Welcome to another insightful article from Rocketalgo Official, where we delve deep into the world of trading, stock markets, and the innovative tools available for traders. Today, we’ll explore the various use cases of the Rocketalgo setup, designed to maximize your trading potential in the NSE and BSE markets. Whether you’re a seasoned trader or just starting, this comprehensive guide will provide you with valuable insights and strategies to enhance your trading experience.

Table of Contents

- Understanding the Rocketalgo Setup 🛠️

- Market Momentum: The Heart of Trading 📈

- Breakout Levels: Seizing the Opportunity 📊

- High Demand Formation: Predicting Price Increases 📉

- Combining Strategies for Maximum Impact 🔗

- Engaging with the Rocketalgo Community 🤝

- Frequently Asked Questions (FAQ) ❓

- Conclusion: Elevate Your Trading Game with Rocketalgo 🎯

Understanding the Rocketalgo Setup 🛠️

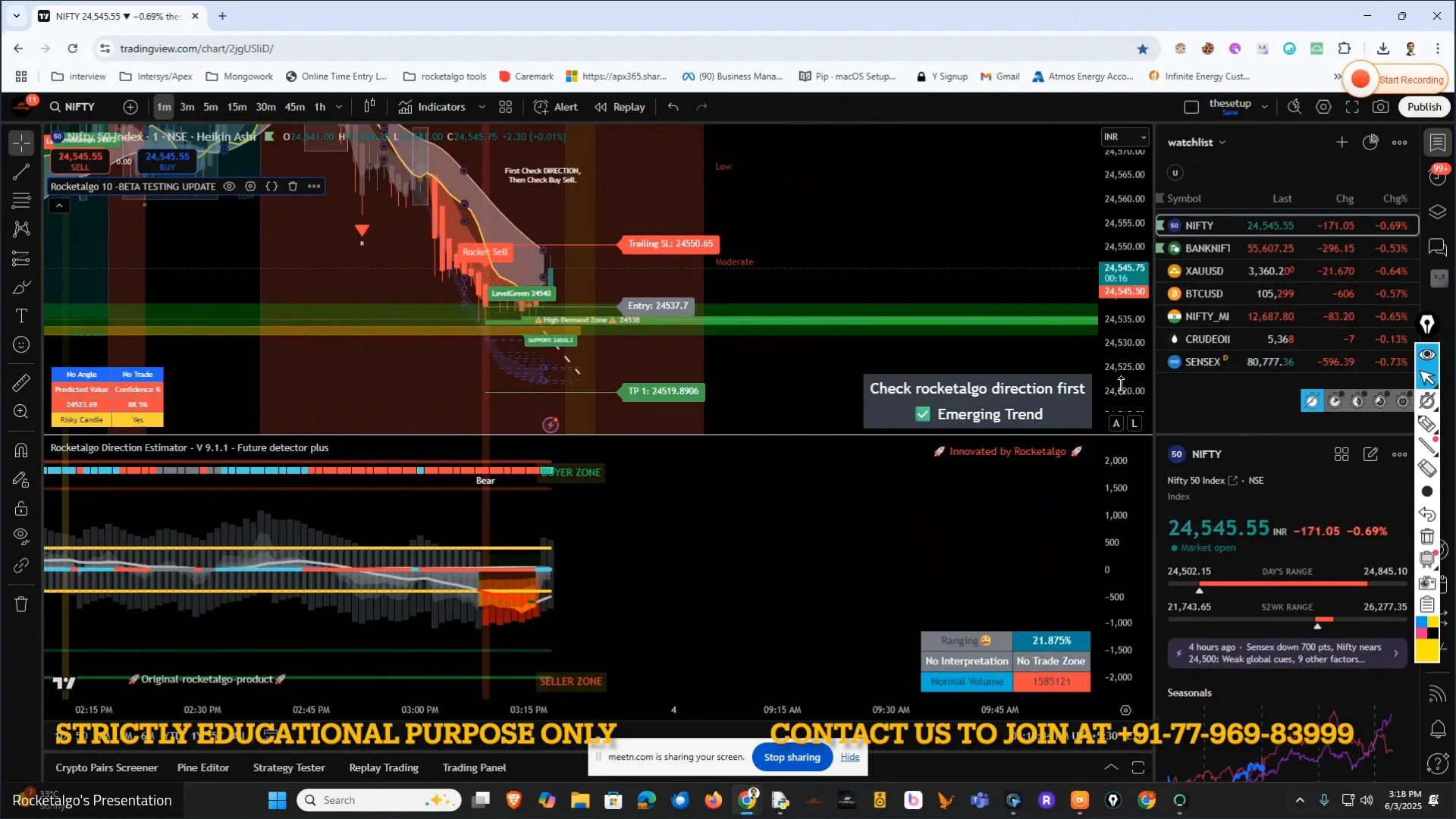

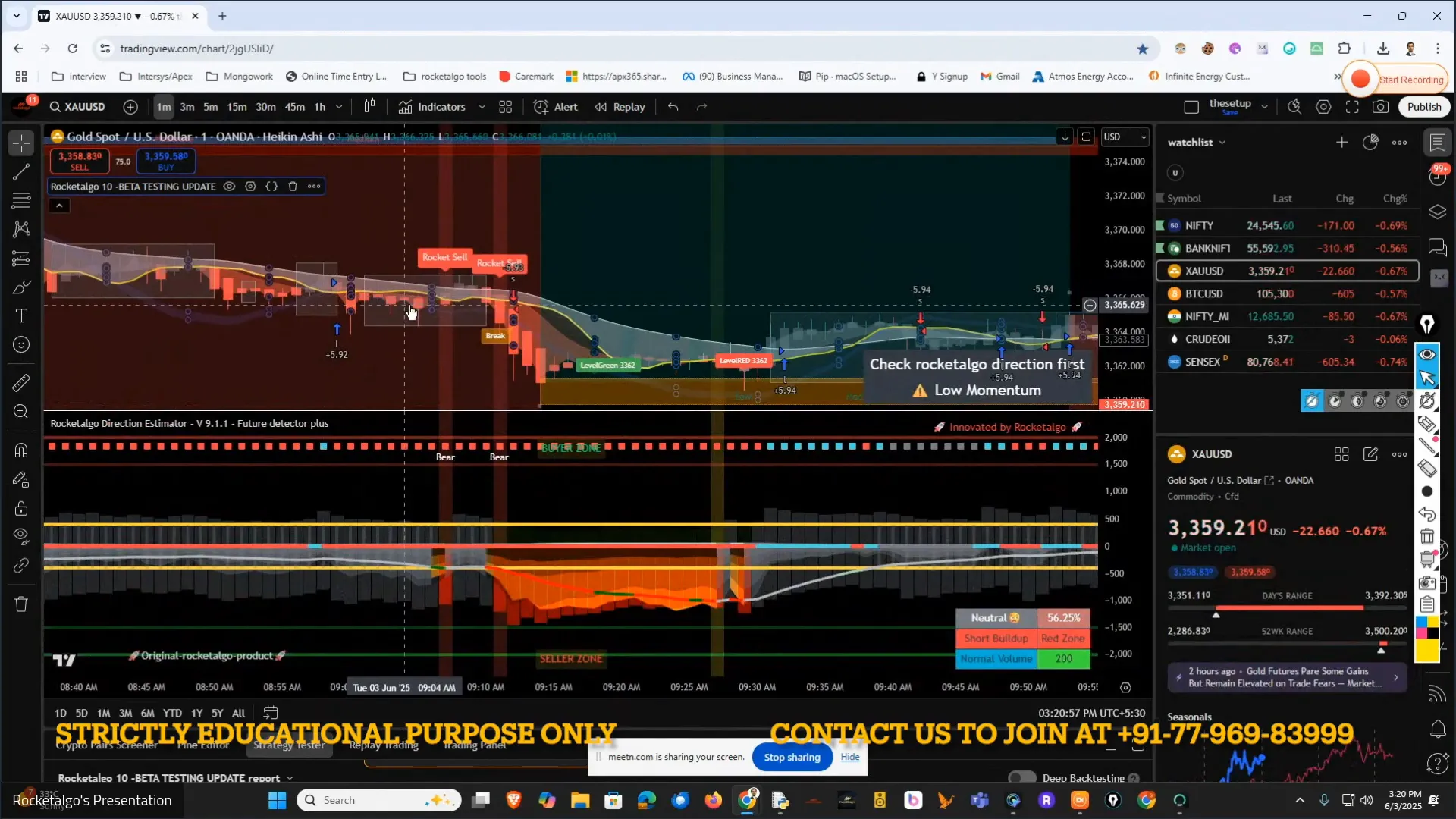

The Rocketalgo setup is a powerful trading tool that simplifies the complexities of market analysis. By combining multiple indicators and strategies, it enables traders to make informed decisions based on real-time data. This setup is particularly beneficial when navigating the dynamic Indian stock market, where conditions can change rapidly.

At its core, Rocketalgo focuses on three main components:

- Market Momentum: Understanding the momentum of the market is key to successful trading. The Rocketalgo setup analyzes various market signals to help you gauge whether to enter or exit a position.

- Breakout Levels: Identifying breakout levels is crucial for capitalizing on price movements. The setup helps traders spot these levels by analyzing historical data and current market trends.

- High Demand Formation: Recognizing high demand formations allows traders to anticipate price increases. The setup uses algorithms to identify patterns that indicate strong buying interest.

Market Momentum: The Heart of Trading 📈

Market momentum is a vital indicator that can dictate your trading strategy. It refers to the rate at which the price of an asset is moving in a particular direction. Understanding momentum can help you make better trading decisions, whether you’re trading stocks, options, or futures.

With Rocketalgo, you can easily track market momentum by leveraging its advanced analytical capabilities. By monitoring the momentum of various stocks, you can identify potential buying or selling opportunities.

For instance, if the momentum is strong and positive, it may be a good time to enter a long position. Conversely, if the momentum is negative, it might be wise to consider shorting the asset or staying out of the market altogether.

Breakout Levels: Seizing the Opportunity 📊

Breakout levels are critical in trading strategies as they indicate significant price movements. A breakout occurs when the price moves beyond a defined support or resistance level, often signaling a strong trend in the direction of the breakout.

Rocketalgo helps traders identify these breakout levels by analyzing historical price data and current market conditions. When a stock breaks above a resistance level, it often indicates that the price will continue to rise. This is the perfect opportunity for traders to enter a position and ride the trend.

Conversely, if a stock breaks below a support level, it may signal a downward trend, prompting traders to either exit their positions or take short positions. The ability to identify these levels in real-time can give traders a significant edge in the market.

High Demand Formation: Predicting Price Increases 📉

High demand formations are essential for predicting price increases. When a stock experiences a surge in buying interest, it often leads to higher prices. Recognizing these formations early can be the difference between a profitable trade and a loss.

Rocketalgo’s algorithms are designed to detect these high demand formations by analyzing various factors, including volume, price action, and market sentiment. By paying attention to these signals, traders can position themselves to benefit from impending price increases.

For example, if a stock is showing signs of high demand with increasing volume and positive price action, it may be wise to consider entering a long position. Conversely, if demand weakens, it may be a signal to exit or reconsider your strategy.

Combining Strategies for Maximum Impact 🔗

The true power of the Rocketalgo setup lies in its ability to combine multiple strategies and indicators. By analyzing market momentum, breakout levels, and high demand formations simultaneously, traders can make more informed decisions.

This multi-faceted approach allows for greater flexibility and adaptability in trading strategies. For example, if market momentum is high, and a breakout level is identified, traders can confidently enter a position, knowing that the conditions are favorable.

Conversely, if momentum is weak, even with a breakout, it may be prudent to hold off on entering a trade. This kind of analytical thinking is what sets successful traders apart from those who rely on gut feelings or incomplete information.

Engaging with the Rocketalgo Community 🤝

One of the most valuable aspects of using Rocketalgo is the community support. Engaging with fellow traders can provide you with insights and feedback that enhance your trading strategies. Regular interactive sessions and discussions can help you stay updated on market trends and share experiences with others.

By participating in these sessions, you can learn from the successes and failures of others, which can be invaluable in honing your trading skills. Plus, it’s a great opportunity to ask questions and get advice on specific trading scenarios.

Frequently Asked Questions (FAQ) ❓

What is Rocketalgo? 🤔

Rocketalgo is an advanced trading platform designed to simplify market analysis and enhance trading strategies. It utilizes algorithms to analyze market data, providing traders with valuable insights.

How does Rocketalgo improve my trading strategy? 📈

By using Rocketalgo, traders can access real-time data on market momentum, breakout levels, and high demand formations, allowing for informed decision-making and improved trading outcomes.

Is Rocketalgo suitable for beginners? 🌱

Yes, Rocketalgo is user-friendly and provides educational resources to help beginners understand trading concepts and strategies.

Can I use Rocketalgo for different markets? 🌍

Absolutely! While it is particularly effective in the Indian stock market (NSE and BSE), Rocketalgo can be adapted for various trading environments.

Conclusion: Elevate Your Trading Game with Rocketalgo 🎯

In conclusion, the Rocketalgo setup provides a comprehensive solution for traders looking to enhance their strategies in the stock market. By understanding market momentum, breakout levels, and high demand formations, you can make more informed trading decisions that can lead to greater success.

Whether you’re trading in the NSE or BSE, Rocketalgo equips you with the tools and insights needed to navigate the complexities of the market. Engage with the community, participate in interactive sessions, and continually refine your strategies to stay ahead of the curve.

For more information about Rocketalgo, visit our website at rocketalgo.in or check out our YouTube channel for more insights.

Remember, trading carries risks, and it’s essential to do your research and consult with a financial advisor before making any trading decisions. Happy trading!