Hello — I’m Aditya from Rocketalgo Official. In this post I’ll walk you through the exact ideas and market lessons I covered in our session recorded on 9th September 2025. If you care about trading, stock market, NSE, BSE, Nifty — read on. I’ll explain real market events, practical trading mindset, how global outages and policy news can move markets, and the product features we’re rolling out to help traders like you. This is written in a direct, conversational tone — the same way I taught in the live session.

Table of Contents

- 📌 The quick concept we started with: XAUUSD movement and pips

- 🧠 Confidence vs Doubt — the psychological lesson

- 🌐 Global internet outage and market impact

- 💥 Image of media and outage reporting

- 🇺🇸 Policy shock: The proposed 25% tax on Indian IT services

- 📈 USD, Gold (XAUUSD) and geopolitical flows

- 🧭 Follow the right news — international sources and checklist

- 🔎 Product updates from Rocketalgo — features we’re rolling out

- 📉 Case study: Hang Seng ETF idea and live example

- 🔐 Say no to astrology and easy “gurus” — trade with data

- 🧾 How to trade when global events create friction

- 🔗 Crypto vs equities — why crypto moved when stocks didn’t

- 📸 Screenshots and community engagement — send us your questions

- 🔧 Practical checklist before you place a trade

- ❓ FAQ — Common questions from the session

- ✅ Conclusion — practical, not theoretical

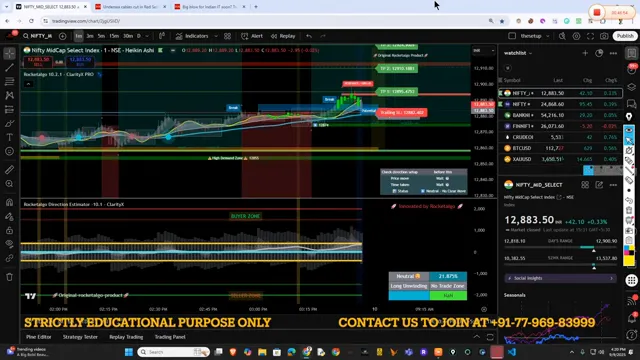

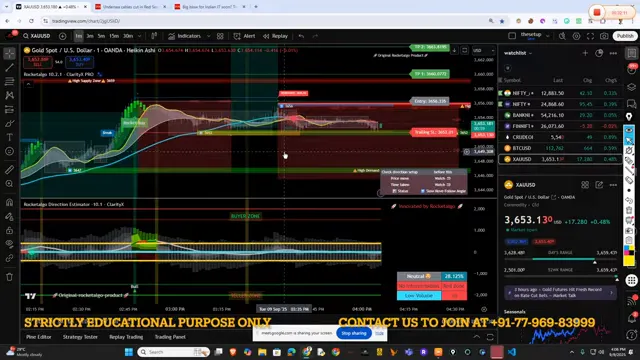

📌 The quick concept we started with: XAUUSD movement and pips

We began with a simple but very common confusion: when XAUUSD (gold priced in US dollars) moves by one dollar, how many pips have you captured? Everyone who trades the trading, stock market, NSE, BSE, Nifty space will face conversion questions between absolute price moves and pips. I asked the audience: “If gold moves $1, how many pips is that?” People gave different answers — some said 10 pips, some said 60 pips, others were confused because Google showed different numbers. Why?

Here’s the practical answer I repeatedly emphasize: pip definitions depend on the instrument and on the convention your platform uses. For XAUUSD many retail platforms treat a pip as $0.01 (i.e., 1 cent) or sometimes $0.10 depending on display. If your system counts 1 pip = $0.10, then a $1 move = 10 pips. If your system counts 1 pip = $0.01, a $1 move = 100 pips. That’s why one one-size-fits-all answer from Google may disagree with your broker’s feed.

Bottom line: Always check how your broker or platform defines a pip for XAUUSD. Don’t trust a generic web answer blindly — verify on your trading platform before sizing trades.

🧠 Confidence vs Doubt — the psychological lesson

One of the most important parts of the session was a mindset message. I told the audience: “Murk people are full of confidence, smart people are full of doubts.” This sounds blunt, but it’s true in markets. Overconfident traders (I called them “idiots full of confidence”) often act fast and follow tips without verification. Smart traders often hesitate, over-analyze, and doubt themselves even when the direction is right.

What I recommend: If your analysis is based on proper data and process, a little doubt is normal — but don’t let doubt freeze you. If you’re right directionally, you might just need a boost: position small, use clear risk rules, and let the trade breathe. Conversely, unchecked confidence without process is a sure way to lose capital.

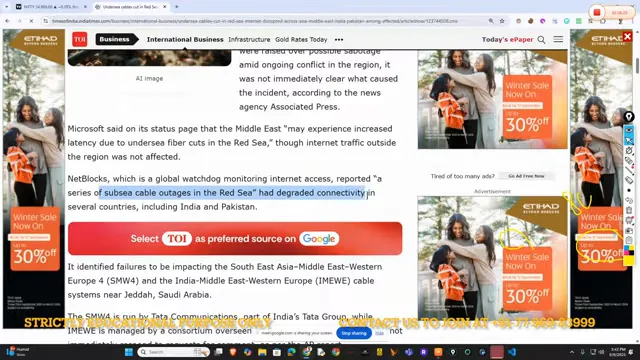

🌐 Global internet outage and market impact

During the session I explained how a worldwide undersea cable event and related internet outages can cause slow markets, slippage and unusual price action. On that day there was degraded connectivity across Asia and neighbouring regions. Times of India, NetBlocks and other sources reported serious cable outages affecting connectivity in India and nearby regions.

Why should a trader care? Trading is not just about charts. It’s also about infrastructure. If your ISP’s speed is fluctuating (one minute 100 Mbps, the next 3–5 Mbps), you may see delayed ticks, failed order submissions, partial fills and latency. I said plainly: “If your internet looks fine for streaming, that doesn’t mean it’s fine for live order routing.” Streaming video can buffer; order routing is latency-sensitive.

Practical steps to handle outages and latency:

- Check multiple sources: your broker status page, Twitter updates from exchanges and infrastructure providers, and NetBlocks when large outages happen.

- Use limit orders when markets are choppy or your connection is unstable to control slippage.

- Avoid adding to positions aggressively during known global outages — wait for normal connectivity.

- Test your connection speed and latency with simple pings/traceroutes before market hours.

💥 Image of media and outage reporting

🇺🇸 Policy shock: The proposed 25% tax on Indian IT services

One of the biggest topics I covered was the new “Hire Act” (as people were calling it) — a U.S. policy proposal discussed in media that included a 25% levy on certain job-sending services and mechanisms that could affect offshore IT delivery. I said this is real and it matters. If the U.S. passes a tax or regulation that makes hiring foreign services much more expensive for U.S. companies, the Indian IT sector (which runs on outsourcing and services contracts) would be directly impacted.

What did I explain about market implications?

- If the bill passes, Indian IT firms could see reduced demand for new contracts and tougher renewals of existing contracts.

- Price-to-earnings and valuations of large IT names could take a hit — and indices heavily weighted by IT could fall.

- Global fund flows and sentiment toward India’s technology sector could change quickly — that’s something a trader in the trading, stock market, NSE, BSE, Nifty ecosystem must monitor.

It’s not just politics — it’s economics. I insisted traders must follow international media, not just domestic TV news, because domestic channels often filter negative stories ahead of elections or due to other biases. We need a global news diet.

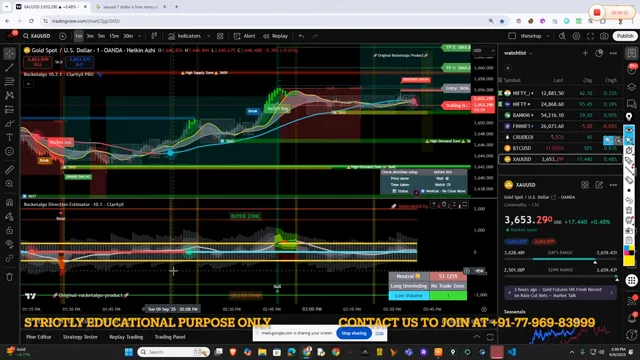

📈 USD, Gold (XAUUSD) and geopolitical flows

An important technical relationship I revisited: gold (XAU) and the US Dollar (USD) tend to move inversely. If USD weakens, gold often strengthens. But there are second-order effects: if BRICS nations and certain trade agreements reduce global reliance on the USD, the dollar could lose some demand and gold may rally as an alternative store of value.

I discussed real drivers for dollar weakness and gold strength:

- BRICS discussions about alternative settlement mechanisms and larger regional trade using other currencies.

- Global risk-off moves during political or infrastructure shocks which can push investors into safe-haven gold.

- Policy moves like new taxes or trade barriers that change cross-border profit flows and valuations.

Practically, when you see a $1 move in XAUUSD, check both your pip convention and the macro drivers: interest rate expectations, USD flows, geopolitical headlines, and structural trade shifts like BRICS-denominated trade. Don’t trade a single stat in isolation.

🧭 Follow the right news — international sources and checklist

Trading is not rocket science if you know what to watch. I gave a short checklist to my subscribers, and you can use it too:

- Follow international news: CNBC, Bloomberg, NetBlocks, Times of India for India context, and major global outlets for cross-border flows.

- Monitor undersea cable, telecom and CDN status pages during unusual network problems.

- Watch policy changes in major markets (U.S., EU, China) that directly affect sectors — e.g., tech, energy, exports.

- Track currency moves — USD strength/weakness often leads equity and commodity rotations.

- Check your broker’s pip conventions, spread policies, and order routing before placing high-risk trades.

These checks help reduce surprises and avoid being blindsided by “TV noise.”

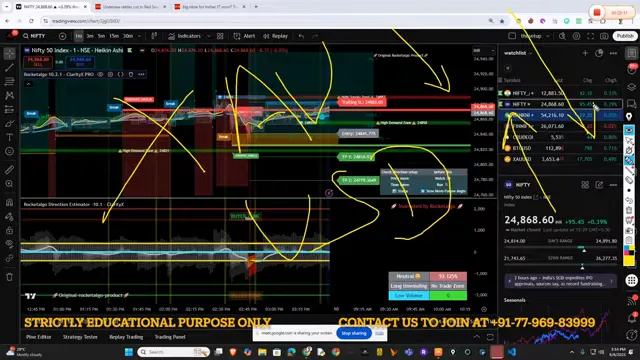

🔎 Product updates from Rocketalgo — features we’re rolling out

During the session I announced a few features we’re adding for subscribers. I explained each feature and why it helps traders in the trading, stock market, NSE, BSE, Nifty environment.

- One-to-one / small group calls with founder: Twice or thrice a month we’ll run live small calls — 1-on-1 or 1-on-3. These are for high-value troubleshooting: help with your platform, order flow issues, and practical trade setup. I’ll personally join and guide.

- Stock research with subscribers: We’ll run guided research sessions where I explain thesis, macro linkage, and trigger points — not buy/sell calls but research and idea-building.

- Screenshot-based video replies: You can send screenshots of your trades/positions and we’ll reply with short videos explaining what we see. This speeds learning and is practical.

- WhatsApp newsletter / Galaxy portal updates: We will start a compact news service for subscribers that flags global events which matter for the trading, stock market, NSE, BSE, Nifty crowd.

These aren’t hypothetical — we are in test run stage and rolling them out soon. I urged attendees to use them — especially the call feature if they experience odd slowness or order issues during outages.

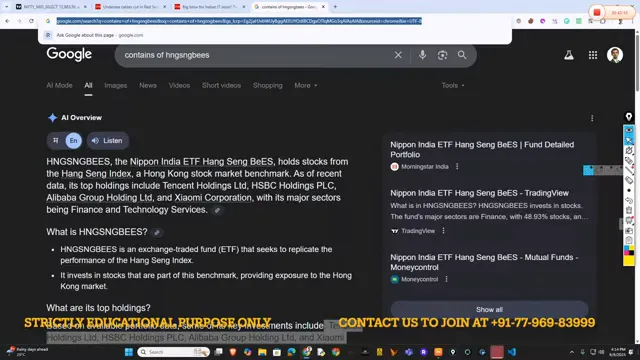

📉 Case study: Hang Seng ETF idea and live example

I explained the Hang Seng ETF (Hang Seng BEES) idea we flagged earlier. Some subscribers were slow to act; those who followed the idea bought at ₹423 and saw the ETF move to ₹502. This was a concrete example of combining macro insight (China-India relationship improving, BRICS positioning) with tactical ETF selection.

Important clarifications I made:

- I’m not giving a “tip”. This is educational research and idea-generation.

- Use position sizing: buying a little over time reduces entry risk.

- Always check your broker (NSE/BSE availability for Indian ETFs), execution costs, and ETF holdings to understand exposure.

🔐 Say no to astrology and easy “gurus” — trade with data

Some viewers asked if astrology or pundit predictions should guide trading. I was direct: “Don’t mix astrology with trading.” Markets require rigorous data, process, risk management and an understanding of macro drivers. If someone wants to base trades on planetary alignments, they should not expect consistent alpha. I shared a few amusing anecdotes from the session — callers who wanted to pay for “gurus” promising life fixes — and I told people not to fall for that nonsense.

🧾 How to trade when global events create friction

When markets show slow motion or friction due to external events (internet outage, major policy statement, elections), here is a practical playbook I shared:

- Reduce execution risk: prefer limit orders and smaller sizes.

- Increase stop discipline: widen stops for known volatility but keep risk per trade controlled.

- Avoid large overnight directional bets if you can’t monitor your position due to connectivity problems.

- Re-check instrument pips and contract specs — especially for commodities and forex pairs like XAUUSD, since platform settings may vary.

- Keep cash ready: market dislocations create both risks and opportunities. If you preserved capital you can buy high-quality opportunities after the dust settles.

🔗 Crypto vs equities — why crypto moved when stocks didn’t

Many asked why Bitcoin and cryptos had momentum while Indian equity markets were quiet. Simple answer: crypto infrastructure is distributed globally and often hosted on different physical servers and exchanges. Crypto servers weren’t impacted the same way as regional undersea cable disruptions. Also, crypto flows can be driven by global liquidity and speculative rotations that don’t immediately affect NSE/BSE/Nifty trading hours.

So if you trade both asset classes, be mindful that correlation regimes change. Crypto may move while your equity positions stay flat — adapt your risk allocation accordingly.

📸 Screenshots and community engagement — send us your questions

One of the new features I emphasized: subscribers can send us screenshots of their charts and positions. We’ll reply with short video explanations or messages. This is practical and helps you avoid long email threads trying to explain chart details. If you want technical help with your XAUUSD pip calculations, send a screenshot — we’ll respond.

🔧 Practical checklist before you place a trade

Final practical checklist I gave at the end of the session — keep this on your desk:

- Confirm instrument pip size and contract specs on your broker.

- Check global headlines for policy or infrastructure shocks (NetBlocks, major wire services).

- Test your internet latency and reliability; have a backup connection or phone-based trading option.

- Use sensible position sizing and risk rules — never risk more than a small percentage of capital on any single trade.

- Keep a trading journal: note reasons for entry, stop, target and what news influenced the trade.

- Don’t trade on astrology or random social media tips — trade a repeatable process.

❓ FAQ — Common questions from the session

Q: How many pips is $1 in XAUUSD?

A: It depends on your platform. Some platforms define 1 pip = 0.01 (1 cent) for XAUUSD, others 1 pip = 0.10. Check your broker’s specification. If 1 pip = $0.01 then $1 = 100 pips; if 1 pip = $0.10 then $1 = 10 pips.

Q: How will a 25% US tax on Indian IT affect the NSE/BSE/Nifty?

A: If passed, the tax could reduce demand for Indian IT services, harming revenues of major Indian IT firms, potentially dragging sector valuations and influencing indices weighted toward IT. Watch sector flows closely and adjust exposure based on the news developments.

Q: Why did markets feel slow during the outage?

A: Because of undersea cable issues and regional connectivity degradation. Latency and packet loss affect order routing and data feeds — you may see slow price updates, order delays, and wider spreads.

Q: Should I trust domestic TV for trading news?

A: No. Domestic TV can filter or delay negative news, especially around elections. Follow international financial media and direct sources for material events that affect global flows.

Q: Is Rocketalgo giving buy/sell tips?

A: No. Our content is educational. We offer research, platform automation tools, and founder-led calls to help you develop process and understanding — not investment advice.

✅ Conclusion — practical, not theoretical

To close — trading is a mix of process, infrastructure awareness, macro understanding and discipline. The session was designed to give traders practical tools: verify pip definitions, monitor global infrastructure and policy news, manage execution risk during outages, and use smart product features like founder calls and screenshot support. The keyphrase remains central: if you trade trading, stock market, NSE, BSE, Nifty, then your edge comes from understanding both the markets and the world that moves them.

Final reminder: follow international news, check your platform specs, and don’t trade on unverified tips. If you’re a subscriber, use our upcoming one-to-one calls and screenshot video replies — we’ll help you fix execution issues and refine your approach. Trade safely, manage risk, and keep learning.

Need more help |

|

Contact us by clicking the button below |

|

Click me |