Welcome to our detailed guide on trading strategies, focusing on the insights shared by Rocketalgo Official. In the fast-paced world of trading, understanding the dynamics of the stock market, especially with indices like Nifty and Bank Nifty, can significantly impact your trading success. This article will break down the strategies discussed in Rocketalgo’s video, offering valuable insights into navigating the complexities of trading on platforms like NSE and BSE.

Table of Contents

- Understanding the Basics of Trading 📊

- Key Trading Strategies: The Premium Combination 🧩

- Utilizing Candlestick Patterns for Analysis 📈

- Market Dynamics: High Volume and Momentum 📉

- Risk Management: Protecting Your Investments ⚖️

- Using Technology: The Role of Trading Applications 📱

- Understanding Institutional Trading 🏦

- Conclusion: Your Path to Successful Trading 🌟

- Frequently Asked Questions (FAQs) ❓

Understanding the Basics of Trading 📊

Trading is not just about buying and selling; it’s a game of strategy, experience, and knowledge. The essence of successful trading lies in understanding market trends, identifying key resistance and support levels, and knowing when to enter or exit a position.

In our discussion, we’ll cover:

- Key trading strategies

- Understanding market momentum

- Utilizing tools for effective trading

- Risk management techniques

Key Trading Strategies: The Premium Combination 🧩

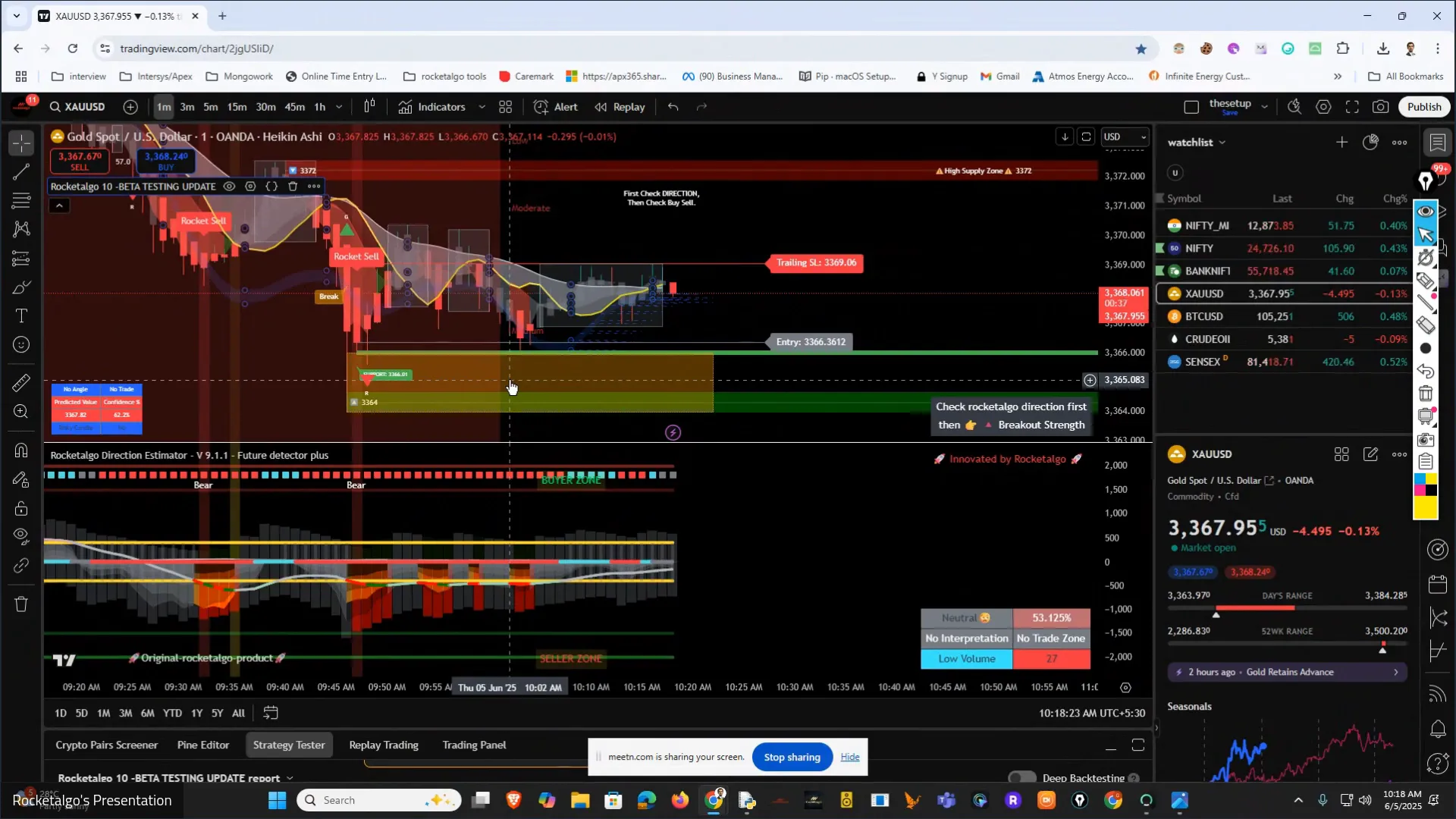

One of the highlighted strategies in the video is the “Premium Combination” approach. This method focuses on identifying high supply and demand levels, along with breakout points. The goal is to project potential market movements based on these indicators.

By recognizing these key levels, traders can make informed decisions about when to enter a trade. The combination of support and resistance levels creates a framework that helps traders anticipate price movements, which is crucial for both new and experienced traders.

Utilizing Candlestick Patterns for Analysis 📈

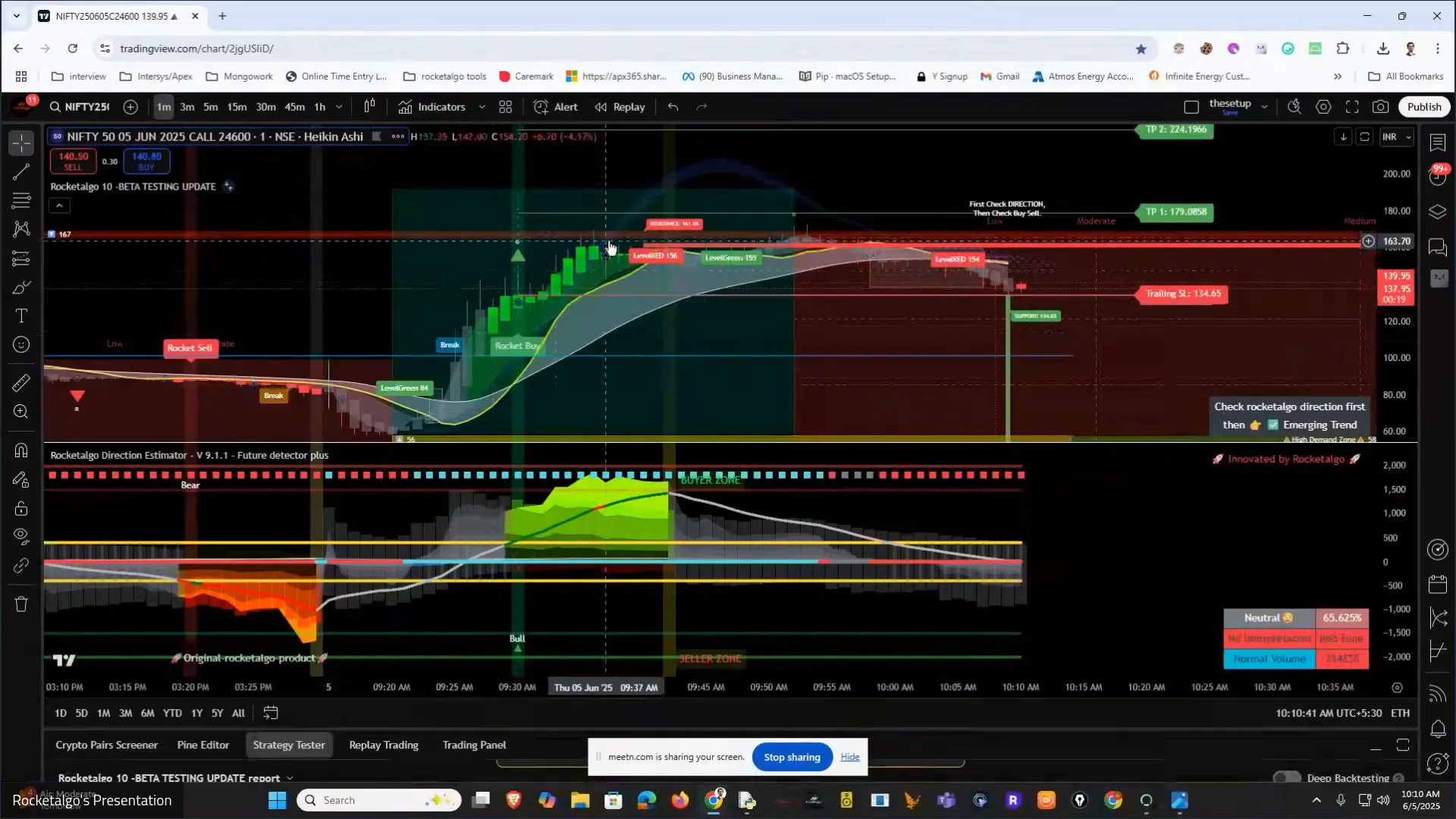

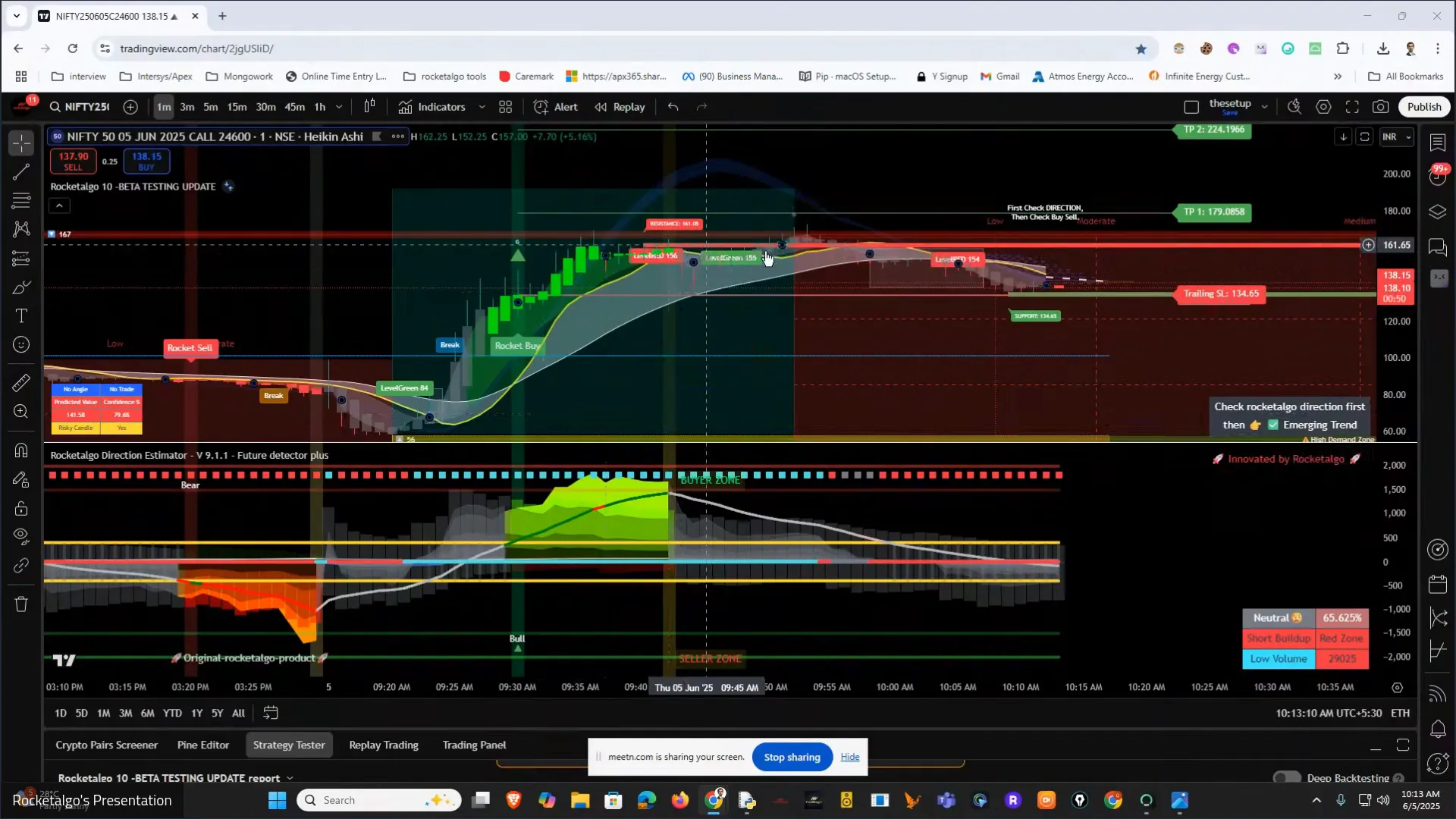

Candlestick patterns play a vital role in technical analysis. In the video, the significance of analyzing breakout candles is emphasized. A breakout candle signifies a strong price movement, and recognizing these patterns can provide traders with critical entry and exit signals.

For instance, if a breakout candle occurs at a resistance level, it may indicate a potential upward trend. Conversely, a breakout at a support level might suggest a downward movement.

Market Dynamics: High Volume and Momentum 📉

Understanding market dynamics, particularly the concept of volume, is essential. High volume often correlates with strong price movements, and identifying these trends can lead to profitable trading opportunities. As discussed in the video, it’s crucial to monitor the volume of trades, especially during key market hours.

The time frame around 9:37 AM is particularly noted for high volume, indicating a robust trading moment. Traders should be alert during these times to capitalize on potential profits.

Risk Management: Protecting Your Investments ⚖️

Every trader knows that with high potential rewards come high risks. Therefore, implementing effective risk management strategies is paramount. This includes setting stop-loss orders and determining your risk-reward ratio before entering a trade.

In the video, it’s emphasized that understanding your risk tolerance is essential for long-term success in trading. Always remember that protecting your capital should be your top priority.

Using Technology: The Role of Trading Applications 📱

With advancements in technology, trading applications have become indispensable tools for traders. These applications help in executing trades, analyzing market data, and even providing alerts on market movements. The video encourages users to utilize interactive applications that can aid in real-time analysis and decision-making.

Understanding Institutional Trading 🏦

Institutional trading plays a significant role in market movements. Understanding the sentiment of institutional traders can provide valuable insights into market direction. The video highlights that big players often set the tone for the market, and tracking their movements can help individual traders make informed decisions.

As a trader, being aware of institutional sentiment can help you align your strategies with the prevailing market trends, ultimately leading to better trading outcomes.

Conclusion: Your Path to Successful Trading 🌟

In conclusion, mastering the art of trading requires a combination of strategies, knowledge, and the right tools. By focusing on key elements such as market dynamics, candlestick patterns, and risk management, you can navigate the complexities of the stock market more effectively.

We encourage you to explore the insights shared by Rocketalgo Official and utilize their learning resources to enhance your trading skills. Remember, trading is a journey, and with each trade, you gain valuable experience that contributes to your growth as a trader.

Frequently Asked Questions (FAQs) ❓

What is the Premium Combination strategy in trading?

The Premium Combination strategy involves identifying key support and resistance levels to project potential market movements. This strategy helps traders make informed decisions about entering or exiting trades.

How important are candlestick patterns in trading?

Candlestick patterns are crucial for technical analysis. They provide insights into market sentiment and can signal potential price movements, making them essential for effective trading strategies.

What role does volume play in trading?

Volume indicates the strength of a price movement. High volume often correlates with significant price changes, providing traders with opportunities to capitalize on market trends.

How can I manage risk in trading?

Effective risk management involves setting stop-loss orders, understanding your risk tolerance, and determining your risk-reward ratio before entering trades. This helps protect your capital and minimizes potential losses.

For more insights and resources, don’t forget to check out Rocketalgo’s official website and learning app. Happy trading!