access to all courses at no extra cost.

Q5: How reliable is the Rocketalgo setup for trading Nifty and Bank Nifty?

A5: The setup has been tested with Nifty, Bank Nifty, and mid cap stocks, showing consistent results. It uses a disciplined approach to identify trends and momentum, making it reliable for these popular indices.

🔑 Conclusion: Elevate Your Trading Journey with Rocketalgo

Trading in the stock market, particularly on platforms like NSE and BSE, requires a blend of technical knowledge, emotional discipline, and continuous learning. Rocketalgo’s setup offers a structured, easy-to-follow framework that incorporates essential trading principles like support and resistance zones, momentum analysis, and breakout confirmations.

By focusing on mid cap stocks and major indices like Nifty and Bank Nifty, the system balances risk and reward, giving traders a better chance to succeed. The free educational courses, combined with automation tools and community support, make Rocketalgo a valuable resource for anyone serious about improving their trading outcomes.

Remember, no system guarantees profits, but with the right approach, consistent learning, and emotional control, you can significantly enhance your trading confidence and performance. Stay disciplined, trust the process, and let Rocketalgo help you navigate the exciting world of trading.

For more information and to join the Rocketalgo trading community, visit their official website and learning portals. Happy trading and may your journey be profitable!