Welcome to our detailed discussion on risk management in trading! In this article, we will explore the essential strategies and concepts shared in a special session by Rocketalgo, focusing on how to manage risk effectively in the stock market, particularly when trading on platforms like NSE and BSE. Risk management is a crucial aspect of trading that can determine your success or failure in the dynamic world of financial markets. Let’s dive into the key points and strategies discussed in the session.

Table of Contents

- 📈 Understanding Risk Management

- 📊 The Importance of Setting Realistic Goals

- 📉 The Impact of Losses

- 💡 Strategies for Effective Risk Management

- 📅 Timing and Market Conditions

- 🤔 Common Trading Mistakes

- 🔍 Understanding Your Emotions in Trading

- 📝 Conclusion: Your Path to Successful Trading

- ❓ FAQ

📈 Understanding Risk Management

Risk management is the process of identifying, assessing, and controlling threats to an organization’s capital and earnings. In trading, it is about protecting your capital from significant losses while maximizing potential gains. The session emphasized that every trader must have a solid risk management strategy in place to avoid catastrophic financial setbacks.

One of the most significant problems that many traders face is unrealistic expectations regarding profits. For instance, many traders enter the market with a small capital, say ₹40,000, and expect to double it by the end of the month. This mentality can lead to risky trading behaviors and ultimately losses.

📊 The Importance of Setting Realistic Goals

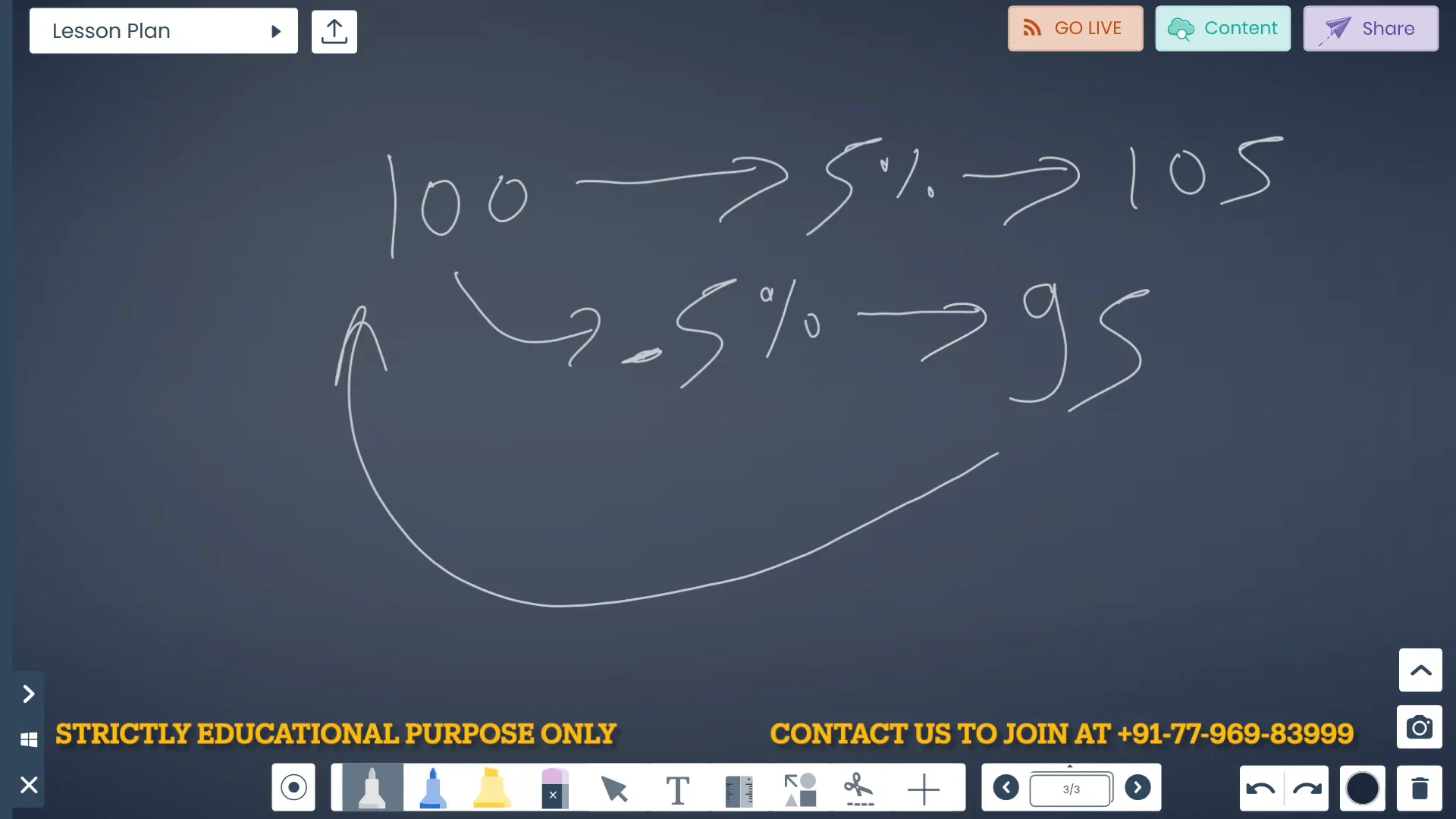

Setting realistic profit targets is critical. If you enter a trade with a ₹100 investment and expect a 5% profit, you would make ₹5, bringing your total to ₹105. However, if you aim for a 10% profit, your target becomes ₹110. This is where many traders miscalculate their risk. If you experience a 5% loss instead, you would end up with ₹95, and recovering from that loss requires a greater percentage gain.

For example, to recover from a ₹95 balance back to ₹100 after a 5% loss, you would need to make approximately a 5.26% profit. This is a crucial concept that many overlook, especially on days of market volatility.

📉 The Impact of Losses

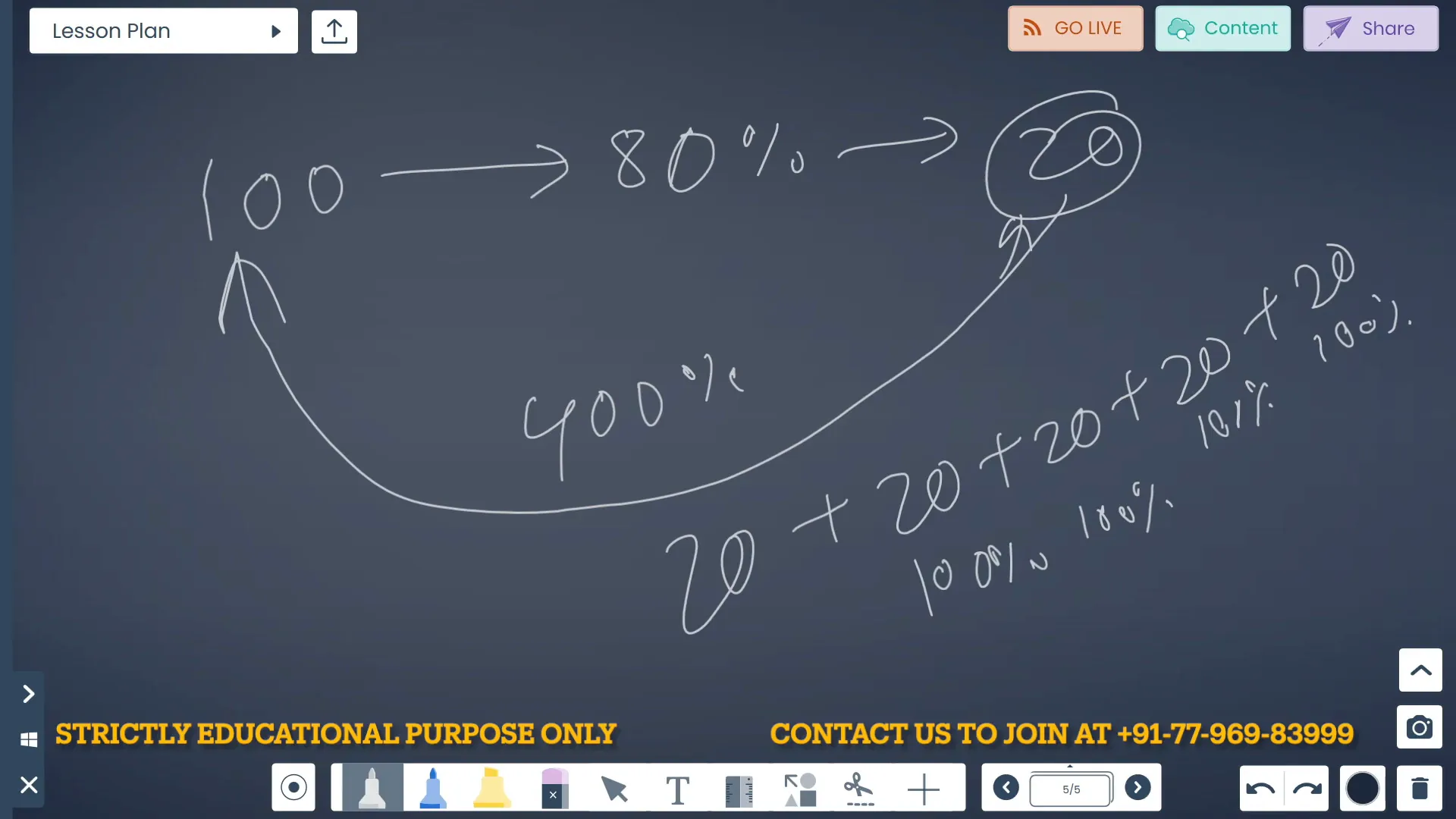

Understanding the impact of losses is vital in trading. If a trader incurs a 50% loss, their capital would drop to ₹50. To recover to the original amount of ₹100, they would need to gain 100% on the remaining capital, which is a significant hurdle. This highlights why it’s essential to limit losses; every percentage of loss has a much more significant impact on the capital required to recover.

For instance, if a trader holds onto a position after a 60% loss, their capital would drop to ₹20. To return to ₹100, they would need to achieve a 400% gain, which is nearly impossible in realistic trading scenarios.

💡 Strategies for Effective Risk Management

During the session, various strategies were discussed to help traders manage their risk effectively:

- Set a Stop-Loss: Always set a stop-loss order to limit potential losses on each trade. This should be based on your risk tolerance.

- Use Position Sizing: Determine the size of your trades based on your total capital and the level of risk you are willing to take. This avoids over-leveraging your account.

- Maintain a Risk-Reward Ratio: Aim for a risk-reward ratio of at least 1:2 or 1:3. This means for every ₹1 you risk, you should aim to make ₹2 or ₹3.

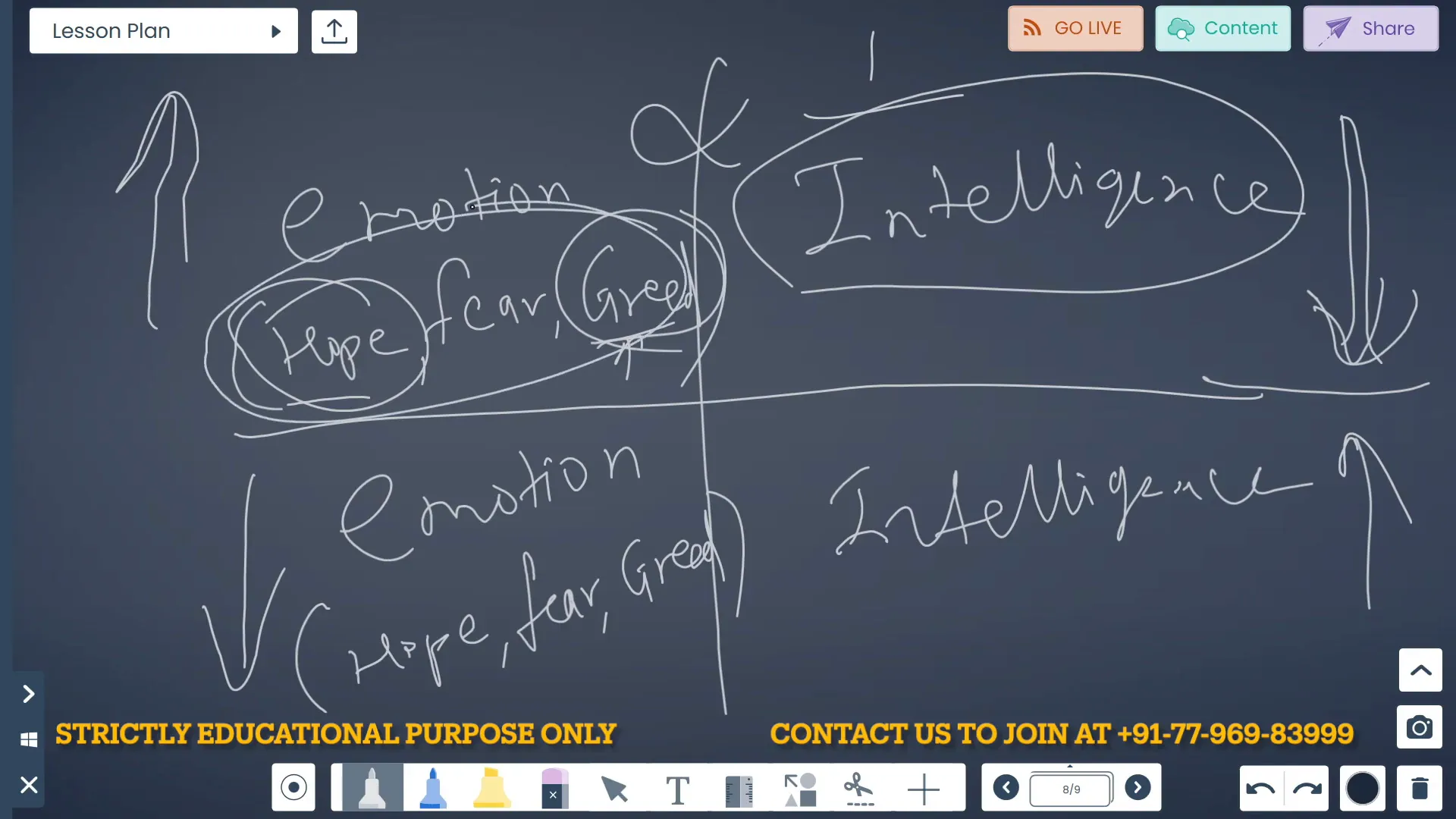

- Keep Emotions in Check: Trading should be a logical process. Avoid making decisions based on fear, greed, or hope, which can lead to poor trading choices.

📅 Timing and Market Conditions

Understanding market conditions is crucial for effective trading. The session highlighted that trading during specific times, such as the first 15 minutes after market open or during significant news announcements, can lead to increased volatility and manipulation. Traders should be cautious during these times and consider waiting for the market to stabilize before entering new positions.

Additionally, being aware of news events that could impact the market can help traders avoid unnecessary losses. Major announcements often lead to significant price movements, and being prepared for these can protect your capital.

🤔 Common Trading Mistakes

Many traders make common mistakes that can be avoided with proper education and risk management strategies:

- Overconfidence: Believing that a trade will recover just because you are holding onto it can lead to larger losses.

- Ignoring Market Trends: Failing to recognize market trends can result in poor entry and exit points.

- Emotional Trading: Making decisions based on emotions rather than logic can lead to significant losses.

🔍 Understanding Your Emotions in Trading

Traders often experience three primary emotions in trading: hope, fear, and greed. These emotions can cloud judgment and lead to poor decision-making. The session emphasized the importance of recognizing these emotions and managing them effectively.

For example, if a trader hopes that a losing trade will recover, they may hold onto it longer than they should, leading to more significant losses. Recognizing when to exit a losing position is crucial for preserving capital.

📝 Conclusion: Your Path to Successful Trading

Risk management is a fundamental aspect of trading that every trader must prioritize. By setting realistic goals, understanding the impact of losses, employing effective strategies, and managing emotions, you can significantly improve your trading outcomes.

Remember, trading is not just about making profits; it’s about managing risk effectively to stay in the game for the long term. Join the Rocketalgo community for continuous learning and support in your trading journey!

❓ FAQ

What is the primary goal of risk management in trading?

The primary goal of risk management in trading is to protect your capital from significant losses while maximizing potential gains. This involves setting stop-loss orders, using proper position sizing, and maintaining a risk-reward ratio.

How can I avoid emotional trading?

To avoid emotional trading, establish a trading plan and stick to it. Set clear entry and exit points, and avoid making decisions based on fear, greed, or hope.

What strategies can I use for effective risk management?

Some effective strategies for risk management include setting stop-loss orders, determining position sizes based on your capital, and maintaining a favorable risk-reward ratio.

How important is market timing in trading?

Market timing is crucial as it can significantly impact your trading results. Being aware of market conditions and timing your trades can help you avoid unnecessary losses and capitalize on opportunities.

What common mistakes should I avoid in trading?

Common mistakes to avoid include overconfidence in trades, ignoring market trends, and making decisions based on emotions rather than logic.

For more insights and guidance, connect with Rocketalgo and join our community of traders.